When it comes to environmental, social, and governance (ESG) investments, it can be beneficial for investors to tap segments and themes that are favored by governments.

On that note, the new Invesco MSCI Green Building ETF (GBLD), the first exchange traded fund dedicated to real estate firms that emphasize climate awareness, might just be on to something because President Biden wants to modernize buildings in an effort to reduce carbon footprints.

“The Biden administration has devoted a significant amount of attention to the building sector as part of its efforts to reduce US carbon emissions,” according to IHS Markit. “Led by the Department of Energy (DOE), these programs seek to revive and expand upon Obama administration programs, and to support states and individual developers as they seek to accelerate building efficiency and electrification.”

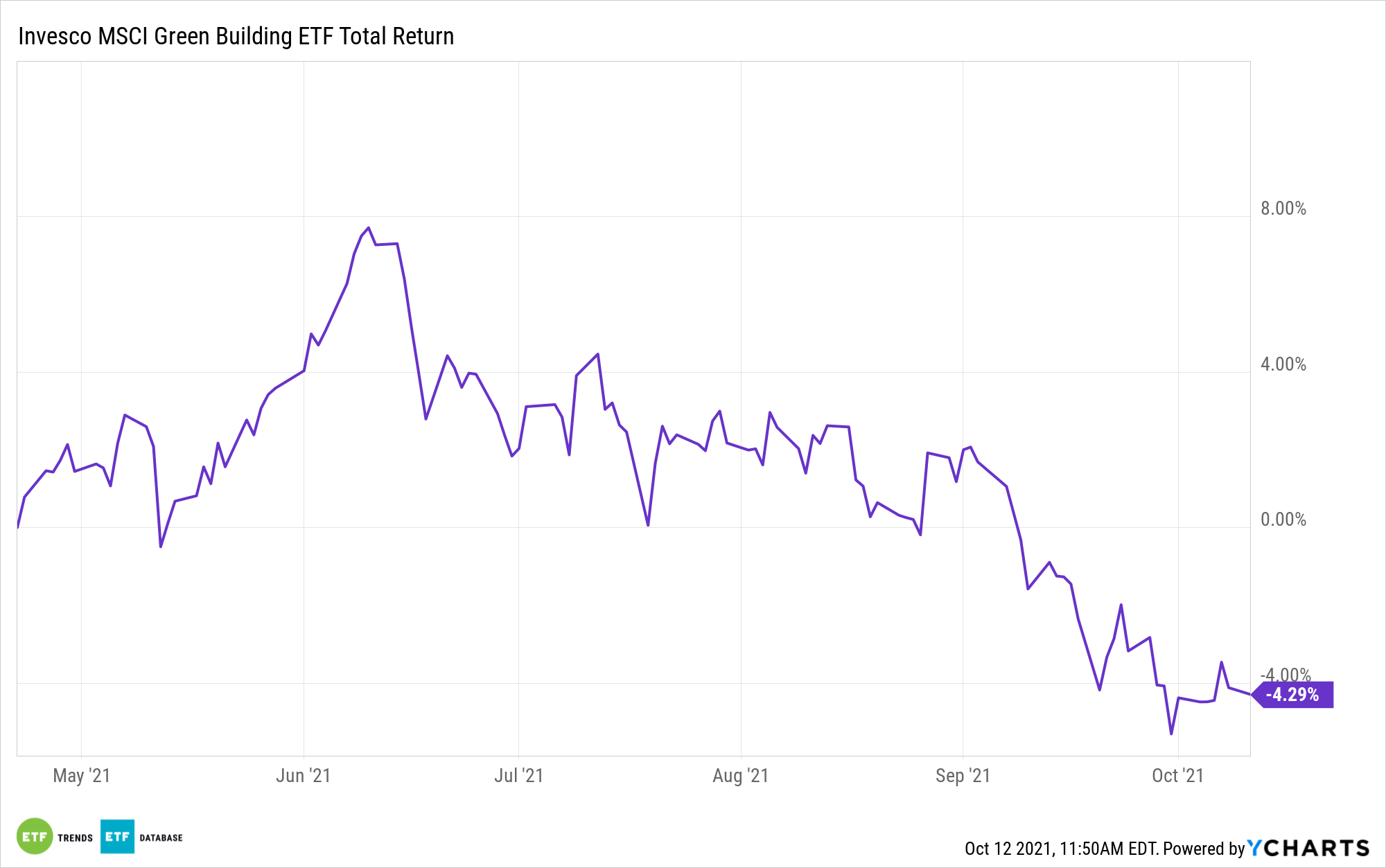

That could be a sign that GBLD has a trait that many new ETFs, regardless of investment objective, long for: good timing. GBLD debuted in April and follows the MSCI Global Green Building Index. Among GBLD’s 80-plus holdings are companies engaged in the design, construction, acquisition, and other aspects of green properties and structures. GBLD’s underlying index is part of MSCI’s suite of global environment benchmarks.

Go With GBLD

Improving efficiencies in commercial buildings could go a long way towards reducing carbon emissions and combating climate change.

“DOE says there are almost 129 million non-industrial buildings in the US that collectively use 75% of the nation’s electricity and 40% of its energy. Energy use in buildings is responsible for 35% of US CO2 emissions, according to DOE,” adds IHS Markit.

Further enhancing the case for GBLD is the fact that the White House is overtly mentioning the need to make buildings more energy efficient. With that cause in the limelight, more attention could shift to GBLD.

“The United States can create good-paying jobs and cut emissions and energy costs for families by supporting efficiency upgrades and electrification in buildings through support for job-creating retrofit programs and sustainable affordable housing, wider use of heat pumps and induction stoves, and adoption of modern energy codes for new buildings,” the White House said earlier this year.

As noted by DOE’s Energy Information Administration, the race to decarbonize buildings is already paying dividends as energy intensity in both commercial and residential buildings declined noticeably from 2007 through 2017. Thanks to GBLD, investors have a direct avenue for participating in that trend.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.