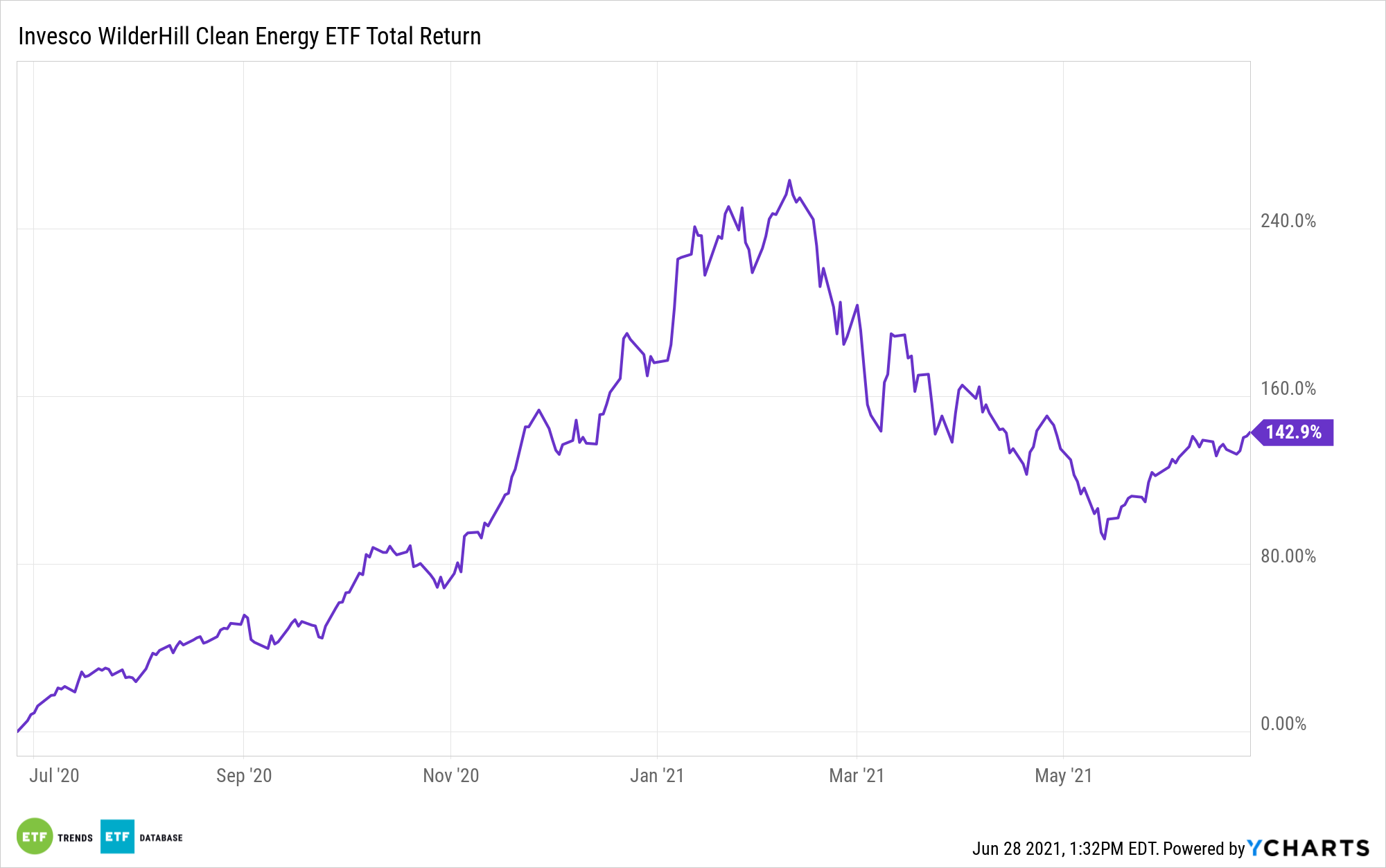

Renewable energy exchange traded funds were among 2020’s most scintillating thematic offerings before giving way to profit-taking earlier this year.

Much of that was attributable to “sell the news” treatment as investors that bid higher on ETFs like the Invesco WilderHill Clean Energy ETF (PBW).

While PBW is down about 13% year-to-date, investors may want to consider that more opportunity than reason to pass over the fund. In fact, PBW may prove to be a relevant idea for today for long-term investors because companies are forecast to continue scaling up renewable energy investments.

“More than two-thirds of surveyed investors (68%) report plans to increase their investments by more than 10 percent this year compared to 2020. Notably, 70 percent of companies that invest greater than $100 million annually plan to increase investment by more than 10 percent compared to last year,” according to the American Council on Renewable Energy (ACORE).

PBW Is Perking Up

PBW is showing signs of life, jumping 13.1% over the past month in what could be a sign that investors are getting past political disappointment and are revisiting the longer-ranging renewable energy investment thesis.

That thesis is rooted in sound fundamentals because, as ACORE points out, clean energy developers are getting active this year.

“All the companies that operate renewable energy businesses with revenues greater than $1 billion plan to increase their activity. Eighty-seven percent of developers indicate that the December 2020 federal tax credit and safe harbor extensions affected their decision-making in 2021,” notes ACORE.

The $2.22 billion PBW, which tracks the WilderHill Clean Energy Index, offers investors other advantages, including industry-level and geographic diversity. Regarding the former, exposure to energy storage, solar, and wind equities is important because the ACORE survey reveals the top six green energy destinations through 2024 include energy storage and various forms of solar and wind energy.

As for geography, PBW features robust exposure to U.S. and Chinese companies. Those countries are leaders in clean energy adoption and technology, though respondents to the ACORE survey see the U.S. as the preferred investment destination.

“Investors consider the U.S. to be an attractive venue for investment compared to leading countries like China over the next three years. Forty-eight percent of investors expect ‘No Change’ in the attractiveness of the U.S., and 46 percent anticipate the country’s attractiveness will increase over the period,” according to the survey.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.