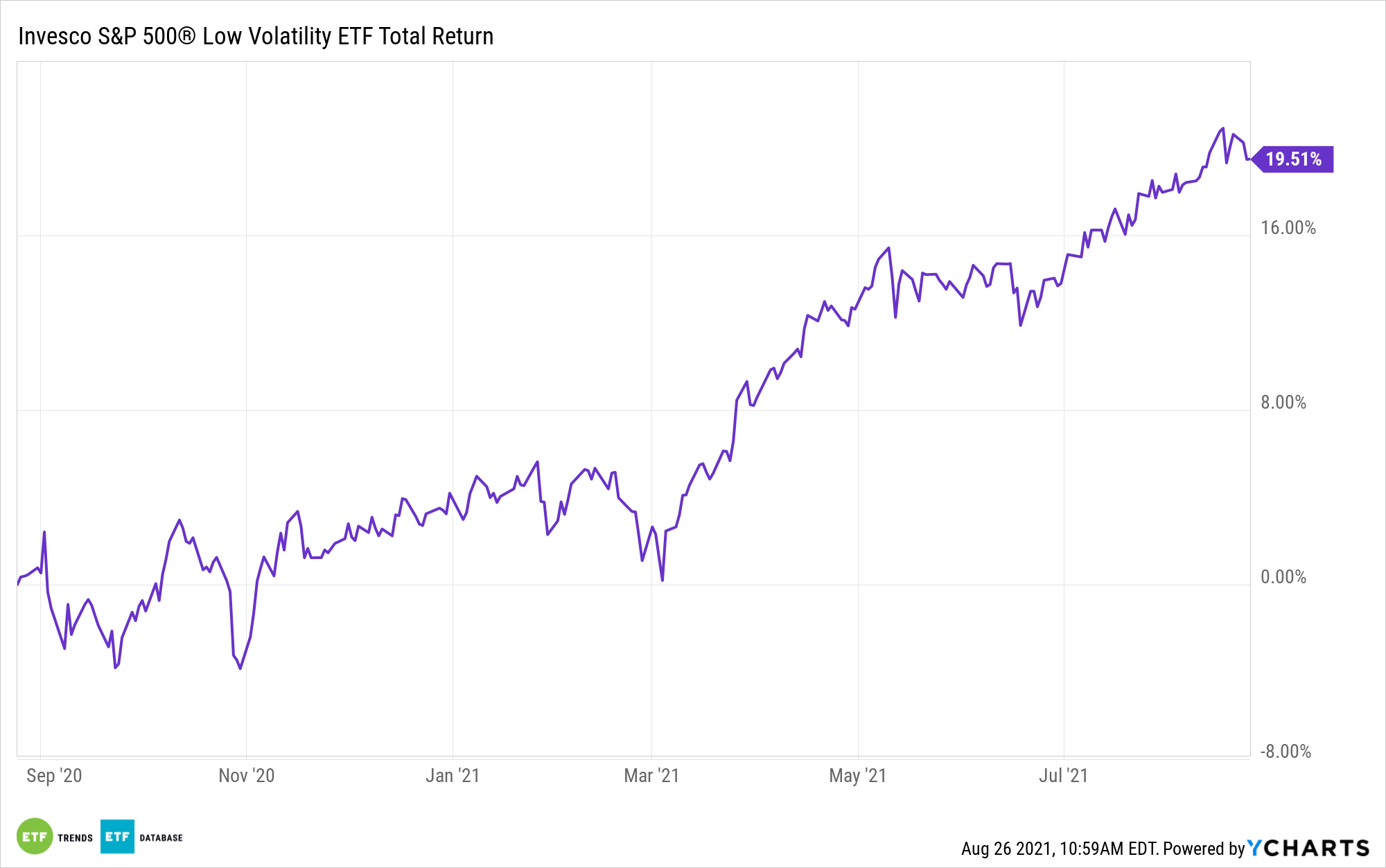

For all the glum talk about low volatility strategies and exchange traded funds, nearly eight months into the year, the Invesco S&P 500 Low Volatility ETF (SPLV) is achieving its objective of reduced volatility while still delivering an admirable gain of 14.16%, as of Aug. 23.

While that performance lags the broader market, as is often the case with low volatility ETFs, SPLV’s year-to-date showing is impressive when considering its hefty weights in defensive sectors, which is the result of low volatility across the board.

“Through Aug. 19, 2021, the S&P 500® is up 17%. The gains were achieved steadily; apart from January, the benchmark has been up every month in 2021. Predictably, in such an environment the S&P 500 Low Volatility Index has lagged, up 14% through close of Aug. 19, 2021,” according to S&P Dow Jones Indices. “Volatility declined slightly in most sectors of the S&P 500. Even Energy was less volatile compared to three months prior.”

SPLV allocates about 41% of its weight to the consumer staples and utilities sectors, which are defensive groups. Those sectors often loom large in SPLV because they’re not known for volatility and the fund’s underlying index, the aforementioned S&P 500 Low Volatility Index, selects holdings based on trailing 12-month volatility.

Healthcare, which is traditionally a defensive sector but is recently showing growth traits, is the third-largest sector weight in SPLV at almost 15%. SPLV’s index rebalanced last Friday, and there were some changes of note for investors in the fund.

“Real Estate and Utilities continued to increase their weight in the index, with Financials and Communication Services showing the largest declines. The reduction in Financials is somewhat surprising given the sector’s relatively large drop in volatility. Despite this decline, however, Financials remains one of the most volatile sectors in the market, and the S&P 500 Low Volatility Index looks to minimize volatility at the stock level,” adds S&P Dow Jones.

From April 30 through July 31, volatility declined across all 11 S&P 500 sectors. Even with its defensive traits, SPLV isn’t solely dependent on large cap stocks. In fact, mid caps combine to about 42% of the fund’s weight. None of the fund’s holdings command weights north of 1.41%.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.