Since the widely followed Russell 2000 Index peaked in March, the small-cap benchmark and assets tracking smaller stocks have done a whole lot of nothing.

With small-caps entering a six month of lagging large-cap rivals, some investors might be itching to throw in the towel on small-cap equities and exchange traded funds, including the Invesco S&P SmallCap 600 Pure Value ETF (RZV), but some strategists believe that smaller stocks are ready to bounce back.

RZV resides about 9% below its 52-week high, but with a deep cyclical value tilt, the Invesco fund could be a leader when smaller stocks come back into style. Additionally, investors that are getting frustrated by recent small-cap lethargy should keep in mind that periods like the current one aren’t uncommon.

“We are in the midst of a longer period of going nowhere for small caps, but this is not anything we haven’t seen before,” says Jefferies strategist Steven DeSanctis. “We thought we needed the ‘pause that refreshes’, but we also think the size segment should begin to perform better this fall.”

RZV Could Be Right Call for Patient Investors

For investors willing to wait on a small-cap rebound, RZV could prove to be a sound wager on that outcome. The Invesco ETF follows the S&P SmallCap 600 Pure Value Index, giving it a deep cyclical tilt, which is relevant because, as Jefferies’ DeSanctis notes, small-cap valuations are interesting today.

“We think we are in the midst of a longer-term outperformance cycle, and these cycles never end when our relative valuation model is as cheap as it is today, in the 22nd percentile,” said the strategist.

RZV is also levered to economic growth. For example, the industrial, consumer discretionary, and energy sectors combine for about 47% of the ETF’s weight, according to issuer data. Jefferies has overweight ratings on the industrial and materials sectors, which combine for more than 30% of RZV’s roster. The research firm applies the same rating to the healthcare and real estate sectors, which combine for 6% of the RZV lineup.

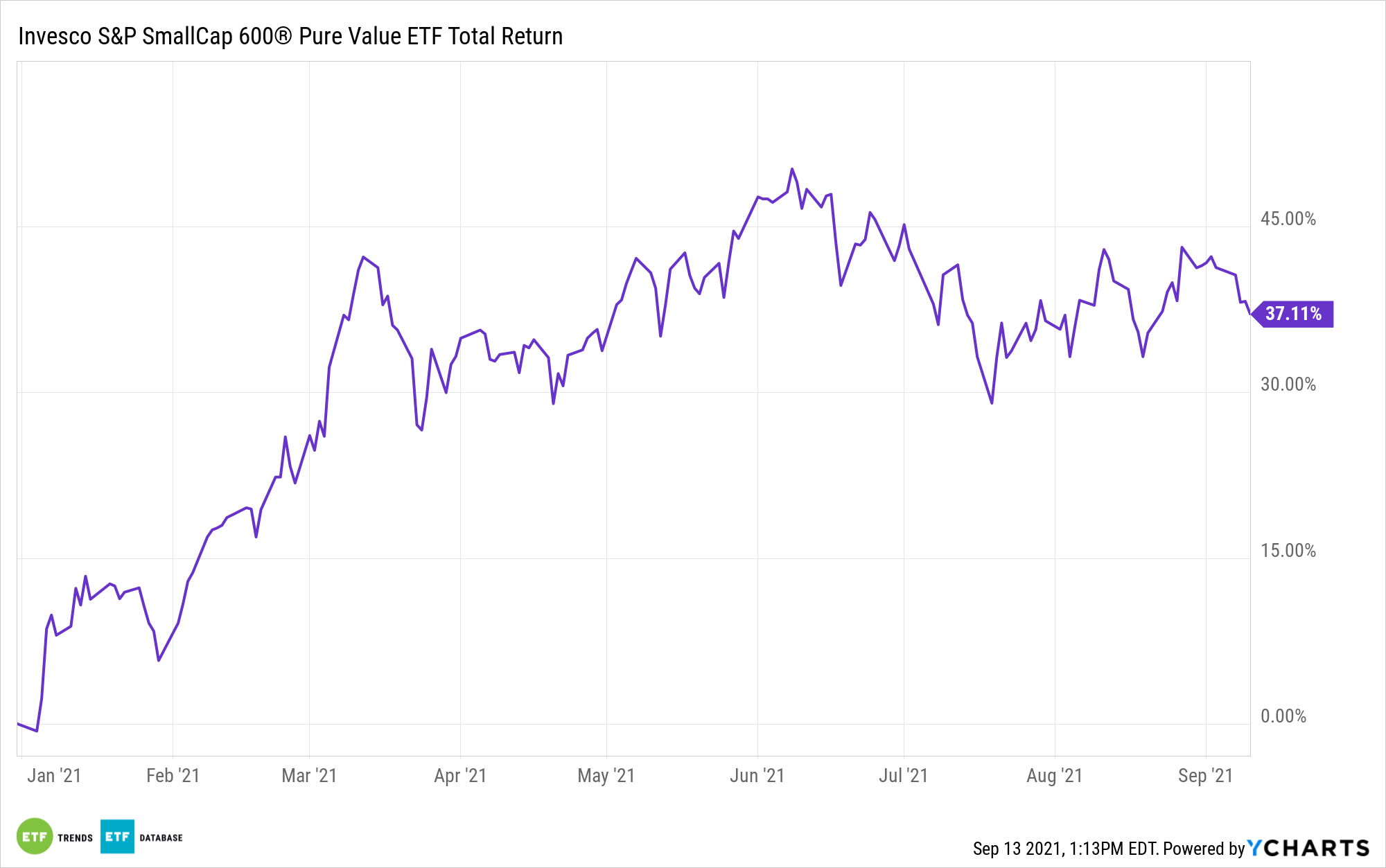

RZV also offers a buffer against rising interest via an almost 20% weight to financial services stocks. That exposure proved useful earlier this year when 10-year yields spiked, contributing in large part to RZV’s nearly 36% year-to-date gain.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.