Debate remains about the existence of another commodities super cycle, but pure price action confirms that, with few exceptions, 2021 is quickly becoming a banner year for commodities.

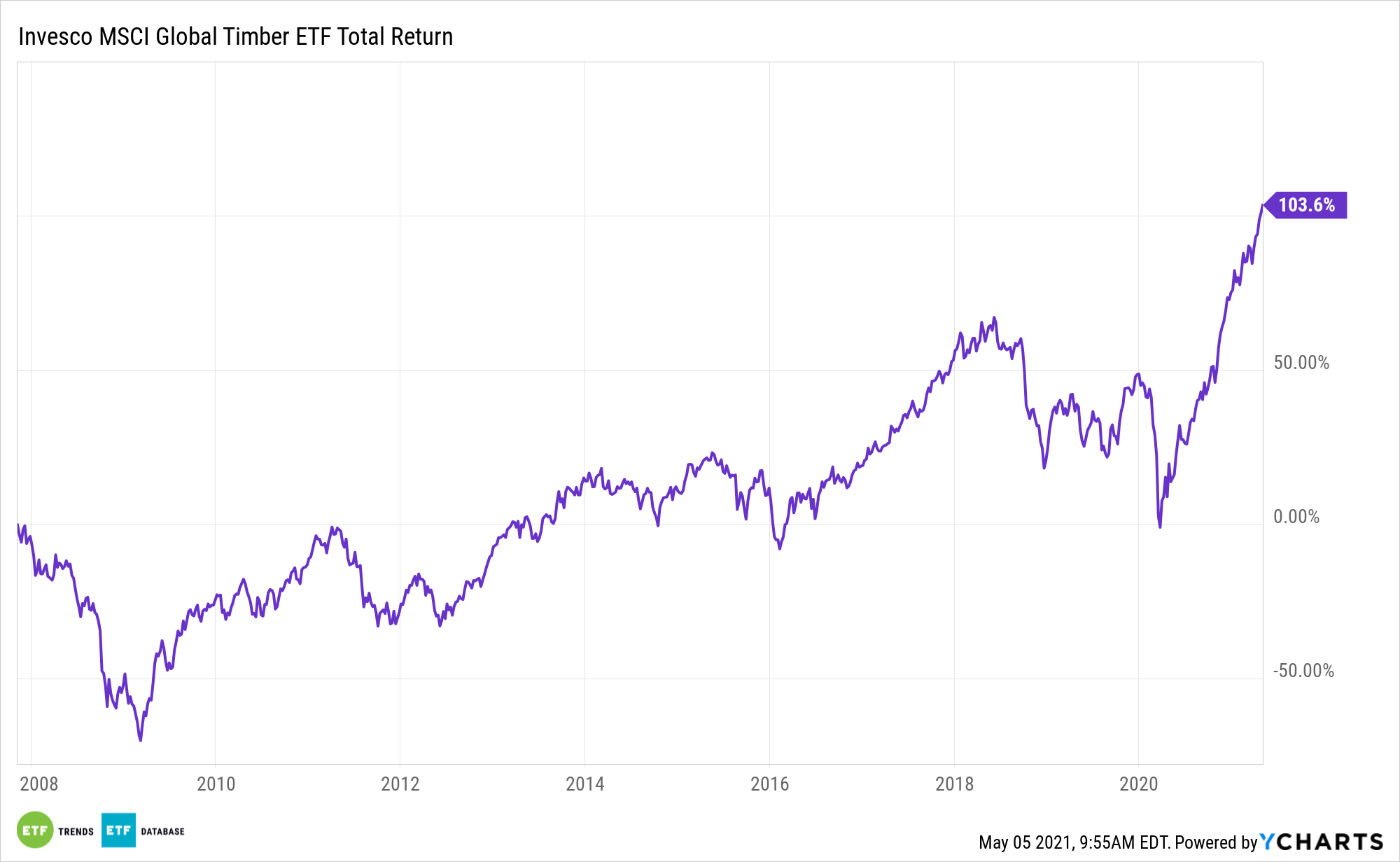

Lumber is one of the leaders in that clubhouse, and that trend is lifting exchange traded funds, including the Invesco MSCI Global Timber ETF (CUT).

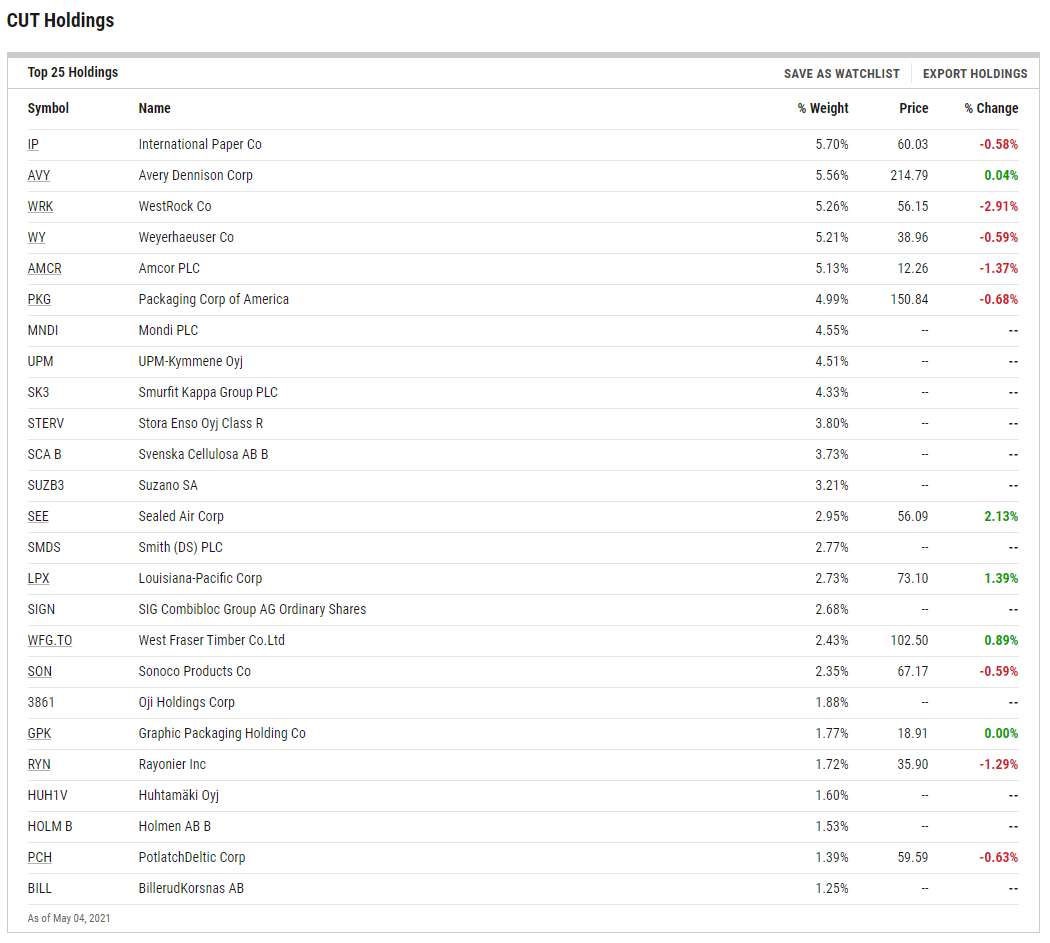

After notching another record high on May 4, the equity-based CUT is up 15.2% year-to-date. The Invesco fund follows the MSCI ACWI IMI Timber Select Capped Index.

“The Index measures the performance of securities engaged in the ownership and management of forests, timberlands and production of products using timber as raw materials. The index is computed using the net return, which withholds applicable taxes for non-resident investors. The Fund and the Index are rebalanced quarterly,” according to the issuer.

CUT has another feather in its cap: heavy mid cap exposure at a time when those stocks are soaring. About two-thirds of the fund’s roster is comprise of mid cap stocks.

The CUT ETF: Capable of More Upside?

Lumber futures are a tough-to-navigate market, one best left to professional investors. However, CUT is approachable to a wide array of market participants and it’s relevant in the current climate.

“Lumber prices pushed further into record territory today, likely meaning that Weyerhaeuser (NYSE:WY), Canfor (OTCPK:CFPZF) and other sawmill owners can expect even fatter profits than the record earnings they reported for Q1 2021 (I, II),” reports Seeking Alpha.

Those two stocks combine for nearly 6% of CUT’s roster. Adding to the near-term case for CUT is a blistering housing market – one supported by low interest rates and a rebounding economy. By some estimates, surging lumber prices are adding more than $30,000 to the prices of new homes. That’s a drag for home buyers, but music to the ears of investors holding CUT.

“In February, the National Association of Home Builders (NAHB) estimated that lumber prices were adding $24,000 to the average purchase price of a new home. Last Wednesday, the NAHB upped that number to $36,000 — and the price of lumber is up another 10% in that short time,” reports Yahoo! Finance.

With lumber futures up 60% from the autumn 2020 peak, some housing experts are saying that either home or lumber prices need to decline, or the hot housing market could rapidly cool.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.