Consumer staples has a lot advantages. While it boasts above-average dividends and low volatility, the sector isn’t known for being dynamic.

Investors can refresh that proposition with the PowerShares Dynamic Food & Beverage Portfolio (NYSEArca: PBJ), which targets food and beverage companies.

PBJ follows the Dynamic Food & Beverage Intellidex Index. That benchmark is “is designed to provide capital appreciation by thoroughly evaluating companies based on a variety of investment merit criteria, including: price momentum, earnings momentum, quality, management action, and value,” according to Invesco.

With consumer staples, investors can rely on a sector that can move with the peaks and valleys of the market. In other words, products that people want regardless of what the market or economy are doing.

“PBJ’s market cap and style allocation is diverse, despite the sector concentration. Between 30% and 35% of the portfolio is invested in each of the three groups: small-cap, mid-cap and large-cap stocks. Value represents the lion’s share of the fund’s holdings, at 40%,” notes DM Martins Research. “But growth, maybe surprisingly within the consumer staples space, accounts for 20% of the total assets – blend is the other 40%.”

PBJ Perks

The consumer staples segment has long been viewed as a high-quality defensive play. The slow and steady nature of the consumer staples business has long been touted as a safe play for all periods since consumers will still need to buy the basic necessities.

“One of the great benefits of owning a portfolio of defensive food stocks is the lower risk profile. For example, PBJ’s volatility since the fund’s 2005 inception has been 12.9%, compared to the S&P 500’s 14.8%. More importantly, the ETF’s maximum decline from a previous peak has been only 34% during the Great Recession of 2008-2009. During the same period, the broad market corrected by over 50%,” according to DM Martins.

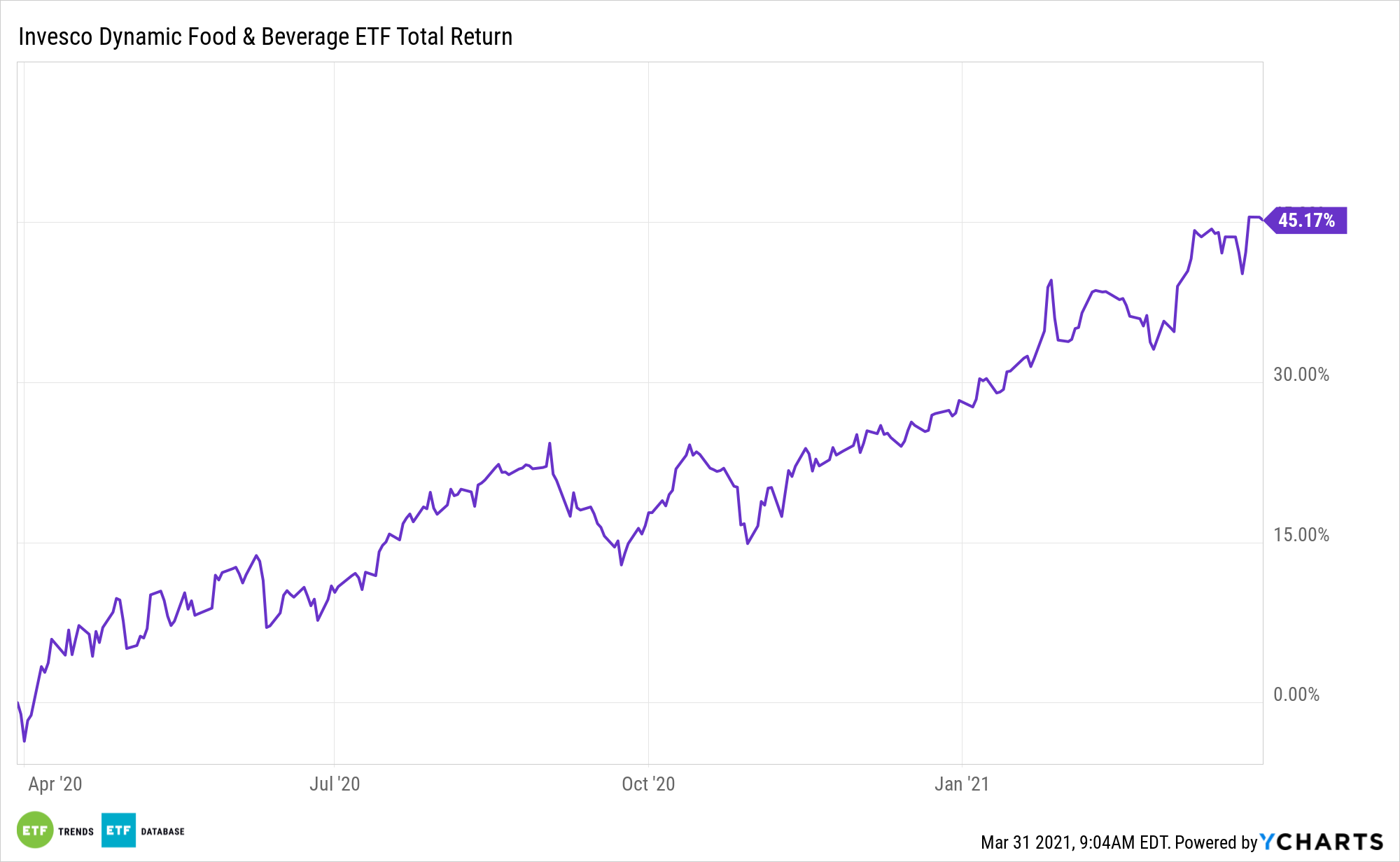

Up 13% year-to-date, PBJ is surging to start 2021. The fund has a dividend yield of 1.08%.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.