Last Friday’s jobs report was a dud and arguably one of the biggest disappointments for that data point on record, but investors shouldn’t jump to the conclusion that cyclical stocks should be abandoned.

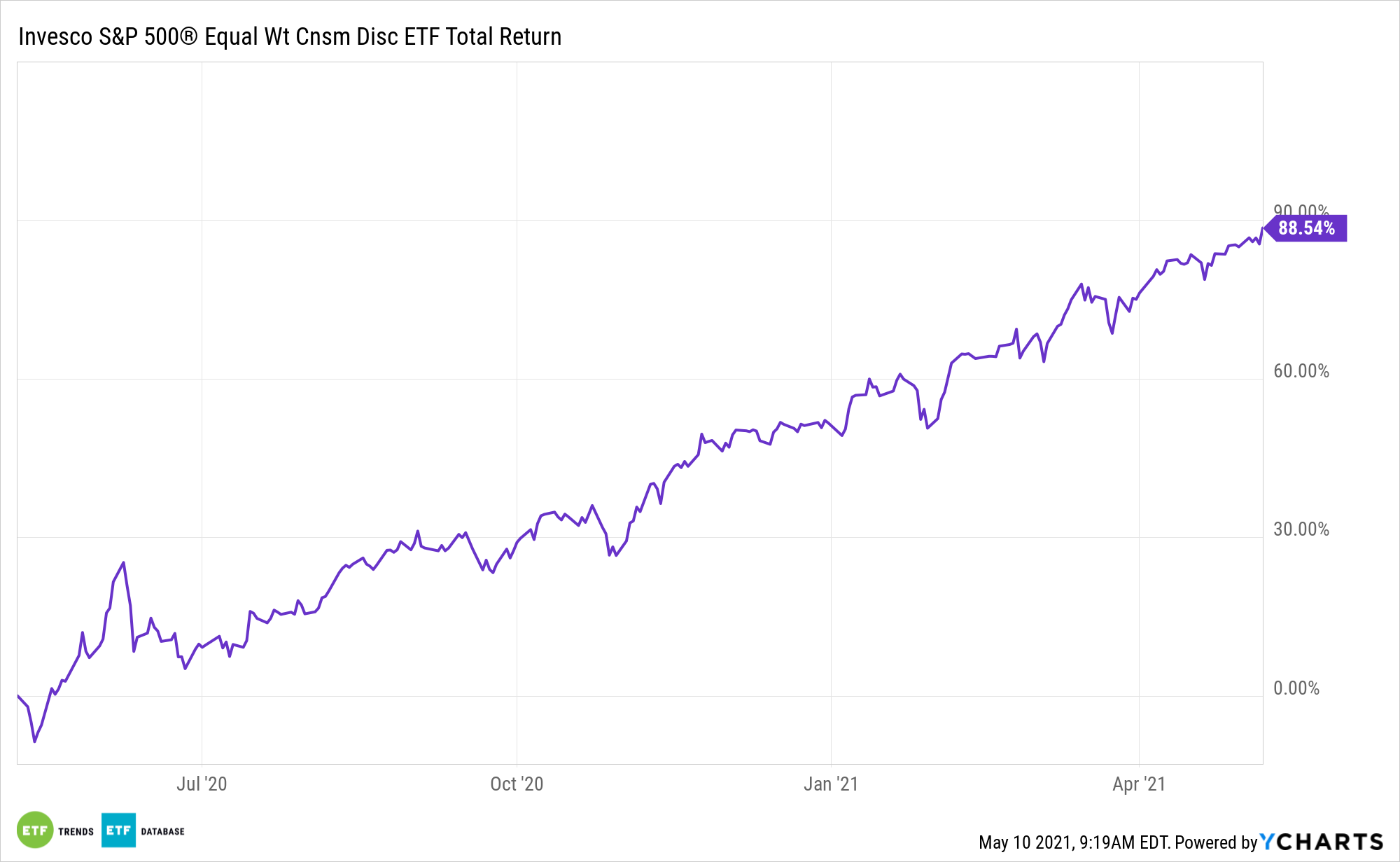

Actually, the case remains compelling for exchange traded funds like the Invesco S&P 500 Equal Weight Consumer Discretionary ETF (RCD).

“The good news for us is that the U.S. consumer is on one of their heathiest footings in decades, particularly relative to past periods immediately following recessions,” according to BlackRock research. “It’s no secret that the massive government transfers over the past year have been a boon for consumer incomes, with disposable income growth meaningfully higher in 2020 vs. 2019 (which compares favorably to the consistent decline in incomes we saw throughout 2008 and into 2009).”

Cementing RCD’s relevance over the near-term is a data point some investors are already familiar: two-thirds of U.S. GDP is driven by consumer spending.

More to the ‘RCD’ Story

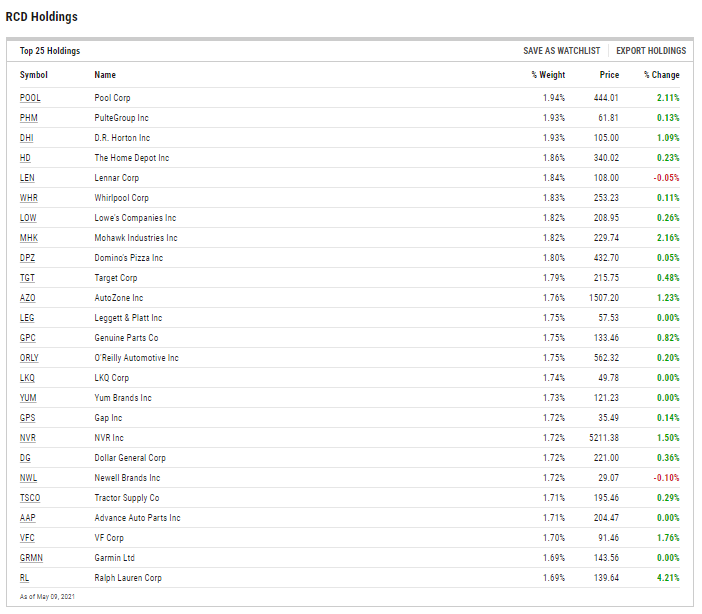

As its name implies, RCD is an equal-weight exchange traded fund. Equal-weight ETFs help investors dodge concentration risk, and RCD lives up to that billing.

Consider that RCD doesn’t allocate more than 1.94% of its weight to any of its 64 holdings. Conversely, the cap-weighted version of the S&P 500 Consumer Discretionary Index devotes about 36% of its weight to just two stocks – Amazon and Tesla.

With Amazon scuffling this year, RCD’s benefits are on full display. The Invesco ETF is up 22.22% year-to-date while the cap-weighted S&P 500 Consumer Discretionary Index is higher by just 9%.

Those are plumbing elements regarding RCD. On a macro level, the fund offers benefits, too, including potentially positive correlation to low interest rates.

“With the precipitous drop in interest rates, household debt service costs as a percentage of disposable income have also fallen massively to lowest levels we have seen since the early 1980s,” adds BlackRock.

Beyond the low rate leverage, RCD is important in this climate for another reason: significant mid cap exposure. Mid cap equities are beating both large- and small-cap rivals this year. Almost 60% of RCD’s roster is allocated to stocks in the market’s sweet spot.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.