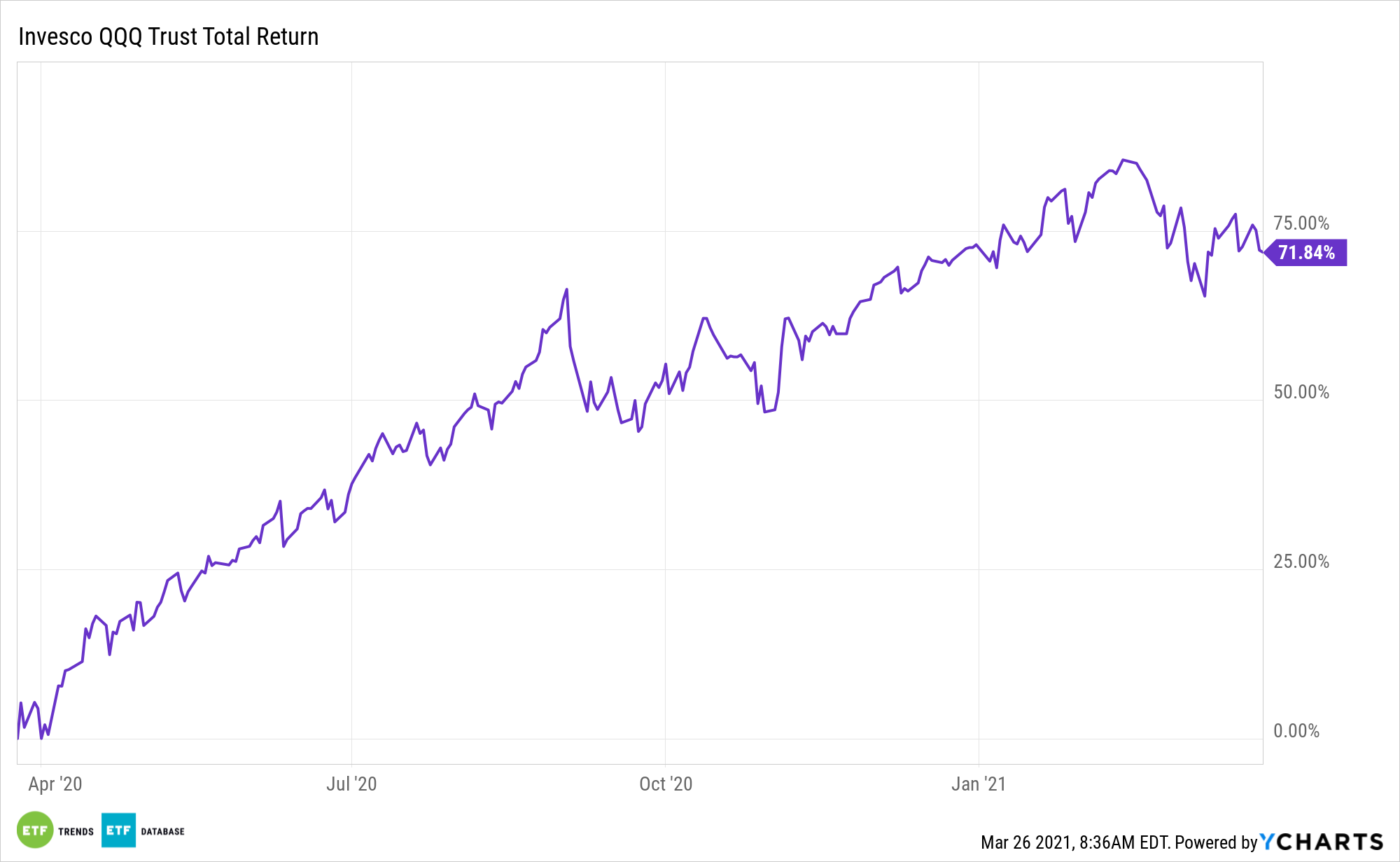

Among U.S.-listed exchange traded funds, the Invesco QQQ Trust (NASDAQ: QQQ) is one of the most venerable.

It sports a track record of more than two decades and is one of the largest ETFs in the world. QQQ, which tracks the Nasdaq-100 Index, is also appealing to a new generation of investors.

“The fund’s concentration in the high-growth stocks billed as ‘innovative’ and ‘disruptive’ in the lingo of the day—it tracks the Nasdaq-100—has made it a favorite of those looking to capitalize on the accelerated shift to working from home,” reports Julia Carpenter for the Wall Street Journal.

Companies in the Nasdaq-100 spend more than twice as much in R&D, on average, compared to those in the S&P 500. Calculating R&D as a percent of sales in the last 12 months, Nasdaq-100 companies averaged 47% higher than S&P 500 firms, explaining some of the allure of QQQ’s younger cohort.

QQQ: A Broad Appeal

With the 2000 technology bubble still remembered by many of today’s market participants, it may be surprising to some to learn that the Nasdaq-100 Index (NDX) and the Invesco QQQ Trust (QQQ) actually prove somewhat resilient in trying markets.

Obviously, given the index’s large technology exposure, it’s not a low volatility fund. Nor does it weather storms entirely, but looking at NDX’s historical performance in crises can prove instructive. Those are more traits appealing to millennials and Gen Z investors.

“QQQ has come to embody one of the signature trends of the current market moment: young investors’ embrace of tech investing via online trading whose falling costs have given rise to tools that didn’t exist before,” according to the Journal.

Many QQQ components are using technology to disrupt the industries they are in. These companies use innovation techniques to create competitive advantages across multiple sectors and industries beyond tech. The coronavirus pandemic has also highlighted opportunities with tech stocks and QQQ.

For cost-conscious, long-term investors, young and old alike, Invesco recently launched the Invesco NASDAQ 100 ETF (QQQM), which costs 5 basis points less than QQQ.

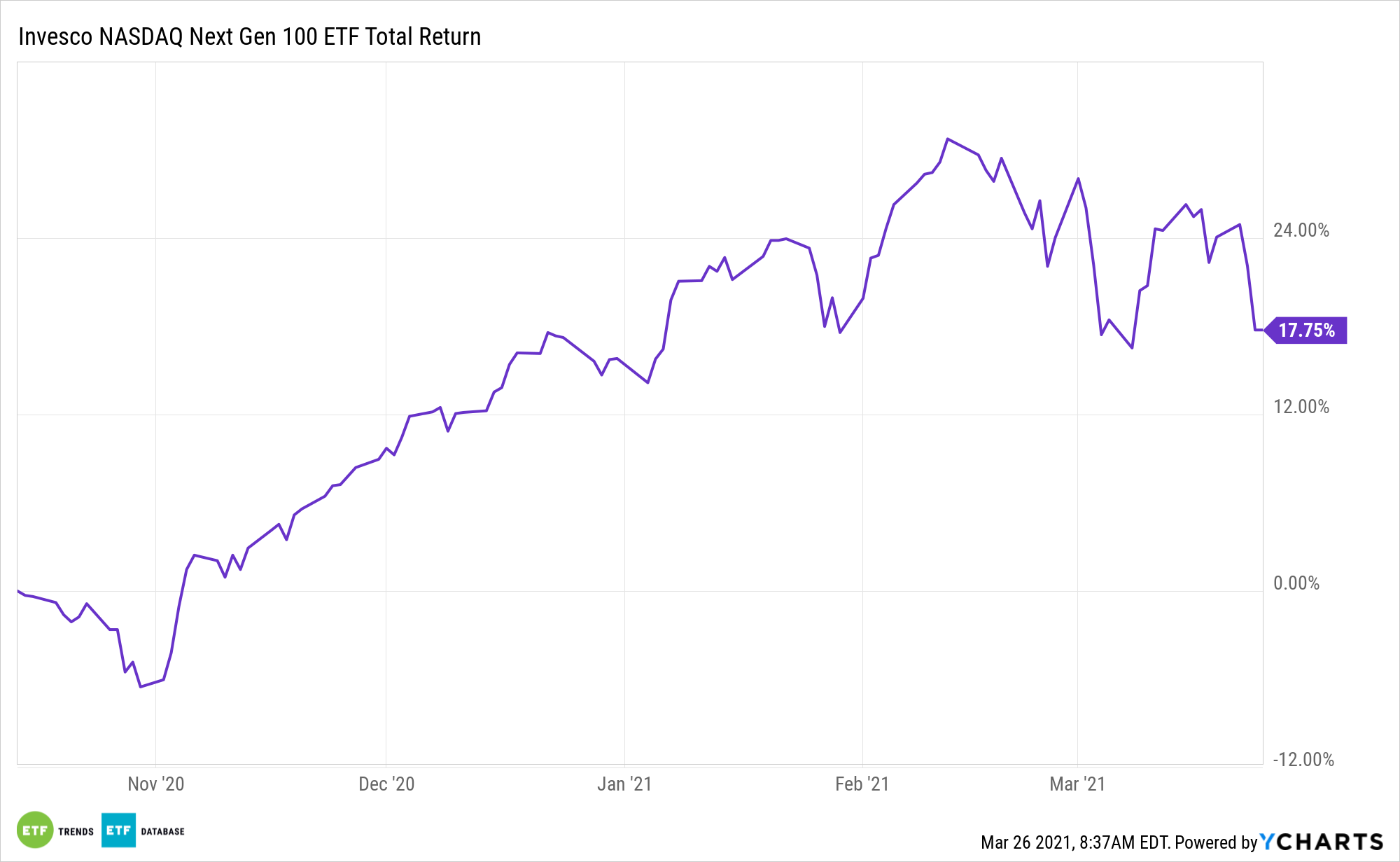

Additionally, both longer- and shorter-term investors looking for exposure to the next generation of innovative companies to be listed on the Nasdaq may opt for the Invesco NASDAQ Next Gen 100 ETF (QQQJ). QQQJ extends this concept further by offering access to the “next 100” non-financial companies listed on the Nasdaq outside of the NASDAQ-100 Index, offering a mid cap alternative to the NASDAQ-100.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.