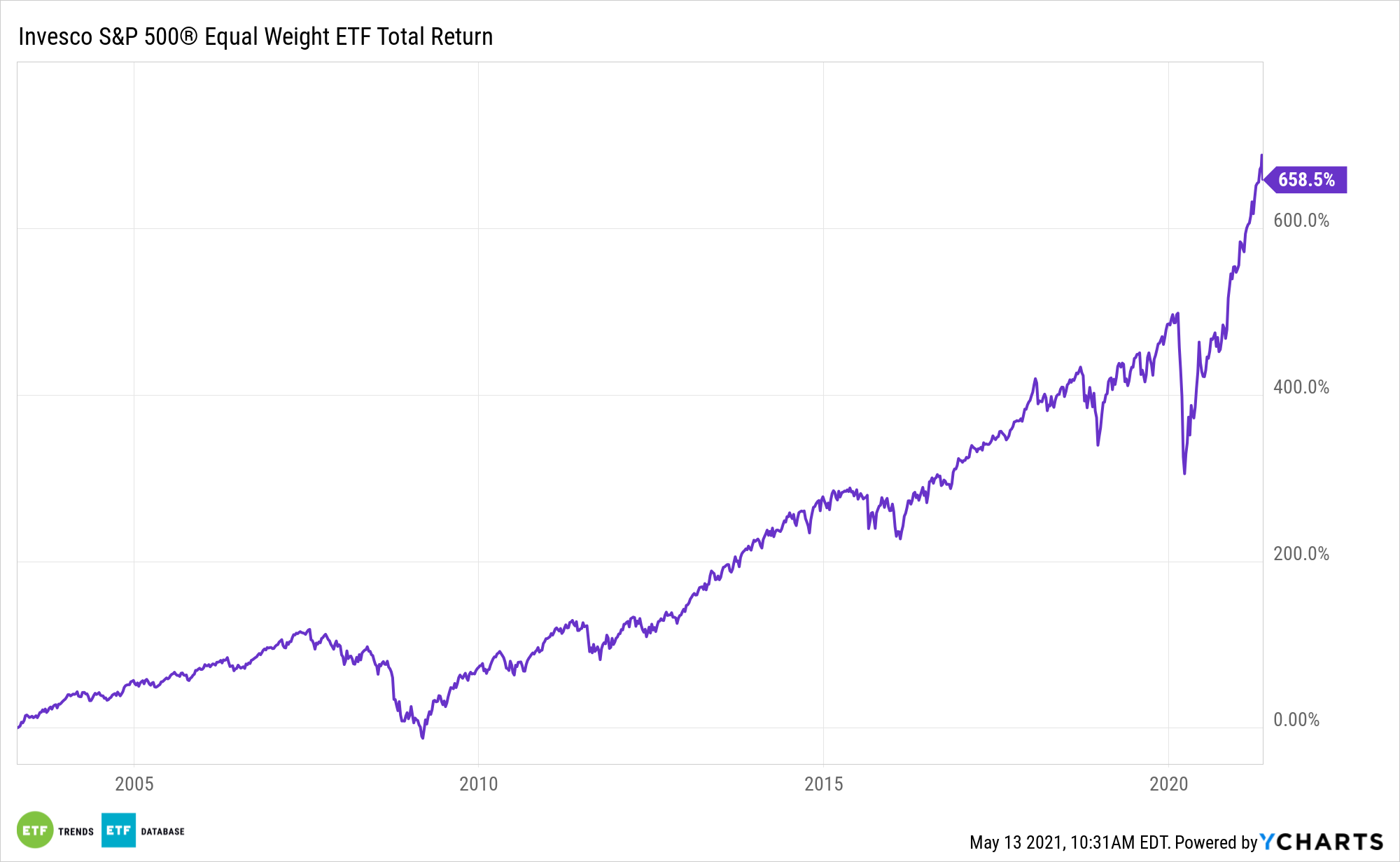

Outperforming the cap-weighted version of the S&P 500 this year, one might say the Invesco S&P 500 Equal Weight ETF (RSP) has momentum.

However, it’s not momentum in the factor sense. In fact, equal-weight strategies, including RSP, aren’t all that dependent on the momentum factor as a driver of returns. In shorter time frames, RSP’s out-performance of cap-weighted benchmarks can benefit from momentum, but over time, the factor’s impact on equal-weight price action declines.

“Unsurprisingly, when Equal Weight is doing well, its momentum score rises. But over time, despite Equal Weight’s outperformance (averaging 2.5% over 22 calendar years), its momentum score is typically negative, at a median of -7.6%,” according to S&P Dow Jones Indices.

That data points to an important concept concerning equal-weight ETFs at large: rebalancing.

“This is a function of the way Equal Weight rebalances—every quarter, it sells its relative outperformers and buys more of its relative underperformers, which has the effect of muting its exposure to the momentum factor,” adds S&P.

Where RSP Momentum Stands Today

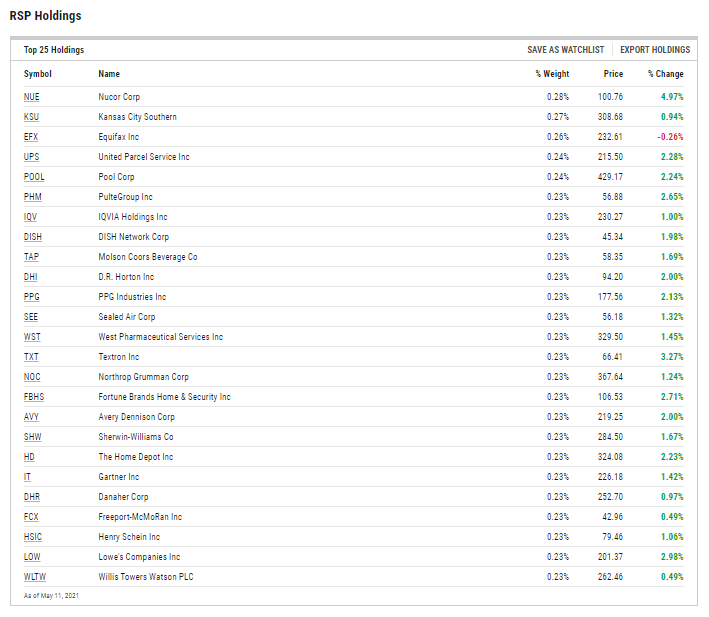

Due its equal-weight methodology, RSP’s sector exposure is significantly different than those found in the cap-weighted S&P 500.

“Interestingly, Equal Weight’s momentum exposure is currently flat. This last occurred at the end of 2016, as Equal Weight’s relative performance turned positive,” says S&P. “Equal Weight experienced the strongest positive momentum exposures when its outperformance was at a peak, such as in 2001, 2003, and 2010.”

Today, RSP’s combined weight of beloved momentum sectors technology and communication services is just 18.60%. Alone, tech is 26% of the cap-weighted S&P 500.

RSP’s strength year-to-date is likely in part attributable to cyclical sectors and the value factor rebounding in earnest.

“The recent comeback of smaller caps and Equal Weight, resulting in a neutral exposure to momentum, indicates a moderately strong relative return environment,” notes S&P. It is important to remember that factor exposures are not constant and experience fluctuations as we experience reversals in performance. If Equal Weight’s outperformance continues, we can anticipate a further increase in its exposure to momentum. We can look to history to provide perspective on these changing relationships.”

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.