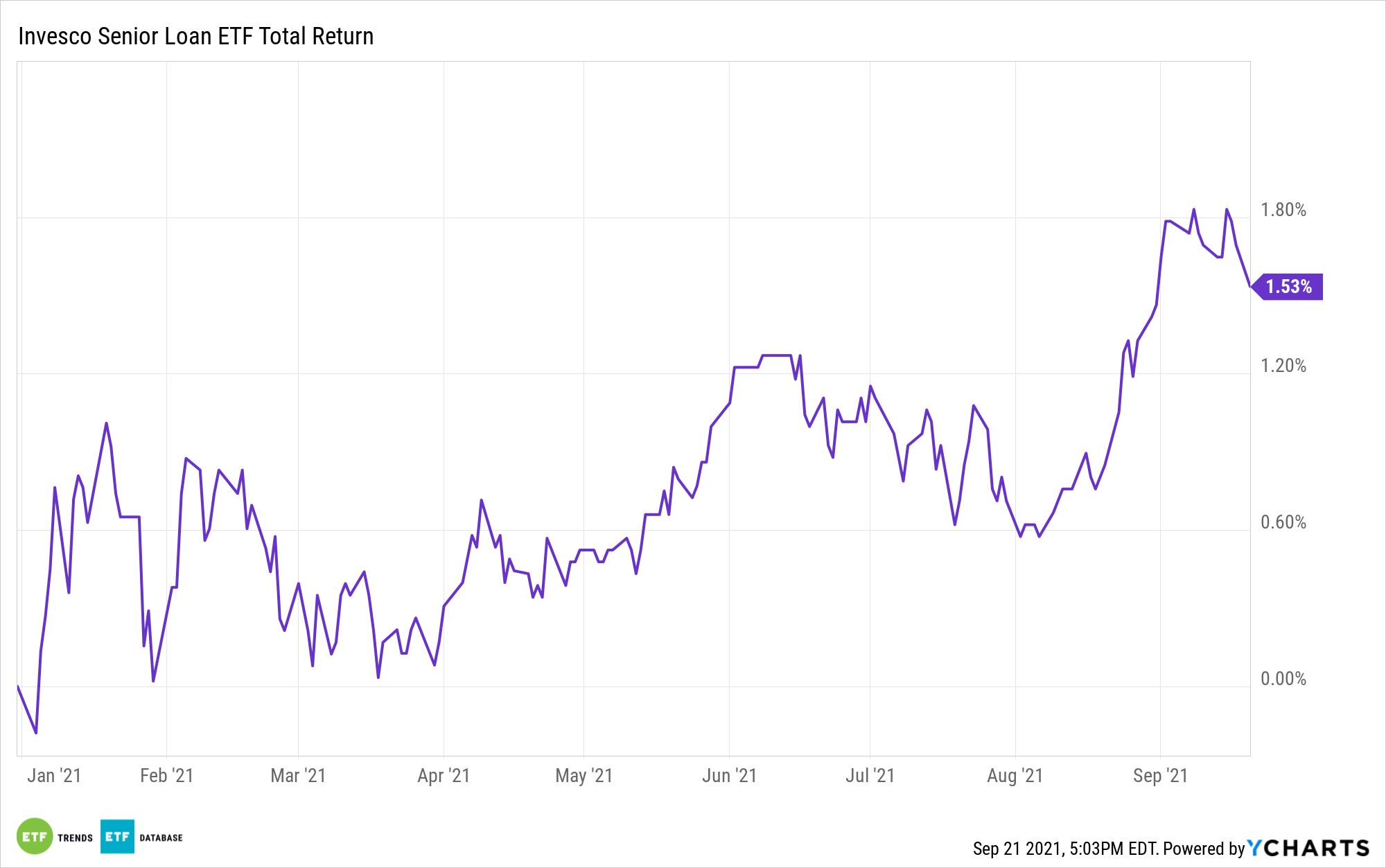

The Invesco Senior Loan ETF (NYSEArca: BKLN) is higher by nearly 2% year-to-date, and income investors are flocking to the original leveraged loan exchange traded fund — signs that the search for income and yield is taking market participants beyond basic bond assets.

BKLN, which follows the S&P/LSTA U.S. Leveraged Loan 100 Index and yields 3.24%, is proving steady amid a spate of new bank loan issuance and as investors look for fixed income assets that can be useful in fighting inflation. Due to the fixed rate component found with BKLN’s components, the ETF can potentially be a better inflation fighter than a traditional high-yield corporate bond fund.

“The rally in junk debt marks one sign of investors’ retreating worries about the recent jump in inflation, which erodes the purchasing power of bonds’ fixed payments and can drive the Federal Reserve to raise interest rates,” reports Sebastian Pellejero for The Wall Street Journal.

Bank loan issuance typically increases as corporate earnings do the same, indicating that companies are confident in their own prospects and those of the broader economy. While economic growth is likely to slow in the third and fourth quarters from the torrid pace set in the first half of the year, economists see the world’s largest economy notching annual GDP growth of around 6% this year.

“Analysts and investors expect bond and loan sales to each set full-year records. With rates low, companies are taking advantage of investors’ demand to refinance higher-cost debt, lowering their interest costs and pushing off repayment,” according to the Journal.

BKLN components are often referred to as senior loans because the debt is higher up the corporate hierarchy than standard junk bonds, meaning that senior loan holders are prioritized in the event of default or bankruptcy. As such, BKLN holdings usually sport lower yields than standard junk bonds, and credit risk is usually lower with this asset class. 91% of BKLN’s 144 holdings are rated BBB, BB, or B.

Nearly all of BKLN’s holdings have maturities of one to five or five to 10 years. Moreover, leveraged loans are topping U.S. government debt and investment-grade corporate bonds, adding to the appeal of BKLN.

“Leveraged loans, which have interest rates that rise and fall with their benchmark, have returned 4.2%. Both beat the 0.05% total return on investment-grade corporate bonds and minus 1.4% for Treasurys,” according to the Journal.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.