There are compelling discounts to be had with ex-U.S. equities, and the Invesco FTSE RAFI Developed Markets ex-U.S. Portfolio (NYSEArca: PXF) is a prime avenue for investors looking to access that increasingly important theme.

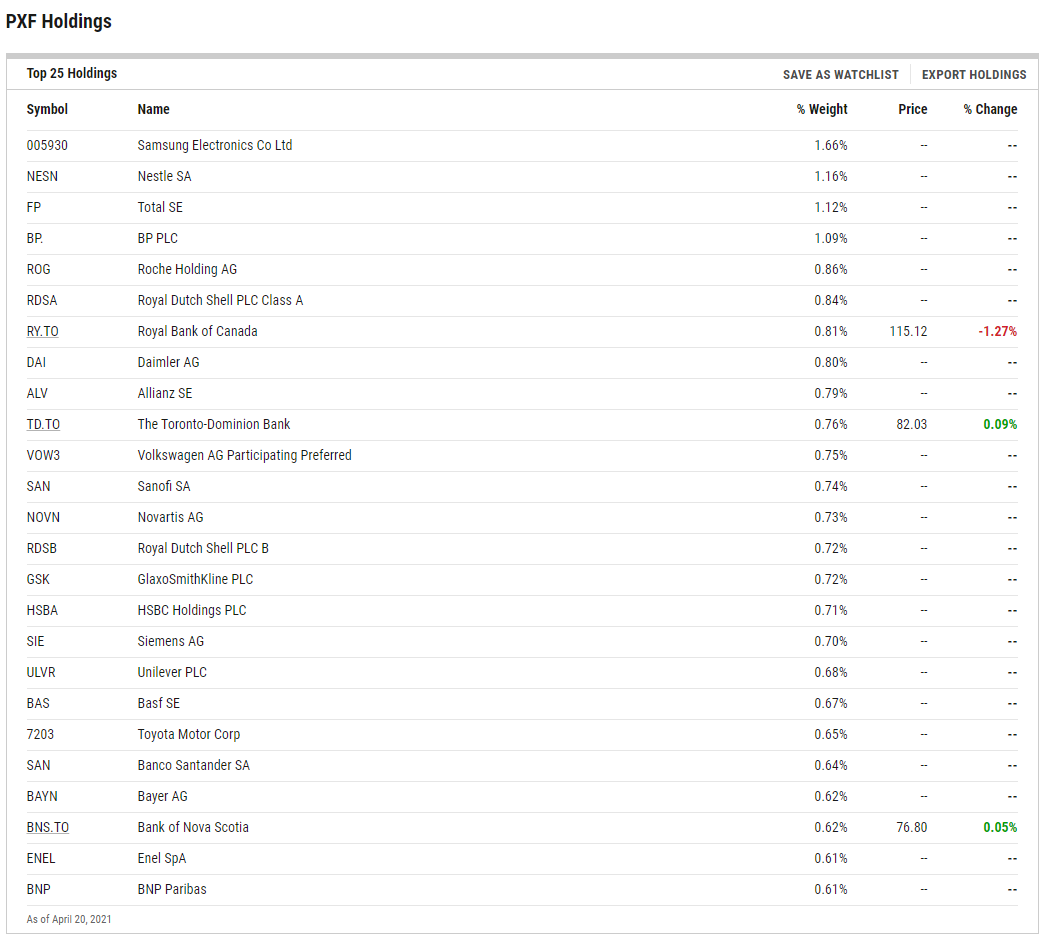

PXF is based on the FTSE RAFI Developed ex U.S. 1000 Index. The Fund will generally invest at least 90% of its total assets in securities that comprise the Index as well as American depositary receipts and global depositary receipts that represent securities in the Index. The Index is designed to track the performance of the largest developed market equities (excluding the U.S.), selected based on the following four fundamental measures of firm size: book value, cash flow, sales, and dividends.

“Stocks outside the United States have shown some signs of strength lately. In the fourth quarter of 2020, for example, the Morningstar Global Markets ex-US Index gained 17.4% compared with a 14.2% return for the Morningstar US Market Index,” says Morningstar analyst Amy Arnott. “That quarter was a rare glimmer of hope amid an unusually long performance slump. Over the past 10 years, annualized returns from international stocks have lagged those of their domestic counterparts by more than 7 percentage points per year, on average. The bright side of this long and painful performance slump: While few markets qualify as cheap, non-U.S. markets offer more attractive valuations in relative terms.”

Broad Developed Markets Exposure

For many decision-makers, rules-based ETFs are considered “hybrid” investment assets. The ETFs combine traditional passive indexing methodologies with additional rules that mimic actively managed styles.

Due to their factor-based styles, these ETFs tend to generate outperformance, come with lower fees, and diminish volatility.

Plus, there’s the added benefit of income, another theme PXF has leverage to. Ex-U.S. developed market dividend payers often feature larger yields than their U.S. counterparts, an assertion proven by comparing large- and mega-cap dividend stocks from familiar dividend sectors such as consumer staples, energy, financial services, and telecommunications.

PXF is a broad developed markets ETF, not a dedicated Europe fund. But it’s exposure to European equities is more than adequate for investors looking for some portfolio benefits without the full commitment of a European-specific ETF.

“On the positive side, the long dry spell for international stocks makes for more attractive valuations. As shown in the chart below, traditional valuation metrics such as price/earnings, price/book, and price/sales are all significantly lower for non-U.S. stocks compared with the domestic market. Japan, some parts of Europe, and the United Kingdom look particularly cheap based on traditional valuation metrics,” adds Arnott.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.