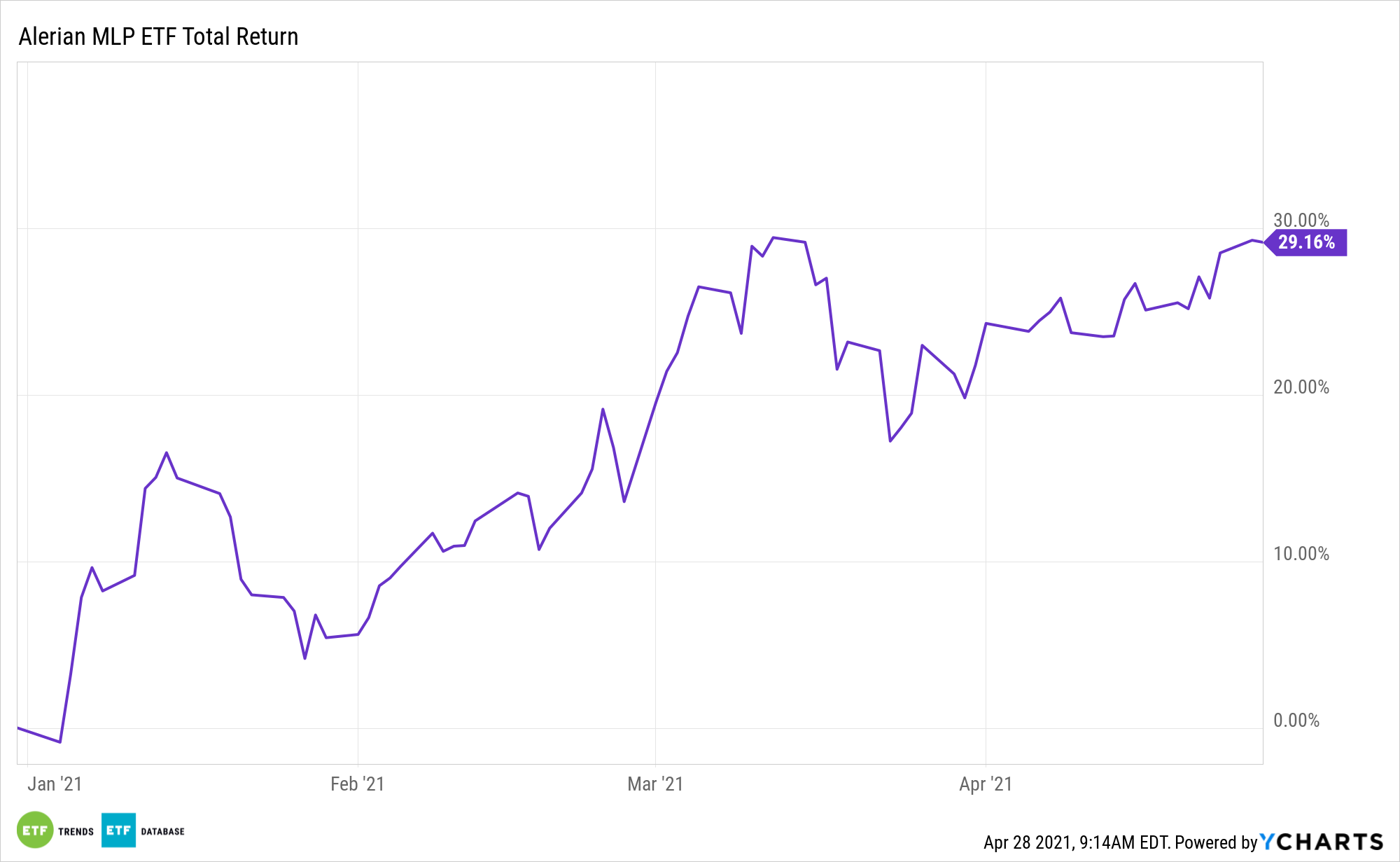

Corporate cash discipline is a concept that can take a while to pay off for investors, but when it does, it’s extremely efficacious. The ALPS Alerian MLP ETF (NYSEArca: AMLP) may just be a case study in this arena.

AMLP seeks investment results that correspond generally to the price and yield performance of its underlying index, the Alerian MLP Infrastructure Index. The index is comprised of energy infrastructure MLPs that earn a majority of their cash flow from the transportation, storage, and processing of energy commodities.

Tighter reins on expenditures instituted last year by midstream energy companies are having positive impacts in 2021.

“The unprecedented events brought upon by the pandemic, including the oil price collapse in 2020, presented a true stress test for energy broadly, including midstream. As previously discussed, despite a pressured commodity price environment and the related impacts to production and demand, the outlook for midstream companies remained fairly stable through 2020 (read more). While some companies lowered 2020 guidance, others maintained their forecasts or ultimately revised guidance back to pre-pandemic levels after initially reducing expectations in the spring of 2020,” says Alerian analyst Mauricio Samaniego.

A Company’s Cost Management Matters

Broadly speaking, energy is a capital-intensive sector, and that’s applicable to the midstream space as well. History proves that when oil prices slump, as they did last year due to the coronavirus pandemic, it’s prudent for companies to manage costs.

“Cost management helped partially offset macro headwinds in 2020, contributing to stable EBITDA and allowing excess cash flow to be used for debt reduction and in some cases, buybacks,” notes Samaniego. “For example, MPLX (MPLX) reduced operating expenses by over $200 million in 2020 relative to initial forecasts by addressing their long-term cost structure. With help from cost reductions, MPLX saw a modest increase in EBITDA year-over-year (+2.1%) and generated excess cash flow after capex and distributions, allowing unit repurchases to begin in 4Q20.”

Discipline instituted last year is delivering in terms of stronger midstream balance sheets in 2021, as well as and more protection and possible upside for payouts.

“While the midstream/MLP space proved resilient in the face of a challenged environment in 2020, mainly due to its fee-based, more defensive business model, initiatives to reduce costs were also beneficial. A continued focus on controlling costs and optimizing assets should benefit the space this year and going forward, even as the macro environment continues to improve,” says Samaniego.

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.