Growth sectors like technology usually have long duration cash flows, meaning they can be sensitive to rising Treasury yields.

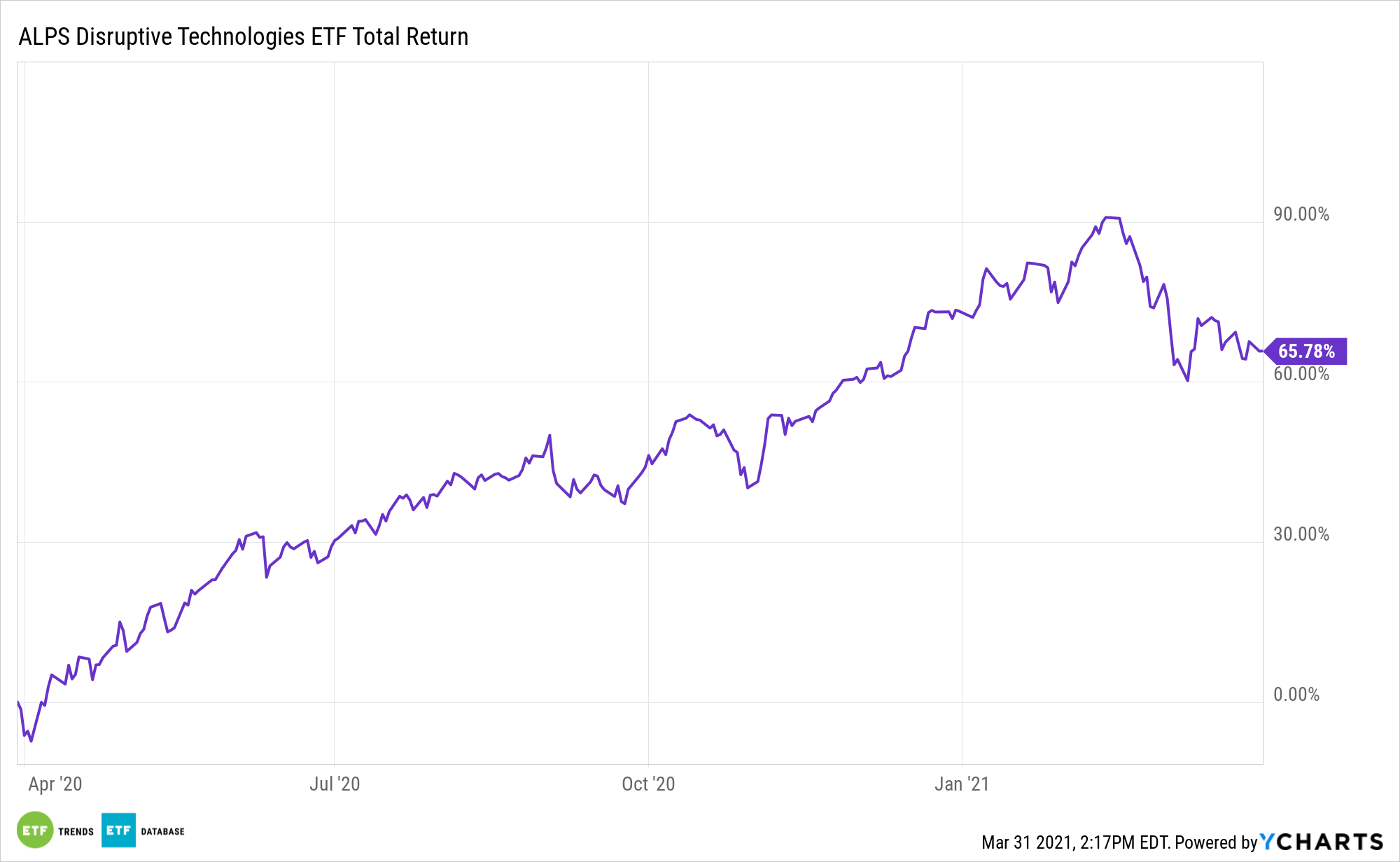

That much has been on display in recent weeks, but investors shouldn’t be hasty in abandoning the sector or funds such as the ALPS Disruptive Technologies ETF (CBOE: DTEC).

DTEC tracks the Indxx Disruptive Technologies Index, which identifies companies using disruptive technologies across ten thematic areas, including Healthcare Innovation, Internet of Things, Clean Energy and Smart Grid, Cloud Computing, Data and Analytics, FinTech, Robotics, Artificial Intelligence, Cybersecurity, 3D Printing, and Mobile Payments.

“The recent bond yield spike has been blamed for pressuring tech stocks as they are seen as vulnerable to rising rates,” according to BlackRock research. “We believe this view is too simplistic: tech is a diverse sector and the driver of higher yields matters more than the rise itself. Our new nominal theme implies central banks will be slower to raise rates to curb inflation than in the past, supporting our pro-risk stance and preference for tech.”

Opportunity Still Beckons in Tech

DTEC is a relevant consideration over the near-term and over longer holding periods because significant disruption is already happen in a myriad of industries. The fund holdings benefit from the shifting bases of technology infrastructure to the cloud, enabling mobile, new, and local services, such as companies that rely on or benefit from the increased use of shared technology, infrastructure, and services, internet-based products and services, new payment methods, big data, the internet of things, and social distribution and media.

“The ‘term premium tantrum’ mostly reflects investors requiring higher compensation for the now greater risks to portfolios presented by government bonds and inflation, in our view,” notes BlackRock. “This makes equities even more appealing than bonds in a multi-asset context – and suggests any further sell-offs in tech may present opportunities. We believe tech companies beating earnings expectations once again will be rewarded if bond yields settle back into a range.”

Overall, DTEC could come back into style regardless of yield gyrations.

“We maintain a positive tactical and strategic view on the tech sector. Any further ‘term premium tantrum’ may present tactical opportunities,” concludes BlackRock.

Other technology funds to consider include the Technology Select Sector SPDR ETF (NYSEArca: XLK) and the Fidelity MSCI Information Technology Index ETF (FTEC).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.