As has been widely documented, the Biden Administration is a persistent backdrop to recent surges by renewable energy stocks and exchange traded funds.

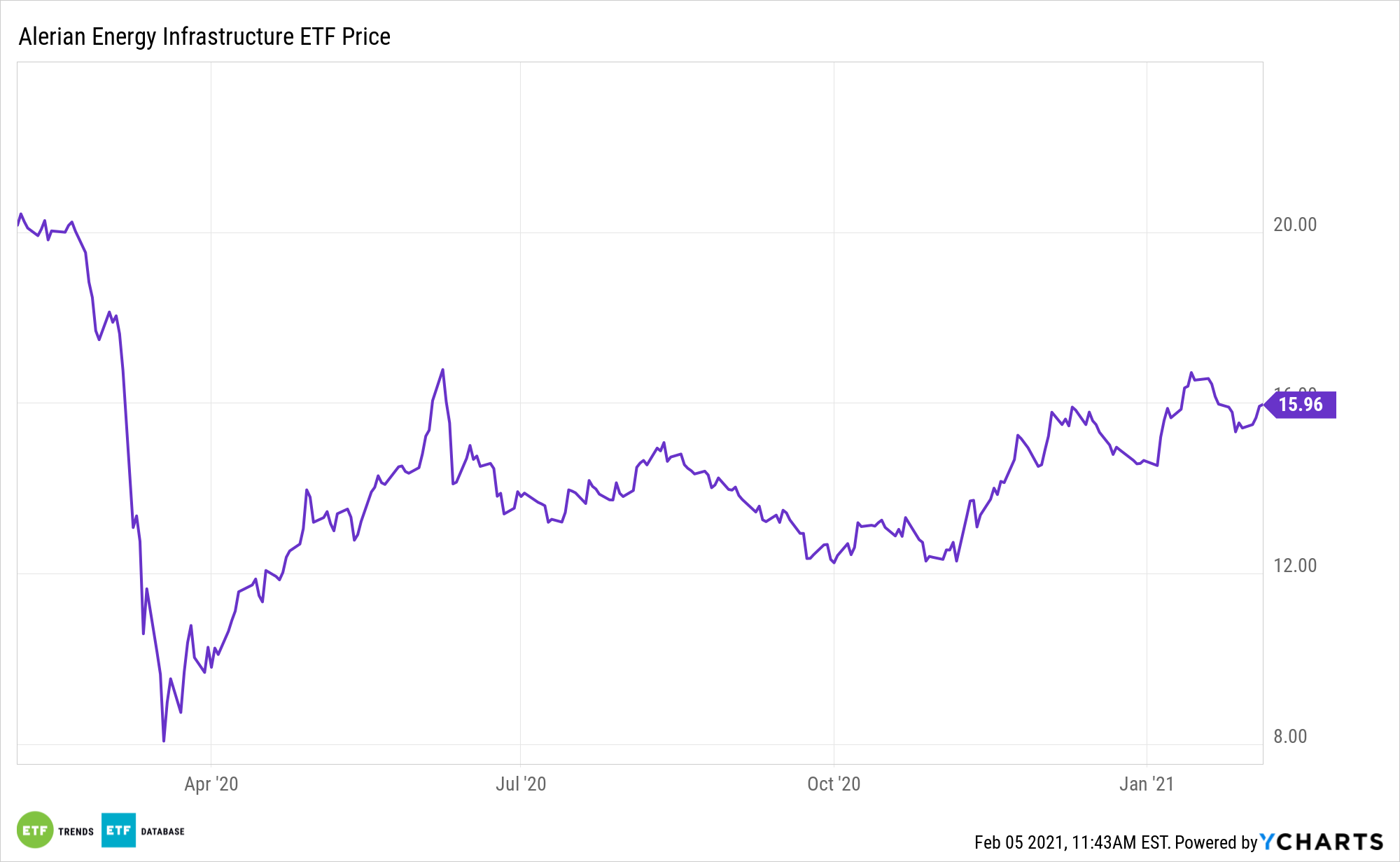

The new administration is pursuing an ambitious clean energy agenda, one that includes reducing U.S. carbon emissions to zero by 2050. That sounds scary for traditional energy companies and it may very well be for some, but that doesn’t mean investors should avoid the Alerian Energy Infrastructure ETF (ENFR).

The ALPS ETF tracks the Alerian Midstream Energy Select Index (CME: AMEI). ENFR acts as a type of hybrid energy infrastructure ETF, which helps investors capture some of the high yields from MLPs while limiting the tax hit from solely owning MLPs. Interestingly, supply/demand dynamics against a green energy revolution could work in ENFR’s favor.

“One important takeaway is that the Biden administration is sowing the seeds of an energy crisis, as demand for cheap and reliable energy commodities and infrastructure will increase at a greater rate than their supply. Equity owners of midstream assets will benefit when that time comes,” according to HFIR Research.

Don’t Drop the Ball on ENFR

What makes ENFR interesting with Biden in office is that the new administration could prove to be more punitive for new midstream companies, and less so for the established names residing in ENFR.

“As midstream development is constrained, existing infrastructure assets will gain in value. With fewer pipelines to service supply and demand centers and compete based on cost, energy transportation will become more expensive. Increasing competition for the use of existing assets will lead to higher fees and growing cash flows for many midstream companies,” notes HFIR.

The other bit of positive news is that as new investment opportunities presumably become sparse under Biden, midstream companies will spend less money on new projects, meaning they can shore up balance sheets and dividends.

“Midstream companies will have fewer investment opportunities. They will therefore be forced to return more capital to investors or to launch new renewable investment initiatives such as transporting renewable gas. We favor the former, which we view as the more likely course for most midstream operators,” adds HFIR.

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.