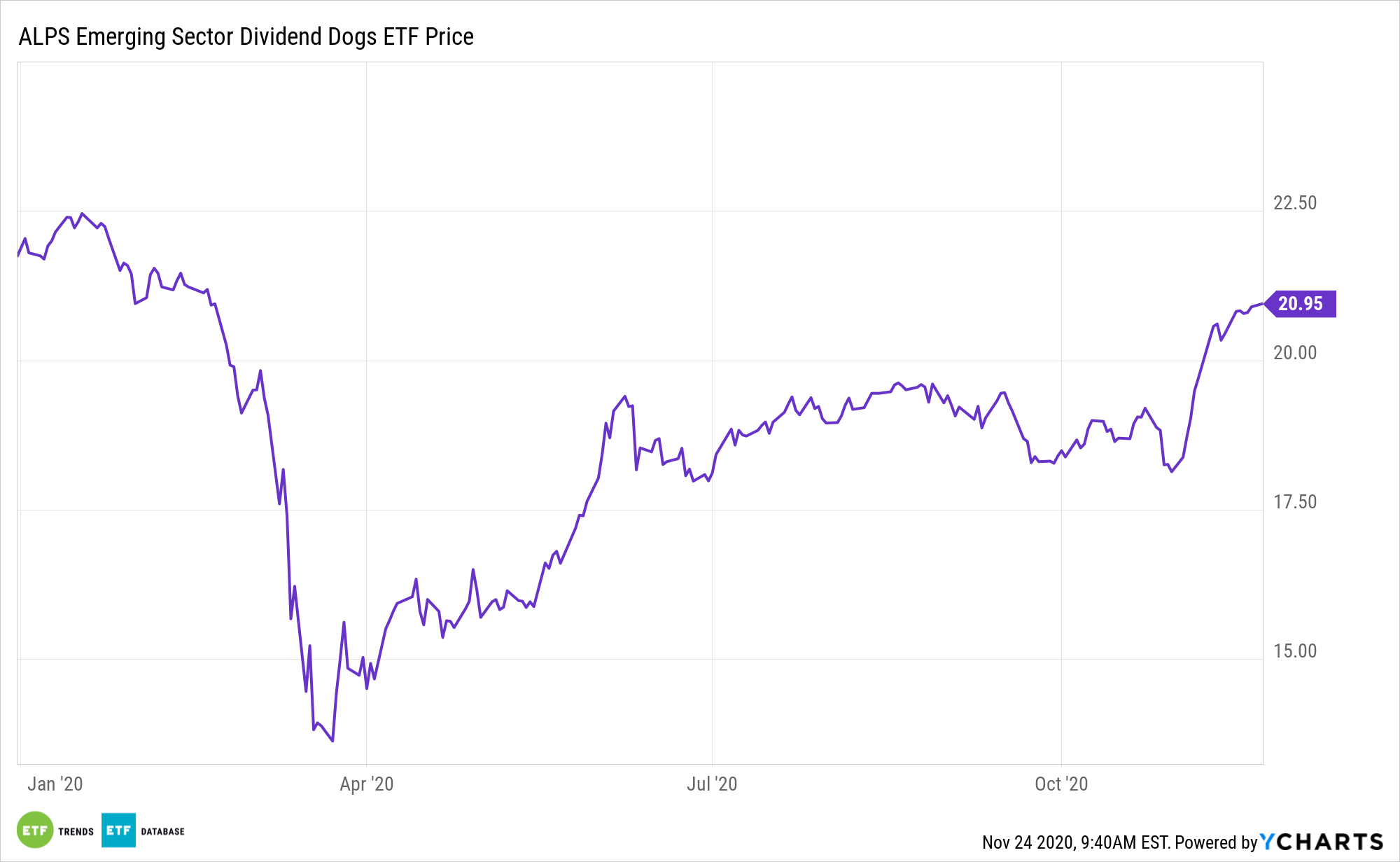

With emerging markets equities perking up, the ALPS Emerging Sector Dogs ETF (NYSEArca: EDOG) could be appealing next year.

EDOG, which debuted over six years ago, tracks the performance of the S-Network Emerging Sector Dividend Dogs Index. The index is comprised of the highest paying stocks, or “Dividend Dogs,” from the S-Network Emerging Markets Index, which holds large-cap, emerging market stocks. The Dividend Dogs include the five stocks in each of the ten Global Industry Classification Standard sectors that make up the S-Network Emerging Markets.

“Emerging markets are set to outperform the rest of the world as a global economic rebound takes hold starting in the second quarter, according to Goldman Sachs Group Inc.,” reports Bloomberg.

EDOG Ready to Roll in Emerging Markets

Up almost 10% over the past month, EDOG is a prime example of an emerging markets ETF benefiting from political change in the United States.

“With reduced political uncertainty following the U.S. election and the potential for more positive vaccine updates, analysts and investors from BlackRock Inc. to JPMorgan Chase & Co. and Morgan Stanley have been flagging opportunities in risky assets that have trailed peers,” according to Bloomberg.

Bolstering the 2021 case for EDOG is that some market observers are growing bullish on emerging markets cyclical assets, a positive for the ALPS ETF given its exposure to energy, financial services, and materials names, among others.

EDOG’s status as a value play could be attractive in this environment because the gap between growth and value could collapse. The otherwise classic mean reversion approach to value may not hold, as many traditional industries face structural risks due to the changing economic environment.

China could deliver over 50% of global GDP over the next couple years as the rest of the world slowly recovers from the economic impact of COVID-19. China’s resiliency and growth in a year riddled with coronavirus-induced weakness have attracted many equity managers looking for some level of certainty, along with those seeking the flavor-of-the-month pick.

Other emerging markets dividend ETFs include the ProShares MSCI Emerging Markets Dividend Growers ETF (CBOE: EMDV), iShares Emerging Markets Dividend ETF (DVYE), and the WisdomTree Emerging Markets Equity Income Fund (NYSEArca: DEM).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.