By Alps Advisors

U.S. REITS RIP AS BUSINESSES CONTINUE TO REOPEN

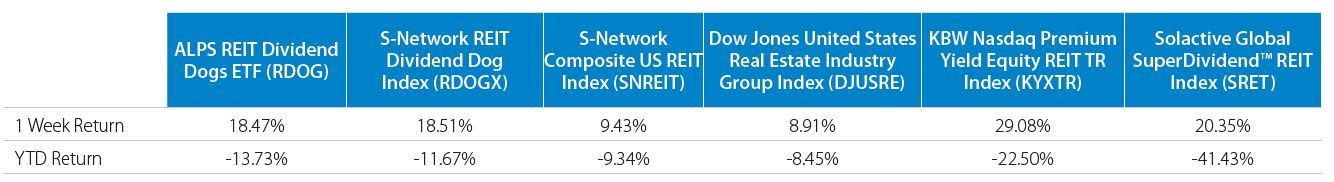

- Broader equity markets cruised towards 5% shy of pre-pandemic highs last week, riding a wave of fresh optimism stemming from an encouraging U.S. jobs report last Friday amid continued business reopenings. Also riding this wave was the ALPS REIT Dividend Dogs ETF (RDOG), which posted gains of nearly 20% on the week and doubled the performance of broad-based REITs last week.

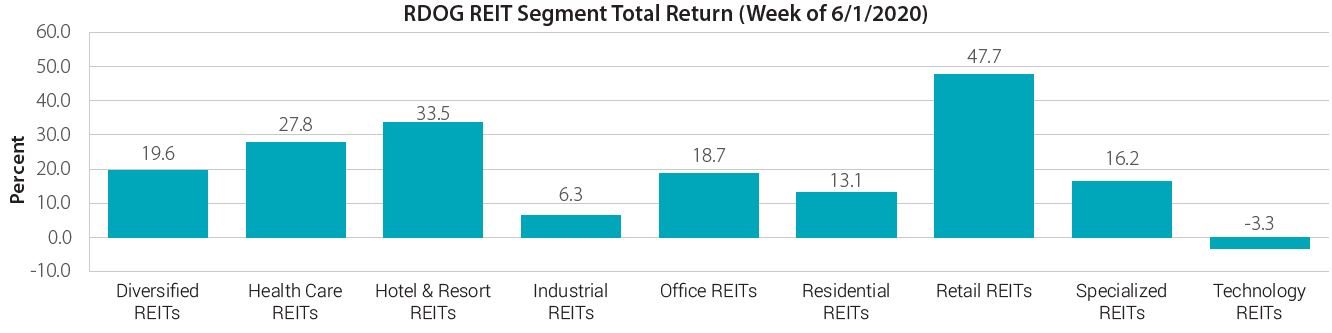

- RDOG’s Retail REITs segment rocketed a staggering 47% last week as shopping malls and retail stores began to reopen and rehire. Additionally, concurrent with the symbolic reopening of Las Vegas casinos and hotels, the Hotel & Resort REIT segment within RDOG climbed 33% last week. Meanwhile, RDOG’s Healthcare REIT segment rose nearly 28% last week as mobility slowly returns for seniors to move into living facilities

Source: Bloomberg L.P. as of 6/5/20

- The global style shift to value from growth was very evident within REITs last week. The cheapest REITs segments within RDOG by Price to Funds-From-Operations are Retail, Hotel & Resort, and Healthcare REITs, which rallied strongly last week while the most expensive Technology REITs segment was sold.

Source Trepp, Nareit as of 6/4/2020

- Credit issues were not spread evenly across property segments in May and were mostly concentrated in loans secured by lodging and retail properties. Business reopenings should help stabilize 30+ day delinquency figures in June.

- 30+ day delinquencies on Office properties remained relatively subdued in May, but the global work-from-home trend may pose longer-term issues.

- RDOG, which tracks the RDOGX Index, gained 18.47% last week and outperformed broad-based REITs.

Source: Bloomberg, L.P., as of June 5, 2020

Performance data quoted represent past performance. Past performance is no guarantee of future results so that shares, when redeemed may be worth more or less than their original cost. The investment return and principal value will fluctuate. Current performance may be higher or lower than the performance quoted. For the most current month end performance data please call 844.234.5852. Performance includes reinvested distributions and capital gains.

Past performance is not indicative of future results. For standardized performance of the fund please click here.

* Weights as of 6/5/20

TOP 10 FUND HOLDINGS

^ As of 6/5/2020 (subject to change)

Important Disclosure & Definitions

An investor should consider the investment objectives, risks, charges and expenses carefully before investing. To obtain a prospectus which contain this and other information call 866.675.2639 or visit www.alpsfunds.com. Read the prospectus carefully before investing.

Shares are not individually redeemable. Investors buy and sell shares on a secondary market. Only market makers or “authorized participants” may trade directly with the Fund, typically in blocks of 50,000 shares.

There are risks involved with investing in ETFs including the loss of money. Additional information regarding the risks of this investment is available in the prospectus. The Fund is subject to the additional risks associated with concentrating its investments in companies in the market sector. Diversification does not eliminate the risk of experiencing investment losses. An investor cannot invest directly in an index.

An investment in the Fund is subject to investment risk, including the possible loss of principal. Ownership of real estate is subject to fluctuations in the value of underlying properties, the impact of economic conditions on real estate values, the strength of specific industries renting properties and defaults by borrowers or tenants. Real estate is a cyclical business, highly sensitive to general and local economic conditions and developments, and characterized by intense competition and periodic overbuilding. Credit and interest rate risk may affect real estate companies’ ability to borrow or lend money.

Dogs of the Dow Theory: an investment strategy which proposes that an investor annually select for investment the ten Dow Jones Industrial Average stocks whose dividend is the highest fraction of their price.

Real Estate Investment Trust (REIT): Companies that own or finance income-producing real estate across a range of property sectors.

The S-Network® REIT Dividend Dogs Index (RDOGX): a portfolio of stocks derived from the S-Network US Composite REIT Index (SNREIT). The RDOGX methodology selects the five stocks in each of the nine segments that make up SNREIT which offer the highest dividend yields as of the last trading day of November. The forty-five stocks that are selected for inclusion in the portfolio are equally weighted.

The S-Network® U.S. Composite REIT Index: a benchmark index for the Real Estate Investment Trust component of the US stock market.

The S-Network Sector Dividend Dogs Index is designed to serve as a fair, impartial and transparent measure of the performance of US large cap equities with above average dividend yields.

The Dow Jones United States Real Estate Industry Group Index is a subset of the Dow Jones US Index and represents Real Estate Investment Trusts (REIT) and other companies that invest directly or indirectly in real estate through development, management or ownership, including property agencies.

Nasdaq Premium Yield Equity REIT TR Index is a modified dividend yield weighted index designed to track the performance of domestic equity REITs that are publicly traded in the U.S. with competitive dividend yields.

Solactive Global SuperdividendTM REIT Index tracks the price movements in shares of international companies with a high dividend yield.

The indexes are reported on a total return basis, which assumes reinvestment of any dividends and distributions realized during a given time period. The indexes are not actively managed and do not reflect any deductions for fees, expenses or taxes. One cannot invest directly in an index. Index performance does not reflect fund performance.

The Fund employs a “passive management”- or indexing- investment approached and seeks to track the investment results of an index composed of global companies that enter traditional markets with new digital forms of production and distribution, and are likely to disrupt an existing market or value network. Unlike many investment companies, the Fund is not “actively” managed. Therefore, it would not necessarily sell a security because the security’s issuer was in financial trouble unless that security is removed from the S-Network® REIT Dividend Dogs Index. Similarly, the Fund does not buy a security because the security is deemed attractive unless that security is added to the S-Network® REIT Dividend Dogs Index. This fund may not be suitable for all investors. There are risks involved with investing in ETFs including the loss of money.

ALPS Portfolio Solutions Distributor, Inc. is the distributor for the ALPS REIT Dividend Dogs ETF.