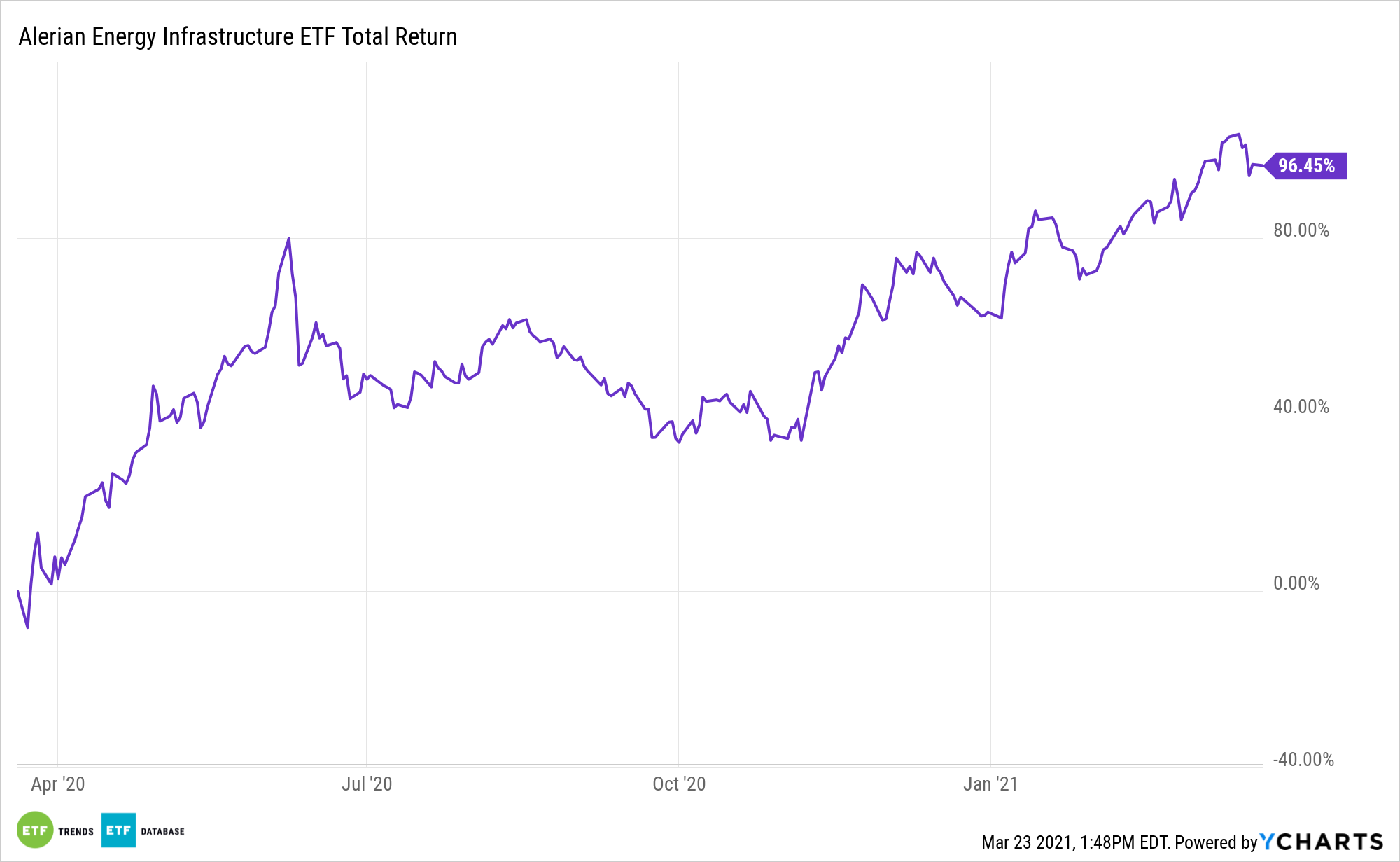

With the energy sector off to a torrid start in 2021, it may like the midstream value proposition may be waning. The Alerian Energy Infrastructure ETF (ENFR) actually shows the opposite may be true.

The ALPS ETF tracks the Alerian Midstream Energy Select Index (CME: AMEI). ENFR acts as a type of hybrid energy infrastructure ETF, which helps investors capture some of the high yields from MLPs while limiting the tax hit from solely owning MLPs. Part of the good news for the sector is that some well-known investors are revisiting energy equities.

Home to a slew of benefits for energy investors, midstream is still offering great value, according to some analysts.

“Midstream tilts toward more value than growth, considering the lack of near-term growth for many, with high yields and substantial excess cash flow after distributions, dividends, and capital spending to devote to debt reduction and share and unit buybacks,” writes Morningstar analyst Stephen Ellis.

To ENFR for Value

Investors can look to the midstream space for more compelling cash flow-generating prospects. Free cash flow is the cash a company has left over after accounting for capital spending and it’s a vital evaluation metric in capital-intensive industries, such as energy. Fortunately, the outlook on this front is bright for midstream names.

Additionally, the midstream space is usually more defensive and less volatile than other energy segments due to steady, reliable cash flows.

“Midstream oil and gas volumes thus tend to be more important than oil and gas prices, and with many U.S. producers pledging to hold volumes flat and live within cash flows (a good move for them), midstream companies aren’t necessarily seeing the same expected volume uplift in the near term that they would have in cycles past,” notes Ellis.

Finally, multiple ENFR holdings appear undervalued today.

“Stronger evidence of capital discipline among the U.S. midstream players, especially as most have substantial excess cash flows available after funding distributions and capital spending plans in 2021. This is a first for the industry. Thus, as stock prices for the space have been crushed over the past few years, we’d like to see more share and unit buybacks and debt reduction,” concludes Ellis.

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.