Advisors and experienced fund investors know that fees matter. These costs have a material impact on long-term returns.

It’s always a positive when an exchange traded fund gets a fee cut. That recently happened with the Alerian Energy Infrastructure ETF (ENFR). As of July 1, the energy infrastructure ETF charges 0.35% per year, or $35 on a $10,000 investment.

ENFR’s previous expense ratio was 0.65%. Not only does the new annual levy equate to one of the most dramatic fee reductions in the ETF arena this year, it makes ENFR the least expensive fund in the midstream space.

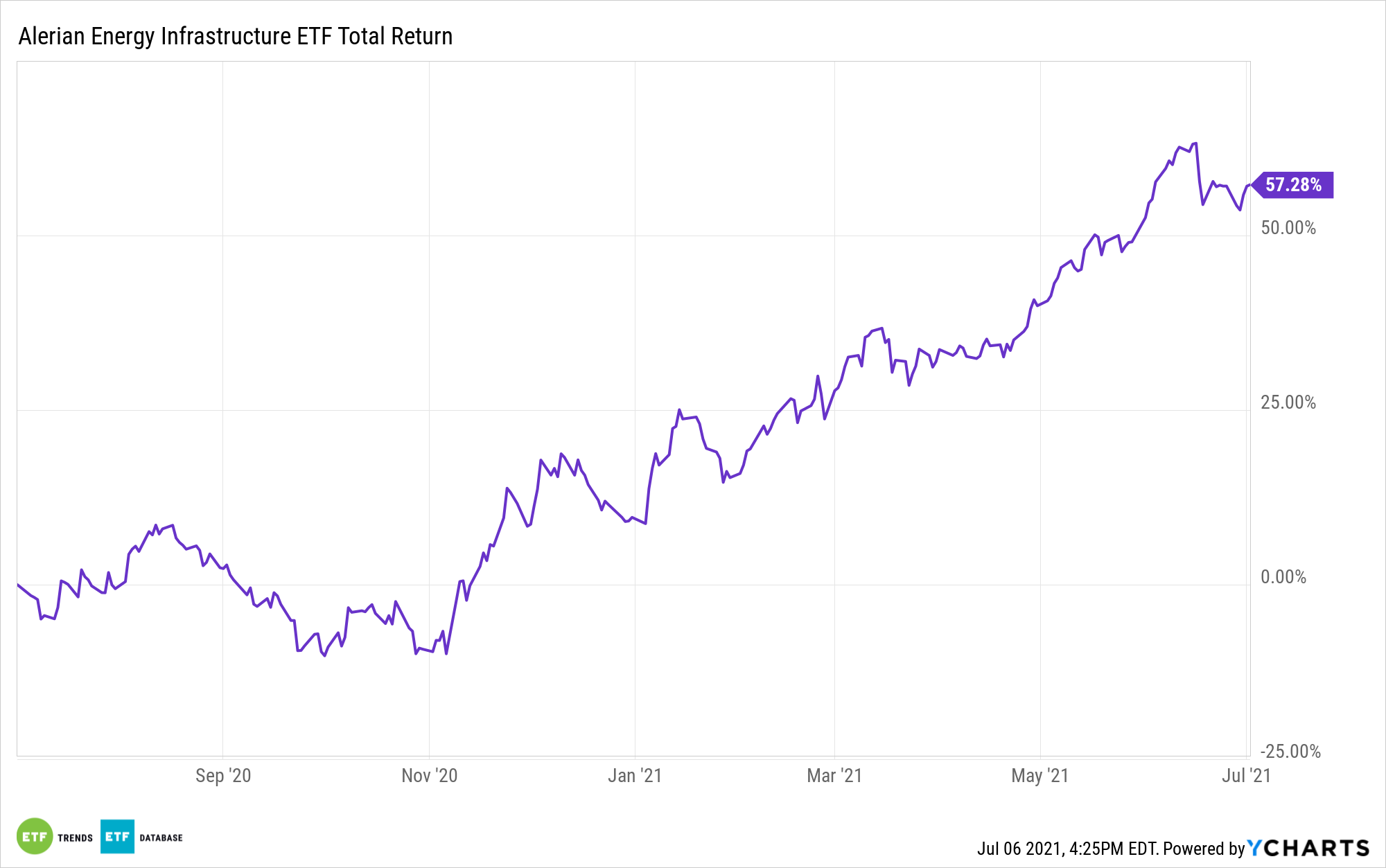

For ETF investors, there’s never a bad time for a fee reduction to arrive, but in the case of ENFR, the substantially lower expense ratio arrives at a time when midstream energy stocks are in the spotlight. Not only are some ENFR components rallying in significant fashion – the fund is higher by 38.63% year-to-date – midstream assets offer other benefits as well.

For example, quiet as it has been kept, energy infrastructure names offer investors some leverage to government plans to finally get to work on domestic infrastructure projects. Additionally, midstream companies are playing an increasingly prominent role – one financial markets may not yet be fully appreciating – in the renewable energy landscape.

“Growth in renewable power has created a supporting role for gas as a backup fuel, balancing the intermittency of wind and solar generation,” according to S&P Global.

For ENFR, which tracks the Alerian Midstream Energy Select Index (CME: AMEI), there are other signs its holdings will maintain relevant, even in a world where renewables are capturing so much adulation. For example, the U.S. is looking to again become energy independent, and that means more exports than imports. One of the areas ripe for significant export potential is liquefied natural gas (LNG), which is in high demand in international markets.

Speaking of support, many ENFR names have placed added emphasis on financial prudence in recent years, positioning these operators to improve their balance sheets and perhaps increase shareholder rewards. In other words, there is growing support for ENFR’s 5.29% dividend yield.

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.