Technology stocks are rarely inexpensive, and that’s particularly true of the next generation of tech names sporting the disruptive growth classification.

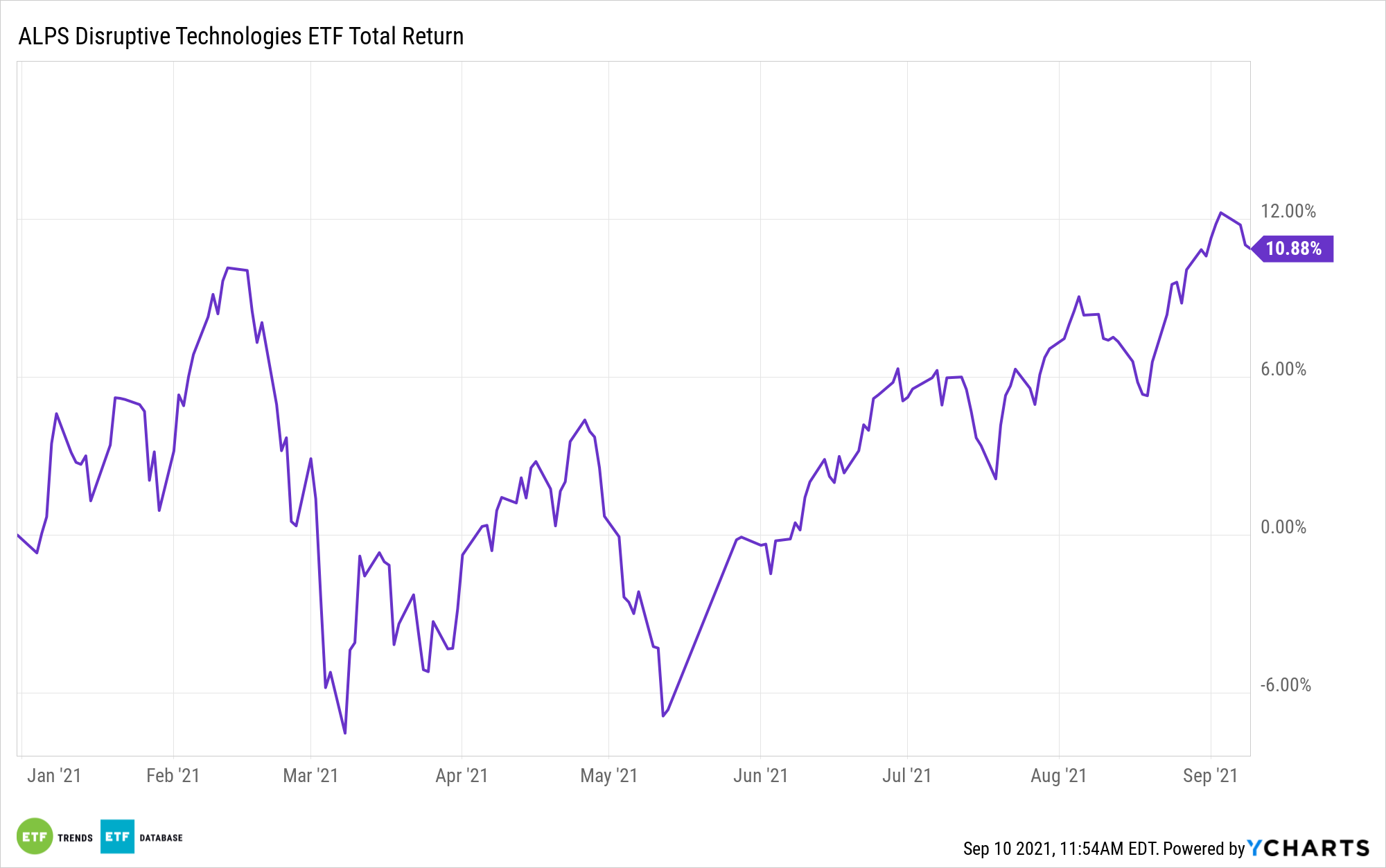

However, tech valuations aren’t excessive today, indicating that the ALPS Disruptive Technologies ETF (CBOE: DTEC) could be worth considering into year-end. With the benefit of declining Treasury yields, tech stocks perked up over the summer, but there were other prominent catalysts, too. DTEC proved responsive, jumping 9.32% for the 90-day interval ending Sept. 9.

“Well, there’s a couple of different things going on in the tech sector which really drove those returns. So, first of all, second-quarter earnings generally were pretty strong across the entire sector,” says Morningstar analyst Dave Sekera. “And we’re looking at pretty strong returns again, here, coming up in the third quarter.”

DTEC tracks the Indxx Disruptive Technologies Index, which identifies companies using disruptive technologies across several thematic areas, including healthcare innovation, internet of things, clean energy and smart grid, cloud computing, data and analytics, fintech, robotics, artificial intelligence, cybersecurity, 3D printing, and mobile payments.

That combination puts DTEC at the epicenter of an array of innovative growth segments. It also ensures that the $243.8 million ETF will rarely, if ever, dwell in value territory. However, with the Delta variant of the coronavirus pandemic still a major concern, DTEC’s cost of admission might be worth it over the near-term.

“I think a lot of investors are taking out that 2020 playbook and reinstituting that a little bit where they’ve probably been scaling back in some of those names which could be harmed if we continue to do have more cases coming up–again, those typical names being in restaurants, retail, hospitality type names–and then reinvesting those proceeds back into the technology sector,” adds Morningstar’s Sekera. “Again, the sector did very well last year during the pandemic.”

Another advantage of DTEC, and one that underscores the point that the fund can be worth paying up for, is that many of the themes represented in the fund are under-represented in traditional tech ETFs. For investors that want to access themes, they have a choice: take on single theme risk and volatility in a related ETF, or opt for the broader, safer approach offered by DTEC.

Other technology funds to consider include the Technology Select Sector SPDR ETF (NYSEArca: XLK) and the Fidelity MSCI Information Technology Index ETF (FTEC).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.