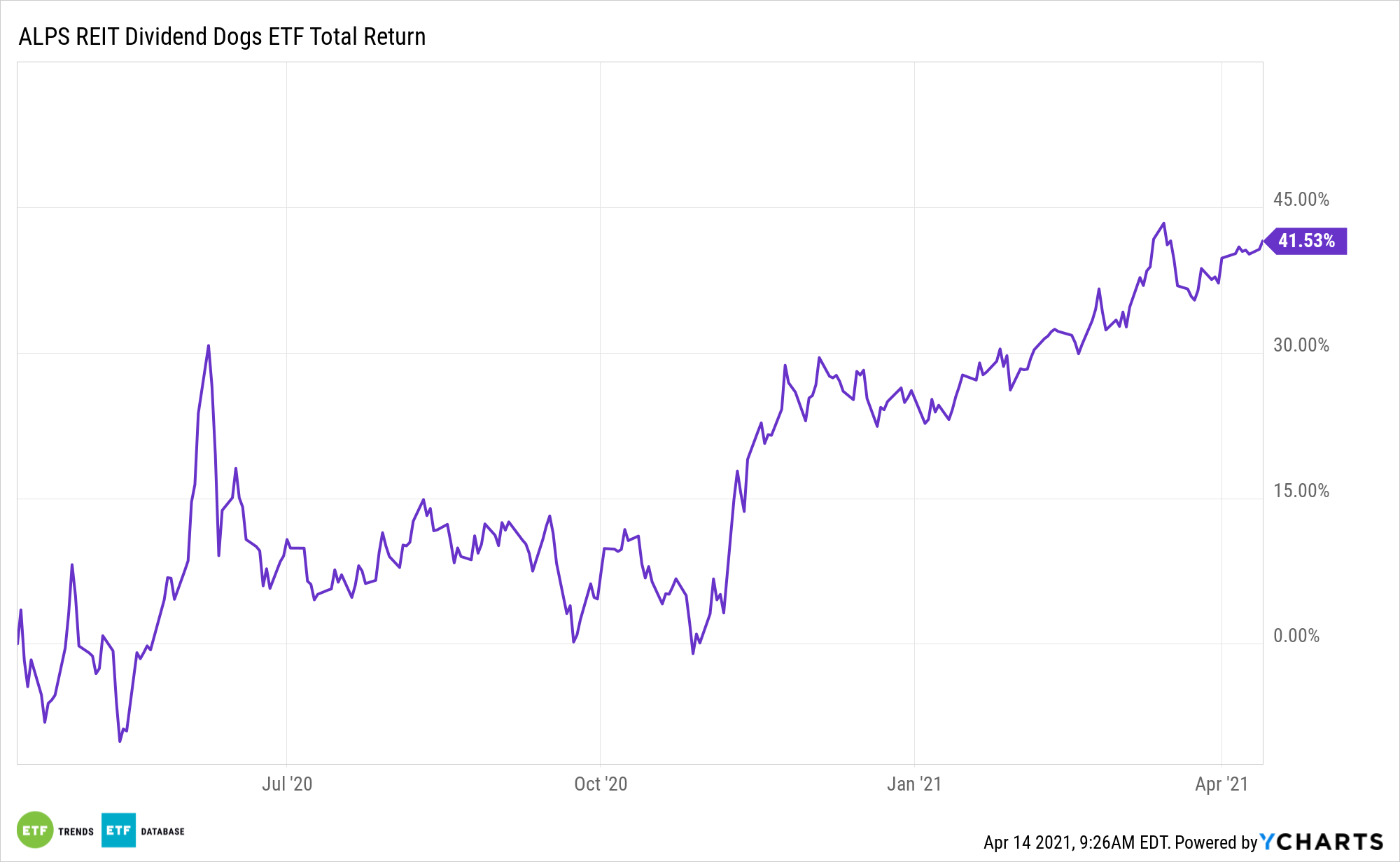

Real estate investment trusts (REITs) were among the most repudiated assets at the height of the coronavirus pandemic, but the ALPS REIT Dividend Dogs ETF (NYSEArca: RDOG) is on the mend.

RDOG tracks the S-Network REIT Dividend Dogs Index, a benchmark that’s similar to those found on ALPS’ other dividend dogs ETFs.

“Investing in real estate securities can be an attractive sector going forward, not only for the short-term dislocation but also because we’re starting a new cycle, lending itself to tremendous opportunity,” notes Bernhard Krieg, Portfolio Manager, Brookfield Asset Management. “Real estate more broadly, but also real estate securities, is driven by long and steady upcycles. We’re seeing rents grow, occupancies increase, and eventually more supply will level things off.”

Emerging Themes, Long-Term Returns, and More

A variety of technological themes are becoming increasingly relevant in the real estate industry. However, many of the traditional exchange traded funds addressing this sector lack the necessary exposure to new trends. For its part, RDOG features robust exposure to industrial and technology REITs, the real estate assets at the center of disruptive trends such as 5G and e-commerce.

Investors should not avoid RDOG on the basis that its tech ties make it richly valued relative to old guard REIT ETFs. In fact, RDOG’s industrial REIT exposure is particularly meaningful for long-term investors.

Low interest rates also support the case for RDOG.

“I don’t foresee risk of inflation. Rather, we’re likely to see continued low interest rates which are very favorable for commercial real estate. As expected, the macro fundamentals are improving which will further drive demand over the next 12 months,” said Calvin Schnure, SVP, Research & Economic Analysis, Nareit.

Real estate investment trusts are great long-term sources of returns. Publicly listed equity REITs exhibited some of the best average annual net returns. There are improved diversification benefits as well. The sector provided a great source of diversification in traditional stock and bond mixes. REITs showed a -0.03 correlation to U.S. long bonds and a 0.53 correlation to U.S. large caps.

As far as improved risk-adjusted returns outside of fixed income, REITs had the highest Sharpe ratio measuring of 0.44. This reflects historically high returns and just above-average volatility.

Other REIT ETFs include the Schwab US REIT ETF (NYSEArca: SCHH) and the Pacer Benchmark Data & Infrastructure Real Estate SCTR ETF (SRVR).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.