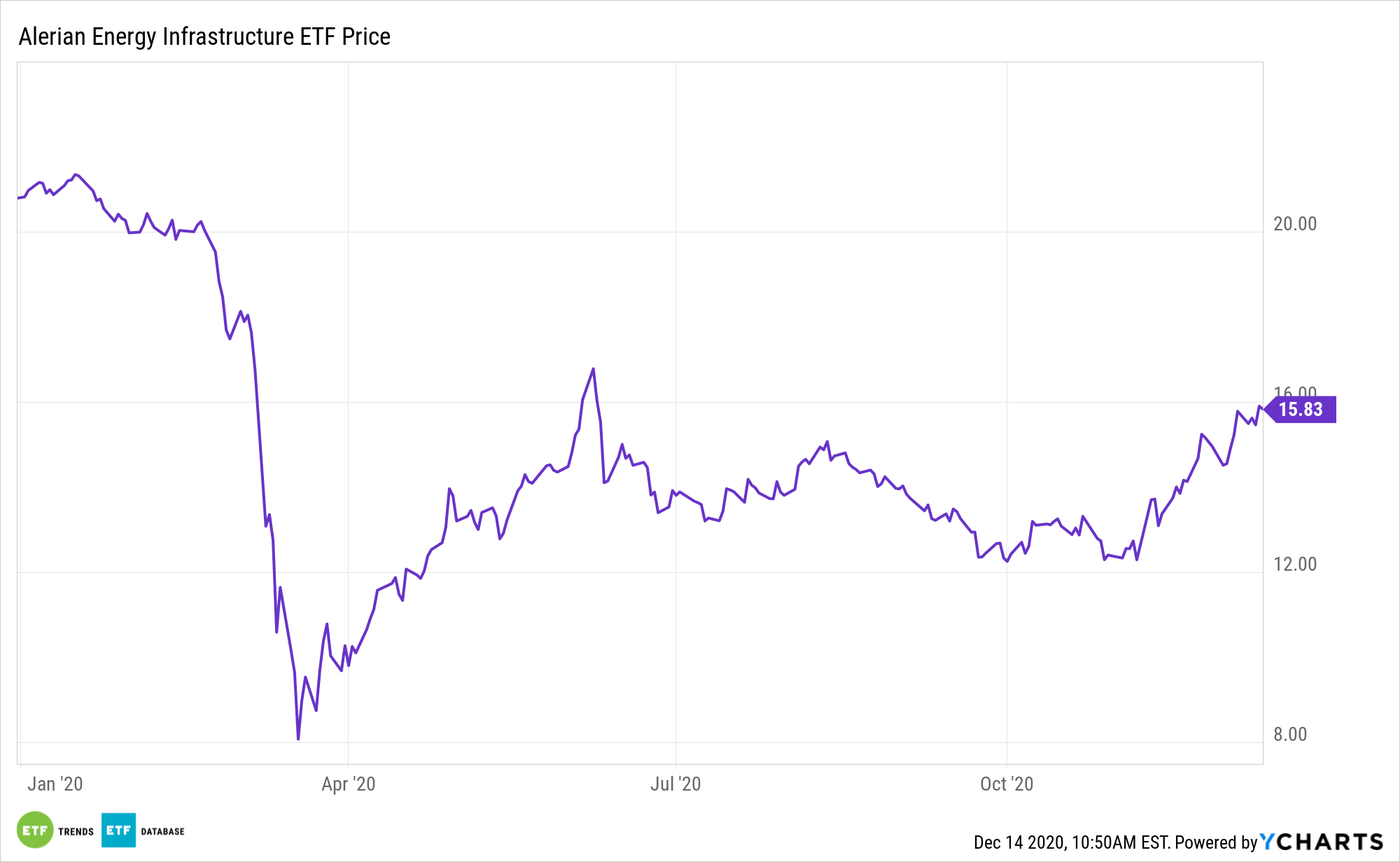

The once downtrodden energy sector is suddenly resurgent. The Alerian Energy Infrastructure ETF (ENFR) has gained 15.42% over the past month.

The ALPS ETF tracks the Alerian Midstream Energy Select Index (CME: AMEI). ENFR acts as a type of hybrid energy infrastructure ETF, which could help investors capture some of the high yields from MLPs while limiting the tax hit from solely owning MLPs.

A potential U.S. economic stimulus package and promising coronavirus vaccines to help support the economic recovery are among the factors boosting energy equities, even as oil supplies and COVID-19 case counts rise.

“Amid the recent rotation into value stocks, one sector stands out: energy. According to data from Ned Davis Research, the sector just posted its best 21-day relative return since at least 1972, up more than 30% versus the S&P 500,” reports Pippa Stevens for CNBC.

Energy’s Resurgence Is a Great Look for the ENFR ETF

Energy’s recent resurgence is widely attributable to success on the coronavirus vaccine front. The faster a vaccine comes to market, the more rapidly demand will increase as industry ramps up and Americans unleash pent-up travel demand.

“Energy’s certainly the most controversial value call here. A lot of it is also due to the ongoing ESG theme and trend that many people continue to push,” said equity strategist Dubravko Lakos-Bujas in an interview with CNBC. “So, yes, it’s not an easy one, but we do think given the massive divergence that’s taken place during this pandemic and even before the pandemic, energy being sort of on the low end of that, we think that there’s more room for the sector to catch up. There’s a potential imbalance that we’re seeing the months and quarters ahead.”

What markets are looking at now when it comes to the traditional energy sector are two Georgia Senate races that move to January. If the Democrats win both, they’d have a Senate majority, providing a bigger runway for clean energy.

On the upside, many of ENFR components are simply transporters of energy and aren’t as sensitive to oil price changes as, say, exploration and production companies or oil services names.

Other MLP funds include the Global X MLP ETF (NYSEArca: MLPA) and the JPMorgan Alerian MLP Index ETN (NYSEArca: AMJ).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.