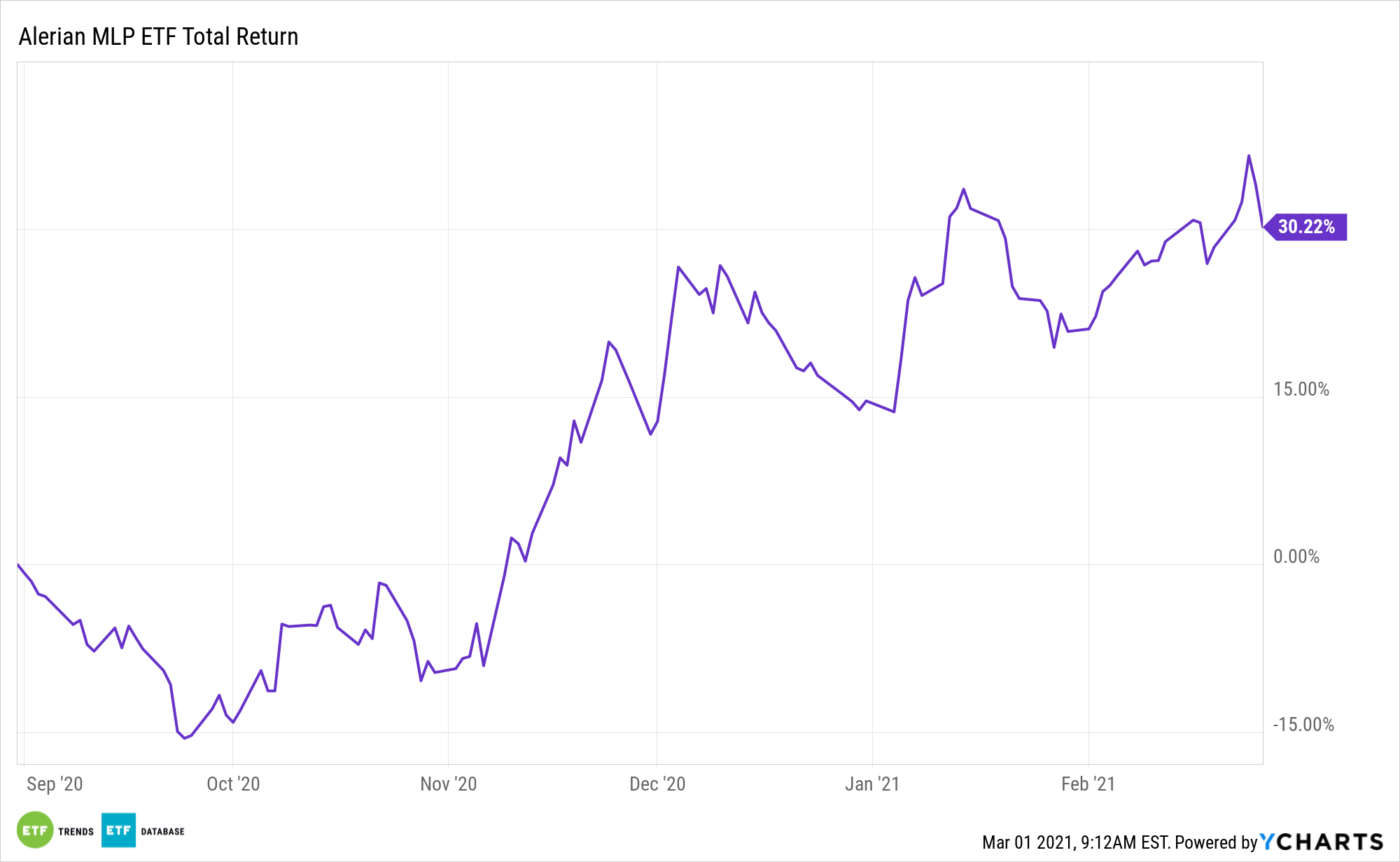

Oil prices are on a tear, and that could encourage producers to up their output. Higher production would be meaningful for master limited partnerships (MLPs), which operate oil and gas pipelines. Enter the ALPS Alerian MLP ETF (NYSEArca: AMLP).

AMLP seeks investment results that correspond generally to the price and yield performance of its underlying index, the Alerian MLP Infrastructure Index. The index is comprised of energy infrastructure MLPs that earn a majority of their cash flow from the transportation, storage, and processing of energy commodities.

“Major oil producers will put their negotiation skills to the test when they meet to discuss production levels in early March,” reports Myra Saefong for Barron’s. “The gathering comes as Saudi Arabia and Russia, two of the world’s largest producers, attempt to balance rising crude prices, tightening global supplies and an uncertain path of recovery for energy demand.”

If OPEC boosts output the United States could follow suit, lifting AMLP components in the process.

MLPs primarily deal with the distribution and storage of energy products, so their business model is less reliant on the commodities market. MLPs profit off the quantity of oil and natural gas they are able to move around. Consequently, they have historically shown a weaker correlation to energy prices over longer periods as the investment vehicle acts more like an energy toll road, profiting on the volume of oil moving through the pipelines.

The Benefits of an MLP Setup

“There has been speculation in recent weeks, however, that OPEC+ will decide to further curb production cuts, raising output to take advantage of high oil prices,” according to Barron’s. “Supply growth from OPEC+ may mute any commodity price appreciation that comes with a return of demand, says Chris Duncan, director of investments at Brandes Investment Partners.”

MLPs are publicly traded partnerships known for a ‘pass-through’ feature that helps investors generate stable, predictable cash flows. Investors, though, are required to pay income taxes in states where the MLP operates and have to report taxes on the K-1 form. Still, AMLP has avenues for upside, even if output doesn’t increase.

“Maintaining current output cuts, along with a rise in travel and oil demand as Covid cases decline, could lift WTI to $70 and Brent to $75 by midsummer,” adds Barron’s.

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.