The ALPS Sector Dividend Dogs ETF (SDOG) is a high dividend strategy with a value tilt. That doesn’t mean it can’t benefit from improving global dividend growth prospects.

SDOG tries to reflect the performance of the S-Network Sector Dividend Dogs Index, which applies the ‘Dogs of the Dow Theory’ on a sector-by-sector basis using the S&P 500 with a focus on high dividend exposure. SDOG’s equal-weight methodology is important because it reduces sector-level risk and dependence of some groups that are considered to be imperiled value ideas.

“Global dividend payments could rebound by as much as 5% this year, a new report estimated on Monday, after the coronavirus caused the biggest slump in payouts since the financial crisis more than a decade ago,” reports Joice Alves for Reuters.

A Truly Global Opportunity in 2021

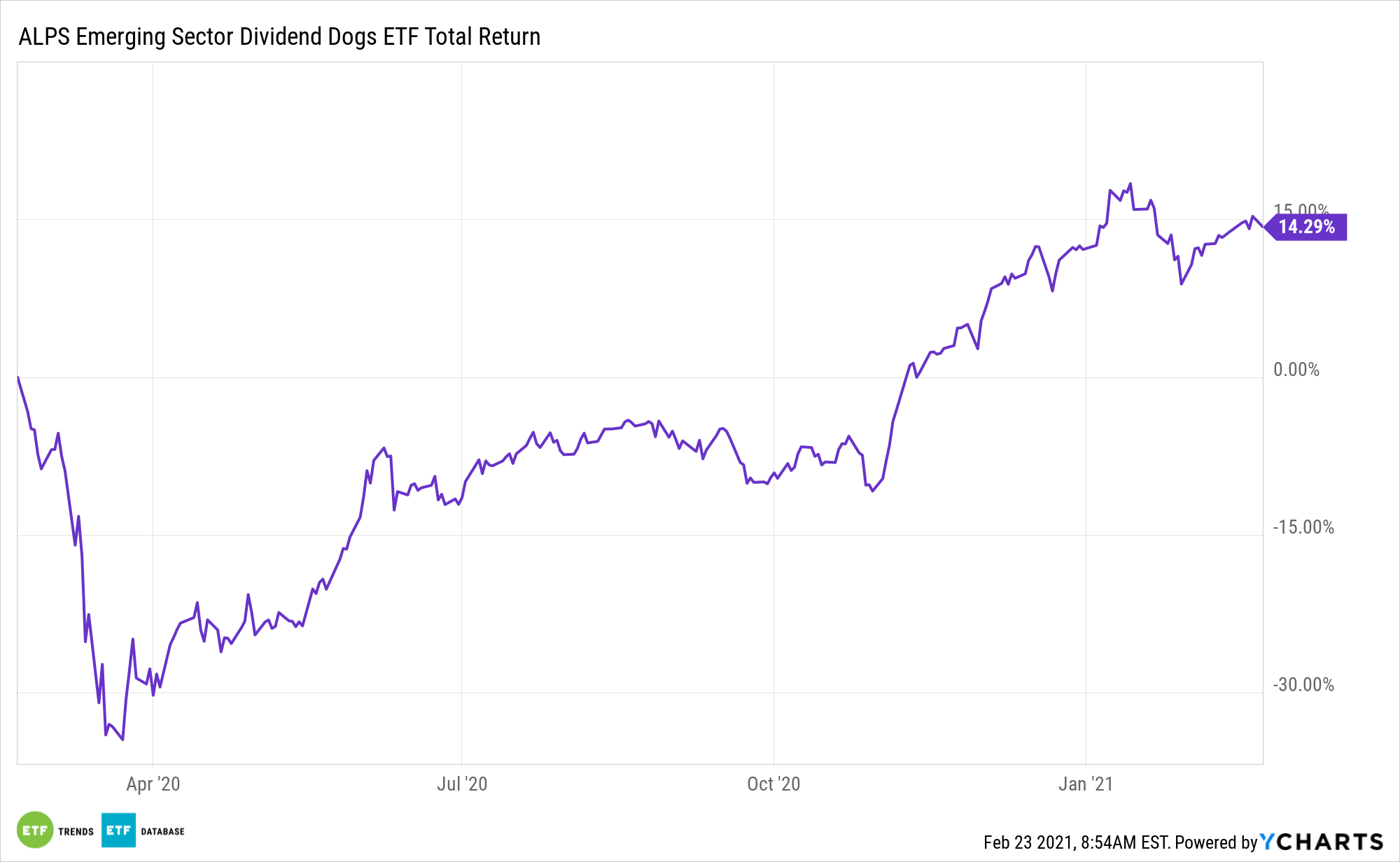

As noted above, that dividend growth expectation is global, indicating there’s opportunity for payout growth with exchange traded funds such as the ALPS Emerging Sector Dogs ETF (NYSEArca: EDOG) and the ALPS International Sector Dividend Dogs ETF (NYSEArca: IDOG).

With more investors looking to foreign markets as a way to diversify away from pricey U.S. equities, they will face certain risks associated with international exposure. Nevertheless, there are a number of smart beta global exchange traded fund strategies that can help investors better manage these pressures.

“Companies’ payouts to shareholders plunged more than 10% on an underlying basis in 2020 as one in five cut their dividends and one in eight cancelled them altogether,” according to Reuters. “A total of $220 billion worth of cuts were made between April and December, based on investment manager Janus Henderson’s Global Dividend Index. But there are signs companies are beginning to reinstate at least some of them. Janus Henderson’s report warned that dividends could still fall 2% this year, in a worst-case scenario. But its best-case scenario sees 2021 dividends up 5% on a headline basis.”

EDOG tracks the performance of the S-Network Emerging Sector Dividend Dogs Index. The index is comprised of the highest paying stocks, or ‘Dividend Dogs’, from the S-Network Emerging Markets Index, which holds large cap emerging market stocks. The Dividend Dogs include the five stocks in each of the ten Global Industry Classification Standard sectors that make up the S-Network Emerging Markets.

Other high dividend ETFs include the SPDR S&P Dividend ETF (SDY), iShares Select Dividend ETF (NYSEArca: DVY), and iShares Core High Dividend ETF (HDV).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.