Emerging markets assets are receiving renewed attention as Election Day looms. A victory by former Vice President Joe Biden on Election Day could lift emerging markets assets because it’s expected his tone toward China – the largest developing economy – will be far less bellicose than President Trump’s has been.

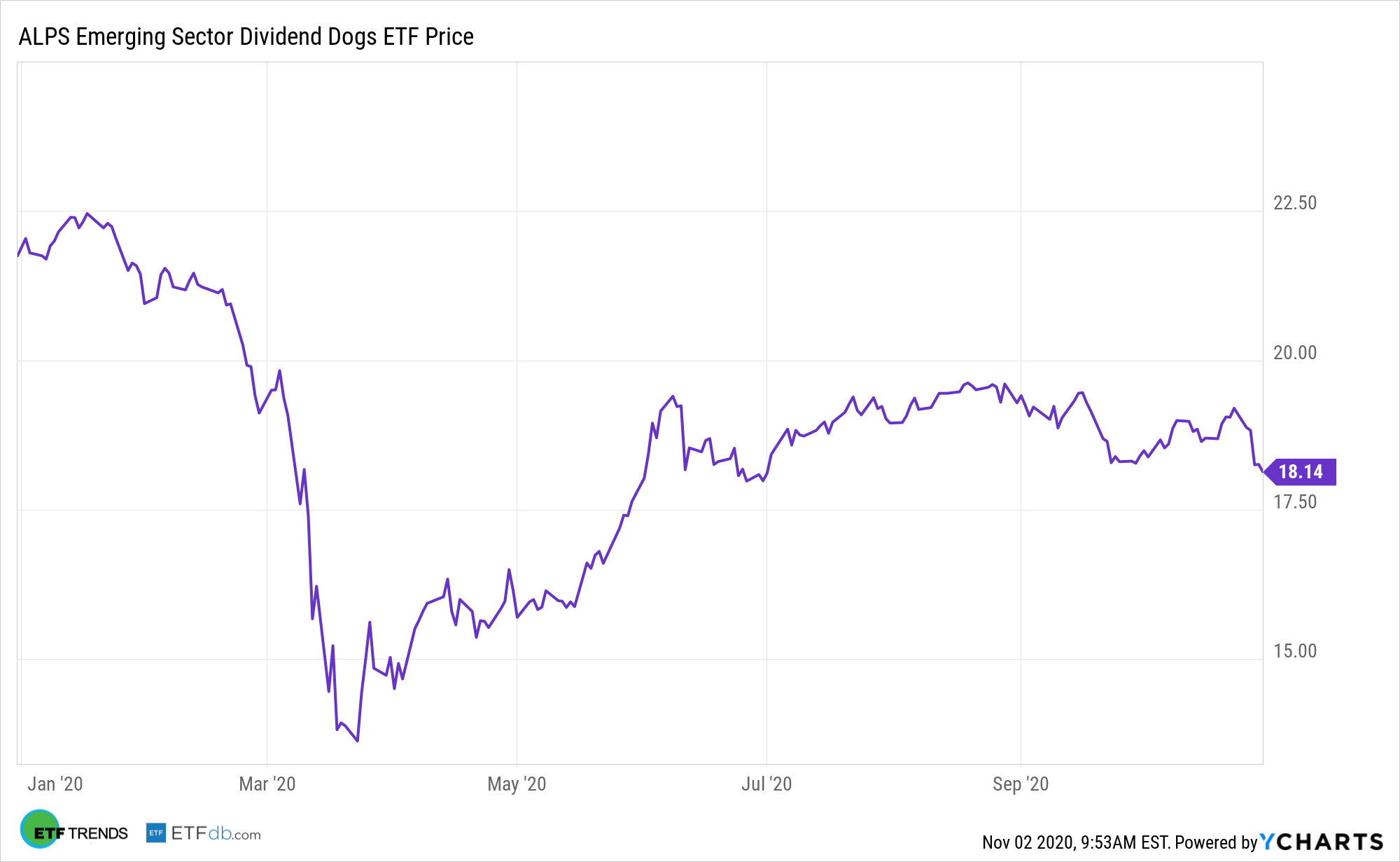

The ALPS Emerging Sector Dogs ETF (NYSEArca: EDOG) is an example of an exchange traded fund that could be poised for near-term benefit, particularly as stocks in developing economies suddenly take on added safety.

The widely followed MSCI Emerging Markets Index “has now outperformed the S&P 500 Index during three major global risk asset sell-offs over the last five months by an average of 6%, according to Goldman Sachs Group Inc. strategists Caesar Maasry and Ron Gray,” as reported by Cormac Mullen for Bloomberg.

Elections and EDOG: How Will Emerging Markets React?

EDOG, which debuted over six years ago, tracks the performance of the S-Network Emerging Sector Dividend Dogs Index. The index is comprised of the highest paying stocks, or “Dividend Dogs,” from the S-Network Emerging Markets Index, which holds large-cap, emerging market stocks. The Dividend Dogs include the five stocks in each of the ten Global Industry Classification Standard sectors that make up the S-Network Emerging Markets.

“A growing number of investors are warming to developing-nation stocks as the global economy recovers from the worst of the coronavirus pandemic. The rapid recovery seen in China and the weaker dollar have also encouraged the bulls,” according to Bloomberg.

Value option or bear trap—these are the paths presented when it comes to emerging markets (EM), which could face significant risks ahead, making the latter option plausible despite the enticing low-priced EM assets.

“Emerging market equities and local bonds may be incrementally insulated from global shocks in the near term and may benefit from a return of flows when looking into 2021,” according to Goldman Sachs. “But our conviction rests upon the fundamental outlook of a strong growth recovery during that period.”

Other emerging markets dividend ETFs include the ProShares MSCI Emerging Markets Dividend Growers ETF (CBOE: EMDV), iShares Emerging Markets Dividend ETF (DVYE), and the WisdomTree Emerging Markets Equity Income Fund (NYSEArca: DEM).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.