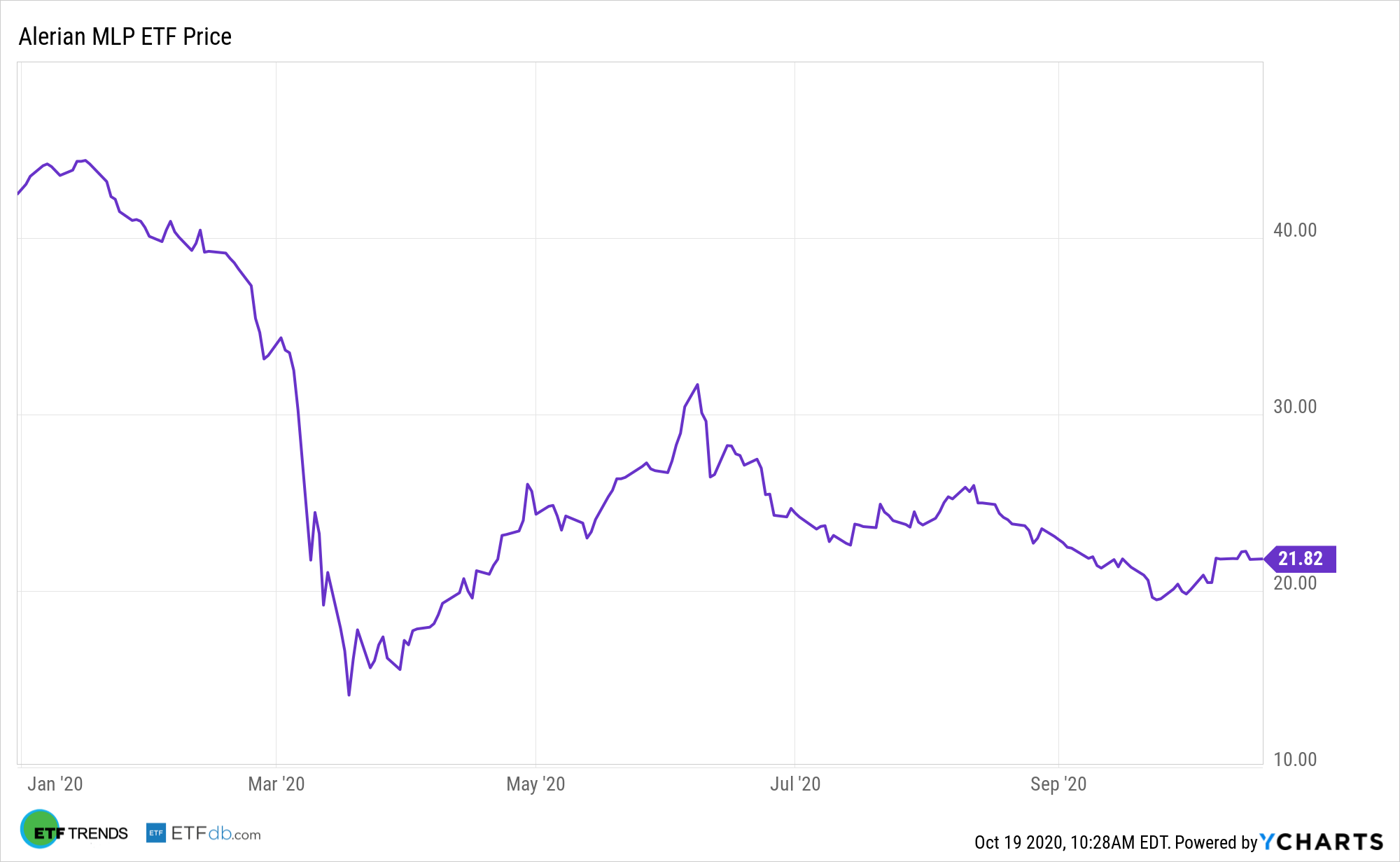

Weakness in the energy sector this year is hampering income-generating assets such as master limited partnerships (MLPs), but some market observers believe the asset class is ready to bounce back and that could be helpful to the ALPS Alerian MLP ETF (NYSEArca: AMLP).

AMLP seeks investment results that correspond generally to the price and yield performance of its underlying index, the Alerian MLP Infrastructure Index. The index is comprised of energy infrastructure MLPs that earn a majority of their cash flow from the transportation, storage, and processing of energy commodities.

MLPs primarily deal with the distribution and storage of energy products, so their business model is less reliant on the commodities market since MLPs profit off the quantity of oil and natural gas they are able to move around. Consequently, MLPs have historically shown a weaker correlation to energy prices over longer periods as MLPs act more like energy toll roads, profiting on the volume of oil moving through their pipelines.

“The dramatic selloff in the sector still appears overdone in our view, especially for the MLPs, and we remain positive—especially as they price in a high cost of capital and as cash flow should pick up as capital spend declines—but we advise investors to temper near-term expectations,” notes Goldman Sachs analyst Michael Lapides.

An AMLP Comeback As Economy Recovers?

Investors may consider incorporating energy infrastructure MLPs and related exchange traded funds to enhance an income-focused portfolio.

The oil industry’s midstream role in the energy value chain may be more insulated from the price volatility since this segment of the energy sector engages in gas processing, fractionation, storage, transportation, and crude oil gathering.

“Their rebound will likely lag behind a rebound for producers, Lapides argues. That said, midstream companies are not a lost cause,” reports Avi Salzman for Barron’s. “Lapides thinks investors need to be picky about what midstream companies they choose, based on their valuation and assets.”

Unlike oil producers and services companies, energy infrastructure companies provide real business-line diversification in the energy sector, as they deal with the transportation, storage, and processing of energy, which are far less reliant on commodity prices.

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.