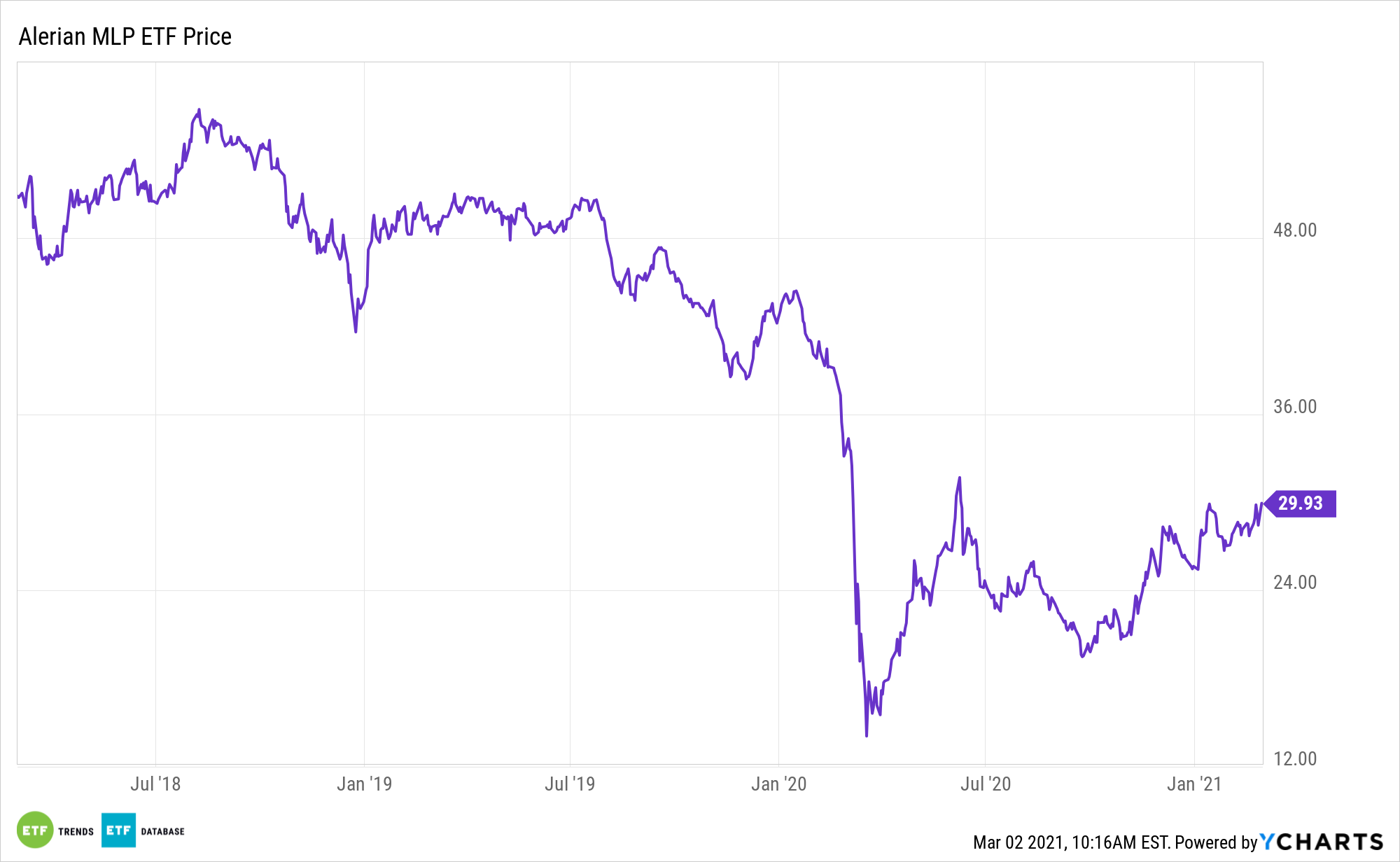

Master limited partnerships (MLPs) are rebounding, providing a spark for the ALPS Alerian MLP ETF (NYSEArca: AMLP) in the process. With coronavirus cases declining and vaccination rates increasing, the energy sector could retain its recent bullishness.

That ebullience was on display last week, and recent inventories data supports the notion that the economy is rebounding.

From the end of January through February 19, total US petroleum inventories (crude and refined products) have fallen approximately 40 million barrels, or by 3.0%. Crude oil contracts through year-end 2021 are trading above consensus as vaccine optimism and a potentially faster return to a normal global economy led to a quick 17% gain in February.

AMLP seeks investment results that correspond generally to the price and yield performance of its underlying index, the Alerian MLP Infrastructure Index. The index is comprised of energy infrastructure MLPs that earn a majority of their cash flow from the transportation, storage, and processing of energy commodities.

Timing Your AMLP Angles

When dealing with oil prices, the basic economic tenets of supply and demand are an obvious factor.

Energy Transfer (NYSE:ETP), one of AMLP’s largest holdings, surged last week after Piper Jaffrey upgraded the MLP for “its difficult to replicate, top-tier integrated network delivering oil, gas, and NGLs (natural gas liquids) that is well positioned to capture the improving energy fundamentals.” UBS also upgraded ET last week on potential tailwinds from increased gas storage and demand pull in the wake of the Texas storm that led to massive gas shortages across the state.

MLPs primarily deal with the distribution and storage of energy products, so their business model is less reliant on the commodities market. MLPs profit off the quantity of oil and natural gas they are able to move around. Consequently, they have historically shown a weaker correlation to energy prices over longer periods as the investment vehicle acts more like an energy toll road, profiting on the volume of oil moving through the pipelines.

As the economy rebounds and begins to pick up momentum, the Organization of Petroleum Exporting Countries and the International Energy Agency anticipate a recovery in global oil demand, to the benefit of ETFs like AMLP.

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.