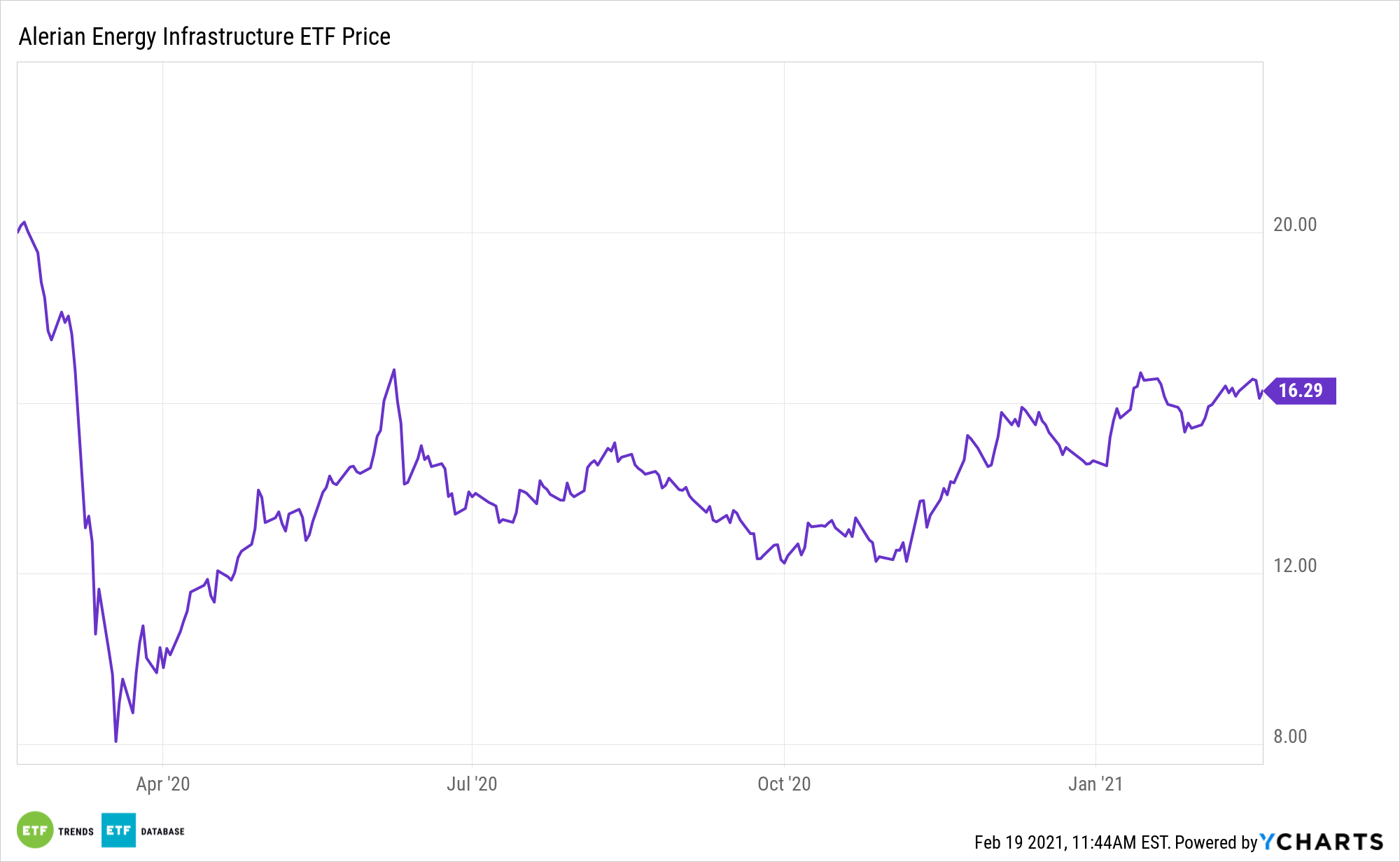

Midstream energy assets and master limited partnerships are playing increasingly prominent roles in the renewable energy revolution, to the benefit of ETFs such as the Alerian Energy Infrastructure ETF (ENFR).

The ALPS ETF tracks the Alerian Midstream Energy Select Index (CME: AMEI). ENFR acts as a type of hybrid energy infrastructure ETF, which helps investors capture some of the high yields from MLPs while limiting the tax hit from solely owning MLPs.

“Discussions of environmental, social, and governance (ESG) factors and the energy transition have pervaded the traditional oil and gas landscape from management remarks on earnings calls to investor presentations,” writes Alerian analyst Stacey Morris. “The industry is making a concerted effort to address ESG-related concerns and questions around the role of oil and natural gas companies in an energy transition. Midstream has been active on this front as well.”

Believe it or not, traditional energy companies are in the early innings of moving toward lower carbon emissions and embracing green energy.

ENFR’s Evolution

Companies must adapt to shifting market conditions or risk being left behind or outright extinct. This is particularly true in the energy sector where renewables continue pilfering market share and investors from fossil fuel producers.

However, some traditional energy companies are changing with the times.

“Energy companies from the integrated majors to refiners to midstream are investing in renewables and clean energy technologies for the future, but many are already involved in activities that support cleaner energy today,” says Morris. “For example, Valero (VLO) is the largest refiner globally, but it is also the world’s second-largest producer of corn ethanol and renewable diesel. Other refiners also produce renewable fuels and support clean energy in more subtle ways. For example, refiner Phillips 66 (PSX) produces special types of petroleum coke used in the lithium ion batteries of electric vehicles.”

Renewable energy, which includes solar, wind, geothermal, hydroelectric, and other low carbon sources, is commanding an increasing share of the energy landscape. The emerging industry represent a new growth frontier for fossil fuel providers.

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.