Energy was one of the best-performing sectors last week as a blockage in the Suez Canal – a major thoroughfare for global oil shipments – sent crude prices skyrocketing.

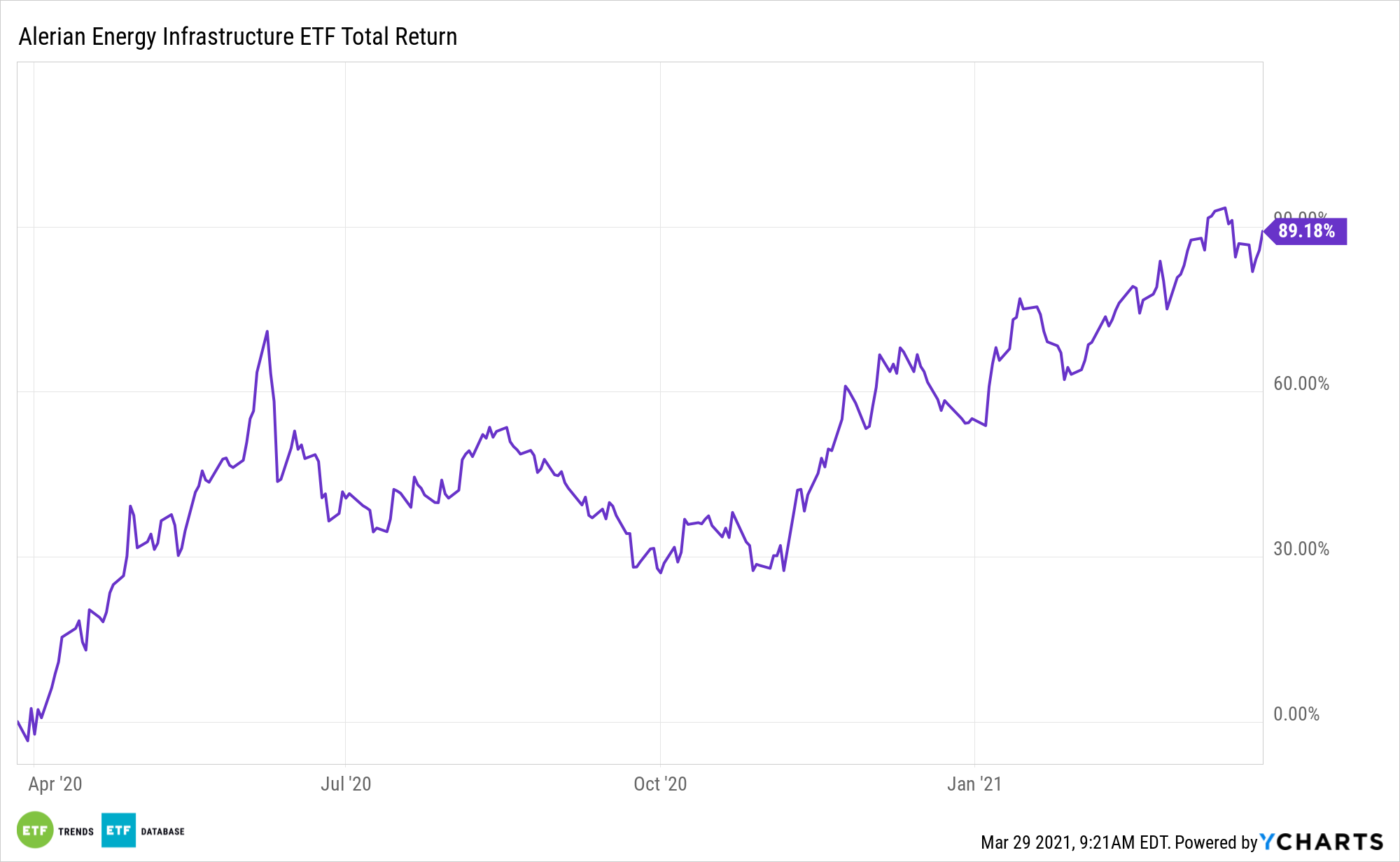

Midstream assets got a lift, too, with the Alerian Energy Infrastructure ETF (ENFR) gaining 1.21% on the week. The fund is higher by 5% over the past month.

The ALPS ETF tracks the Alerian Midstream Energy Select Index (CME: AMEI). ENFR acts as a type of hybrid energy infrastructure ETF, which helps investors capture some of the high yields from MLPs while limiting the tax hit from solely owning MLPs. Part of the good news for the sector is that some well-known investors are revisiting energy equities.

“Energy sector exchange-traded funds were the only group this week to add more than $1 billion in inflows as the cargo-ship blockage in the Suez Canal helped oil prices recover from their slump into correction territory,” reports Business Insider.

Oil and Energy Are Soaring Once More

Investors can look to the midstream space for more compelling cash flow-generating prospects. Free cash flow is the cash a company has left over after accounting for capital spending and it’s a vital evaluation metric in capital-intensive industries such as energy. Fortunately, the outlook on this front is bright for midstream names.

Last week, market participants flocked to energy ETFs “during a week when the blockage of the Suez Canal, the prospect of the North American spring and summer driving season and expectations of less investment in new supply helped the price of oil rebound from an earlier correction,” said Cameron Brandt, director of research at EPFR.

It could be awhile before the ship blocking the Suez Canal is set free.

“Oil prices gained on expectations of tighter oil supplies while a cargo ship remains stuck in the Suez Canal, a key trade route that’s used to transport crude and refined products and connects Europe to Asia. Analysts have said it may be weeks before the Ever Given, a nearly 200-foot-wide and 1,300-foot-long vessel, is dislodged from the canal,” according to Business Insider.

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.