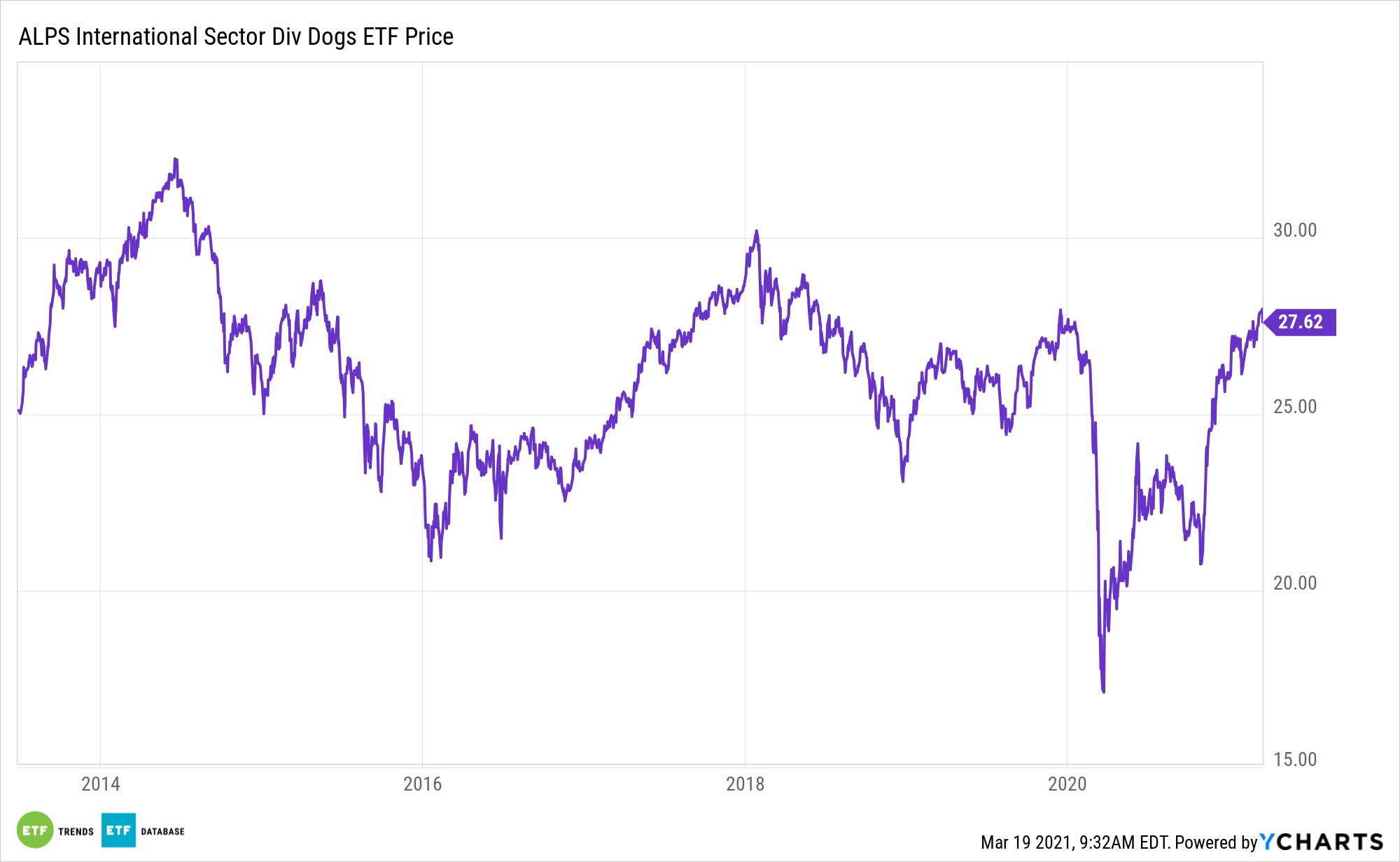

With value stocks bouncing back and international developed markets doing the same, the ALPS International Sector Dividend Dogs ETF (NYSEArca: IDOG) is an increasingly alluring proposition for dividend investors.

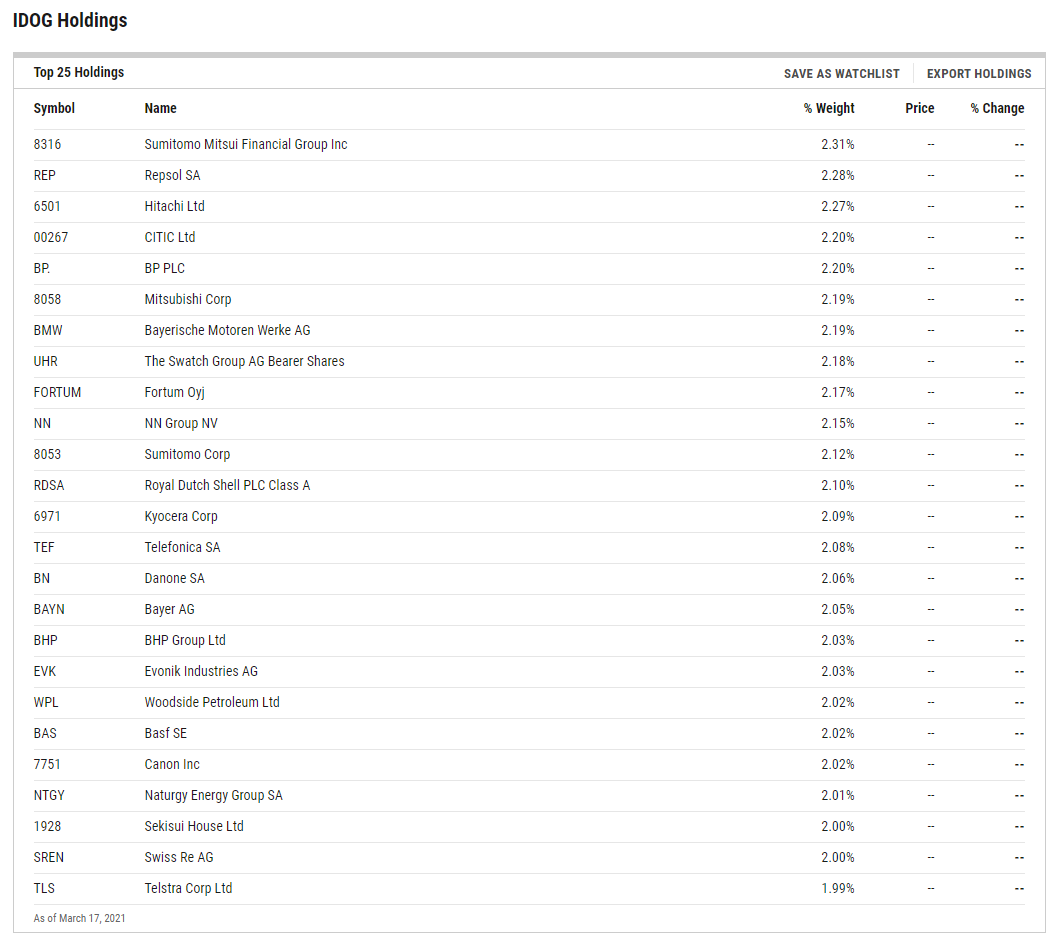

ALPS identifies the five highest-yielding securities in the 10 GICS sectors on the last trading day of November. From there, IDOG is rebalanced quarterly in an effort to keep sector weights in the area of 10% and individual holdings at around 2%.

See also: As Dividends Rebound, This Dog ETF Could Have Its Day

“International securities have underperformed for a bit more than a decade, causing yields to rise and valuations to plummet. International equities are likely to outperform in the coming decade, due to their greater yields, and due to the possibility of substantial capital gains if valuations rise,” according to Seeking Alpha.

Not all markets are currently offering value propositions. Fortunately, for investors considering a value wager, some of the larger, least volatile developed markets outside the U.S. are showing some signs of value rebounds. Those include the U.K. and Japan, among others.

The Growth Is Overseas

Japanese companies are not taking on new debt to fuel shareholder rewards. The country is home to some of the world’s sturdiest corporate balance sheets. Japan’s payout ratio, the proportion of earnings paid out as dividends, is the developed world’s lowest. IDOG’s portfolio is substantially allocated toward Japan.

“Diversification serves to reduce portfolio risk and volatility, but also precludes the possibility of substantial under or overperformance, at least relative to international equities,” according to Seeking Alpha.

One issue for investors to consider is the unusual payment schedules for many foreign dividend companies. While many of those companies pay dividends just once or twice a year, IDOG pays quarterly dividends.

Ex-U.S. developed market dividend payers often feature larger yields than their U.S. counterparts, an assertion proven by comparing large- and mega-cap dividend stocks from familiar dividend sectors such as consumer staples, energy, financial services, and telecommunications.

“International diversification reduces portfolio risk and volatility as international stocks sometimes perform quite differently compared to U.S. equities. Sometimes international stocks underperform, sometimes U.S. equities do, so investing in both means that the possibility of substantial underperformance is lessened,” concludes Seeking Alpha.

Other international developed market dividend ETFs include the FlexShares International Quality Dividend Dynamic Index Fund (NYSEArca: IQDY), ProShares MSCI EAFE Dividend Growers ETF (CBOE: EFAD), and the SPDR S&P International Dividend ETF (NYSEArca: DWX).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.