The widely observed MSCI Emerging Markets Index is up 7% year-to-date. That’s decent, but investors opting for emerging markets exchange traded funds with deeper cyclical value tilts could be doing a lot better.

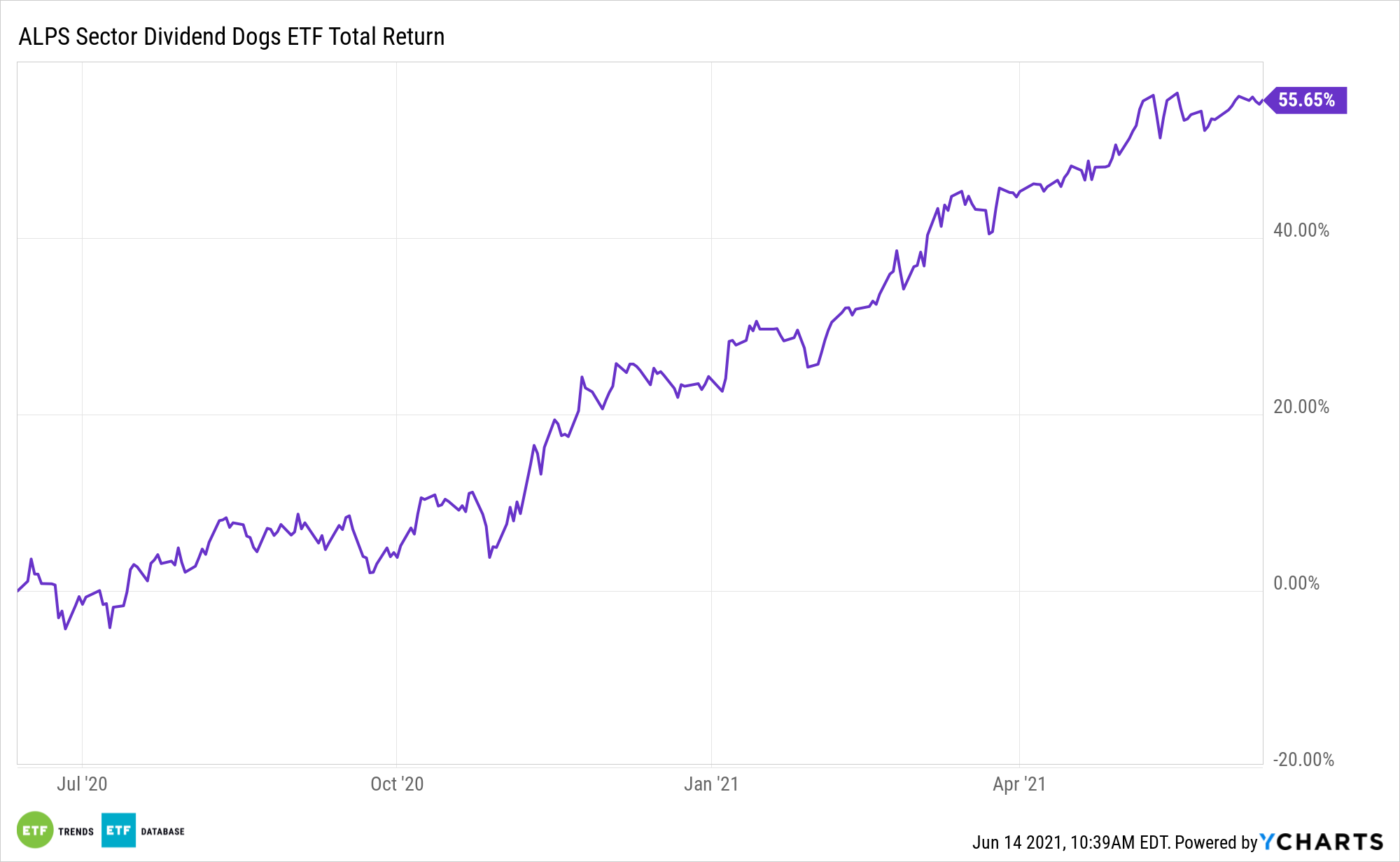

For example, the ALPS Emerging Sector Dogs ETF (NYSEArca: EDOG) is up nearly 13% since the start of the year. As is the case with domestic high-dividend strategies, including its stablemate the ALPS Sector Dividend Dogs ETF (SDOG), EDOG is being buoyed by the out-performance of cyclical value stocks. That value tilt could also prove beneficial if emerging markets interest rates suddenly rise.

“Our outlook for emerging markets equities remains positive, although interest rates remain a factor to watch,” according to Lazard Asset Management. “When bond yields rise gradually due to strong growth, emerging markets equities can outperform, particularly traditional value securities.”

A Buffer Against Rising Treasury Yields

As EDOG’s year-to-date showing confirms, the fund is mostly resilient against the backdrop of rising U.S. interest rates. In part, that resilience is attributable to EDOG equally weighting sectors – something the MSCI Emerging Markets Index does not do.

EDOG’s sector allocation range from weights of 9.32% to 11.17%, reducing exposure to long duration cash flow of tech stocks while increasing exposure to sectors that thrive when rates rise.

“In fact, when yields are gradually rising due to a strong recovery in economic growth, emerging markets can outperform, particularly the economically sensitive, traditional value securities, such as materials, energy, and financials,” adds Lazard.

Those three groups combine for about 30% of EDOG’s roster. EDOG’s value tilt is relevant for another reason: experts see emerging markets value continuing to cut into the lead accrued by growth in the second and third quarters. Rising commodities prices are bolstering EDOG too. That’s a plus because the fund’s geographic weights lean toward commodities exporters. For example, Brazil and Russia combine for 22.1% of EDOG’s roster.

Another reason EDOG can keep shining is the expectation that Latin America will be one of the leading regions for 2021 earnings per share growth. Countries in that region represent almost 28% of EDOG’s geographic exposure. In addition to Brazil and Mexico, Chile and Peru are also represented in EDOG.

Other emerging markets dividend ETFs include the ProShares MSCI Emerging Markets Dividend Growers ETF (CBOE: EMDV), iShares Emerging Markets Dividend ETF (DVYE), and WisdomTree Emerging Markets Equity Income Fund (NYSEArca: DEM).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.