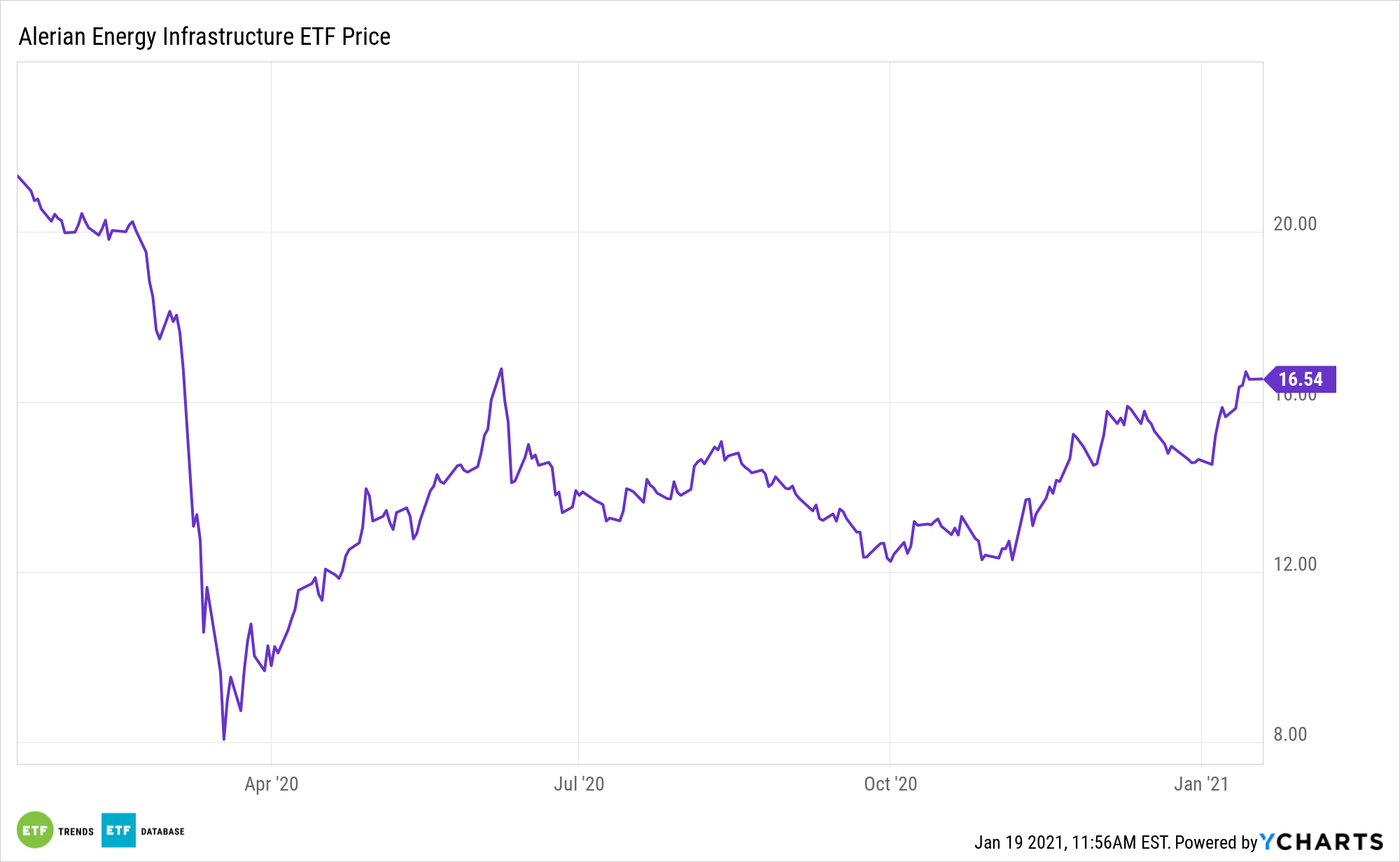

After ranking as the worst-performing group in the S&P 500 last year, the energy sector could be in for a major comeback this in 2021, boding well for midstream assets like the Alerian Energy Infrastructure ETF (ENFR).

The ALPS ETF tracks the Alerian Midstream Energy Select Index (CME: AMEI). ENFR acts as a type of hybrid energy infrastructure ETF, which helps investors capture some of the high yields from MLPs while limiting the tax hit from solely owning MLPs.

“After trailing again in 2020, energy stocks are up 18% in the first two weeks of 2021, even though the S&P 500 is only up 1%. Thomas Lee, head of research at Fundstrat Global Advisors, thinks that energy stocks could benefit from the same change in investor sentiment that helped drive Tesla (ticker: TSLA) in 2020,” reports Avi Salzman for Barron’s.

ENFR offers a unique way to access the U.S. energy market, giving investors an avenue for avoiding exploration and production names and lumbering integrated oil giants.

ENFR’s Time to Shine

Investors should look past the energy sector’s now diminutive stature in the S&P 500.

“That underweighting in energy, however, may suddenly shift in 2021, some analysts are predicting. Oil suddenly looks like a decent bet, given that Saudi Arabia has signaled that it will backstop the price by curbing production. U.S. producers, meanwhile, are being prudent with their cash.” according to Barron’s.

The traditional energy market has been shaky ever since prices fell in 2015 when a glut of petroleum flooded world markets. Supply and demand were supposed to come into balance this year, but the pandemic crushed global demand when the world effectively shut down. Crude-oil prices are hovering around $45 a barrel now, about the mid-point for where prices have traded for the past five years, but a far cry from the $100 a barrel they were trading at 10 years ago.

The midstream space is usually more defensive and less volatile than other energy segments due to steady, reliable cash flows.

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.