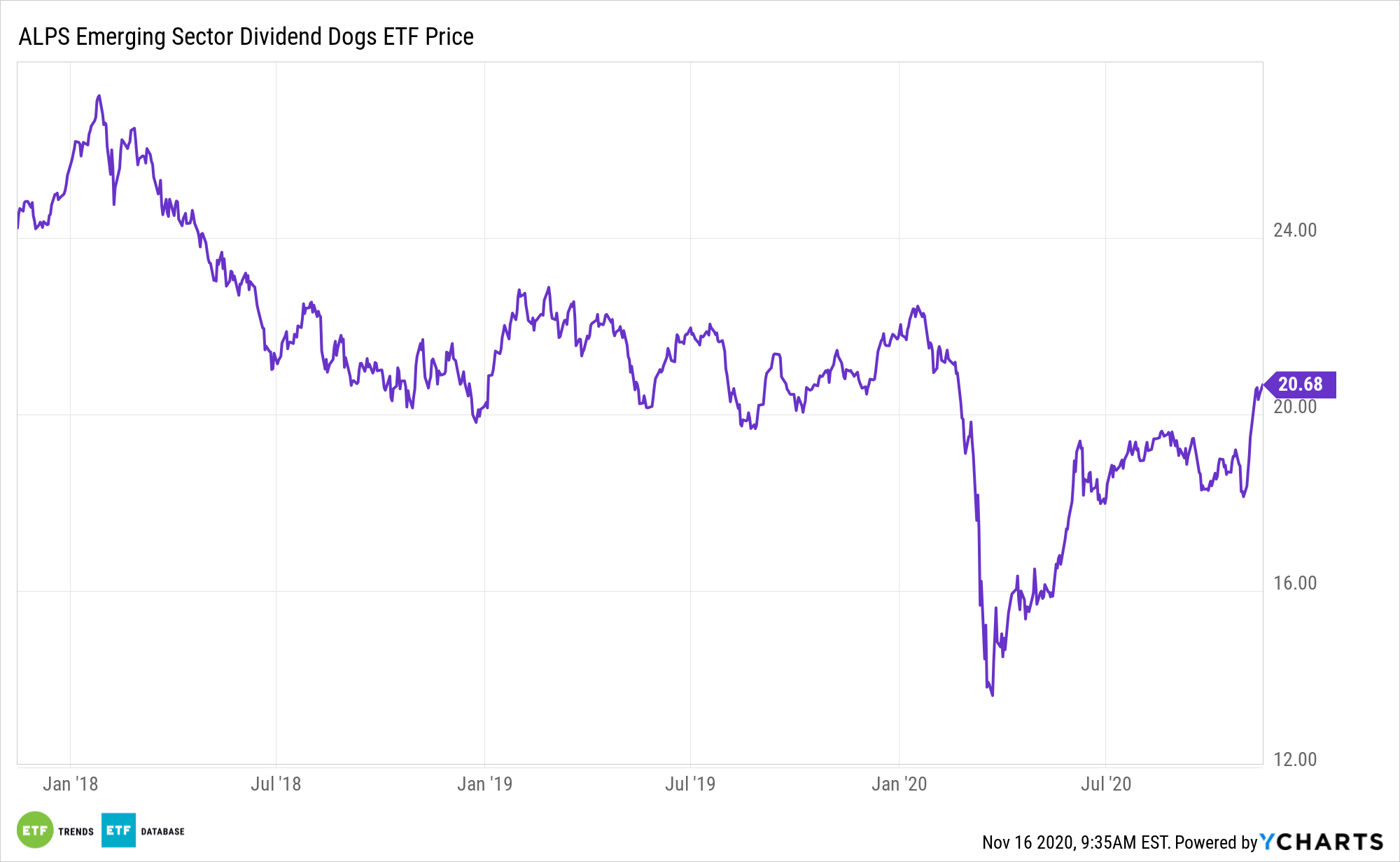

The ALPS Emerging Sector Dogs ETF (NYSEArca: EDOG) could be ready to build on recent momentum – gaining almost 4% last week – as regime change takes shape in Washington, D.C.

EDOG, which debuted over six years ago, tracks the performance of the S-Network Emerging Sector Dividend Dogs Index. The index is comprised of the highest paying stocks, or “Dividend Dogs,” from the S-Network Emerging Markets Index, which holds large-cap, emerging market stocks. The Dividend Dogs include the five stocks in each of the ten Global Industry Classification Standard sectors that make up the S-Network Emerging Markets.

With emerging markets equities embracing the notion of a Biden/Harris Administration, EDOG’s yield-based, equal-weight approach could pay off for committed investors.

“Emerging markets now contain more than half of the world’s GDP, and most of the world’s GDP growth, but only account for 11% of global equity market value, since they’re pretty cheap relative to earnings,” according to Fed Week.

A Hot Month for EDOG

Emerging markets can continue to enjoy a recovery if a tailwind of factors can keep blowing in their favor. This should give EM exchange-traded fund (ETF) investors something to cheer about when they’re focused on equities.

Another benefit of EDOG is that emerging markets central banks are aggressively easing off, and the fruits of their labor could be harvested early next year.

“On average, companies in the emerging market index have a price-to-earnings growth of 16x, and 5-year annualized earnings growth rates of 14%. So, they are quite fast-growing, but also the cheapest. As usual, the top companies tend to be more expensive and faster-growing than the average,” according to Fed Week.

Covid-19 put the hammer down on emerging markets (EM) just as the group was getting 2020 was getting going. However, now could be an opportune time for getting EM exposure as economies try to recover from the pandemic. While the EM space has seen better days, the group has the historical ability to outperform.

EDOG is higher by more than 9% over the past month.

Other emerging markets dividend ETFs include the ProShares MSCI Emerging Markets Dividend Growers ETF (CBOE: EMDV), iShares Emerging Markets Dividend ETF (DVYE), and the WisdomTree Emerging Markets Equity Income Fund (NYSEArca: DEM).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.