When it comes to risk and reward, disruptive growth investing offers plenty of both.

Investors are often lured in by tantalizing returns offered by emerging growth companies, but stock-picking in this space is notoriously difficult. Too much concentration in a small number of names exposes portfolios to considerable vulnerabilities if one of those names declines.

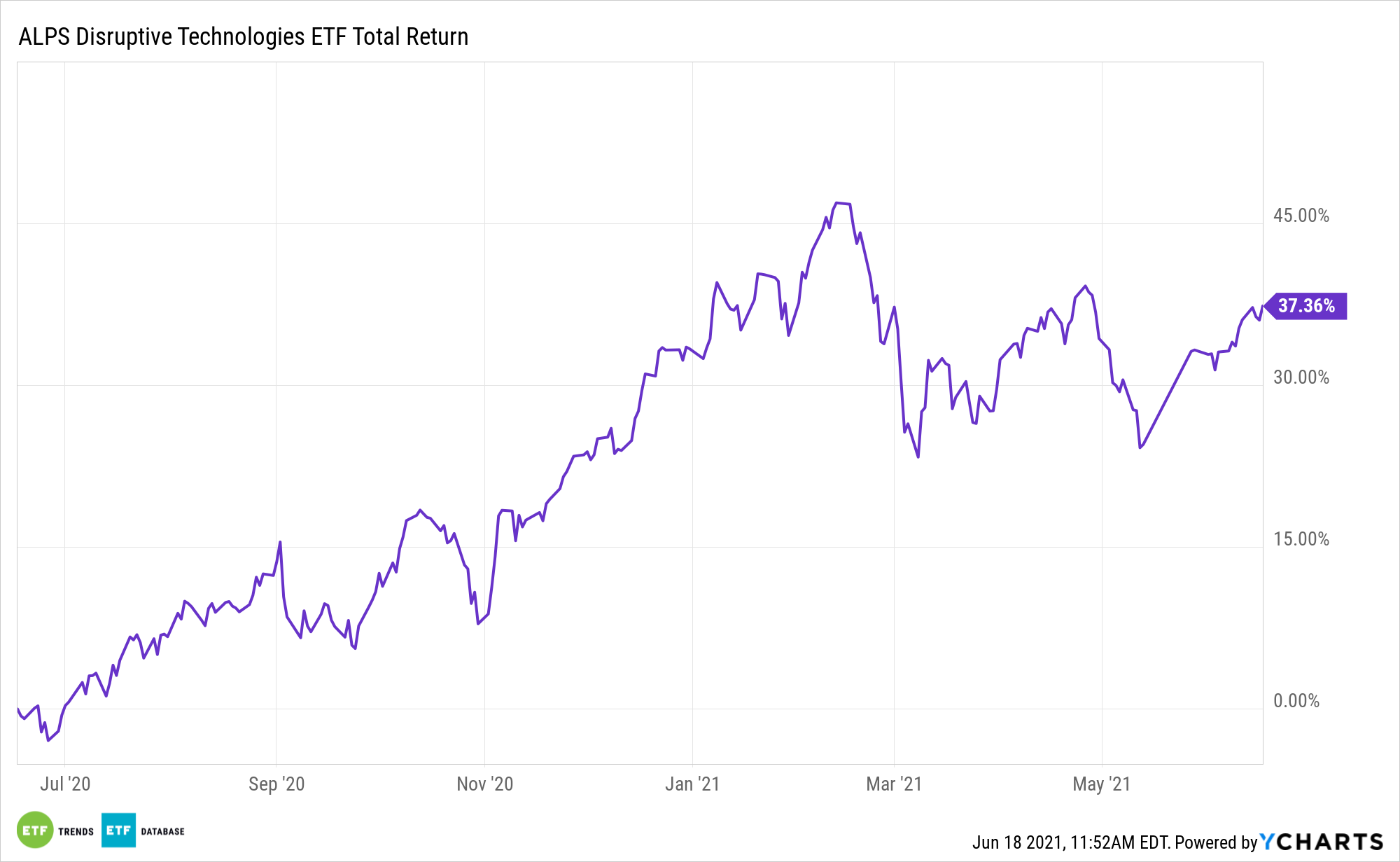

While it does not guard against all the downside of a market swoon, the ALPS Disruptive Technologies ETF (CBOE: DTEC) can reduce some of the risk associated with disruptive growth investing.

“For investors who don’t have the inclination to spend the time and effort to analyze and invest in individual stocks, it is most appropriate to gain exposure through an exchange-traded fund or mutual fund,” said Morningstar analyst Dave Sekera of disruptive technology stocks.

DTEC’s De-Risking Advantages

The $224 million DTEC has some avenues for presenting a less risky though potentially still rewarding play on disruptive growth investing. First, the fund doesn’t home in on a specific theme. Rather, it provides exposure to 10 innovative themes, including 3D printing, artificial intelligence, cloud computing, cybersecurity, fintech, and healthcare innovation, among others.

Second, DTEC components are equally weighted. Currently, none of the ETF’s components exceed weights of 1.34%. That methodology significantly reduces concentration risk and vulnerabilities created by large exposure to a small number of stocks.

DTEC’s broad approach has another, arguably underappreciated advantage. It provides investors with an avenue for being patient – a vital virtue when it comes to this style of investing.

“Investing in this space will require patience, as many of these stocks may take several years to fully play out and reach their full potential. In the meantime, investors will need the fortitude to weather heightened volatility as well as the dedication to monitor the individual companies in which they are invested,” adds Sekera.

One way of looking at that scenario is that with an individual stock, antsy investors may be compelled to constantly monitor their positions, potentially selling stocks on the first dip or selling too early as it runs higher. With a diversified approach such as DTEC, investors can take a more relaxed approach and eschew daily monitoring of single-stock positions.

Other technology funds to consider include the Technology Select Sector SPDR ETF (NYSEArca: XLK) and the Fidelity MSCI Information Technology Index ETF (FTEC).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.