With cyclical value stocks recouping their lost glory this year, it would be easy for investors to be dismissive of innovative growth strategies. However, market participants shouldn’t take their eyes off the innovative investing ball.

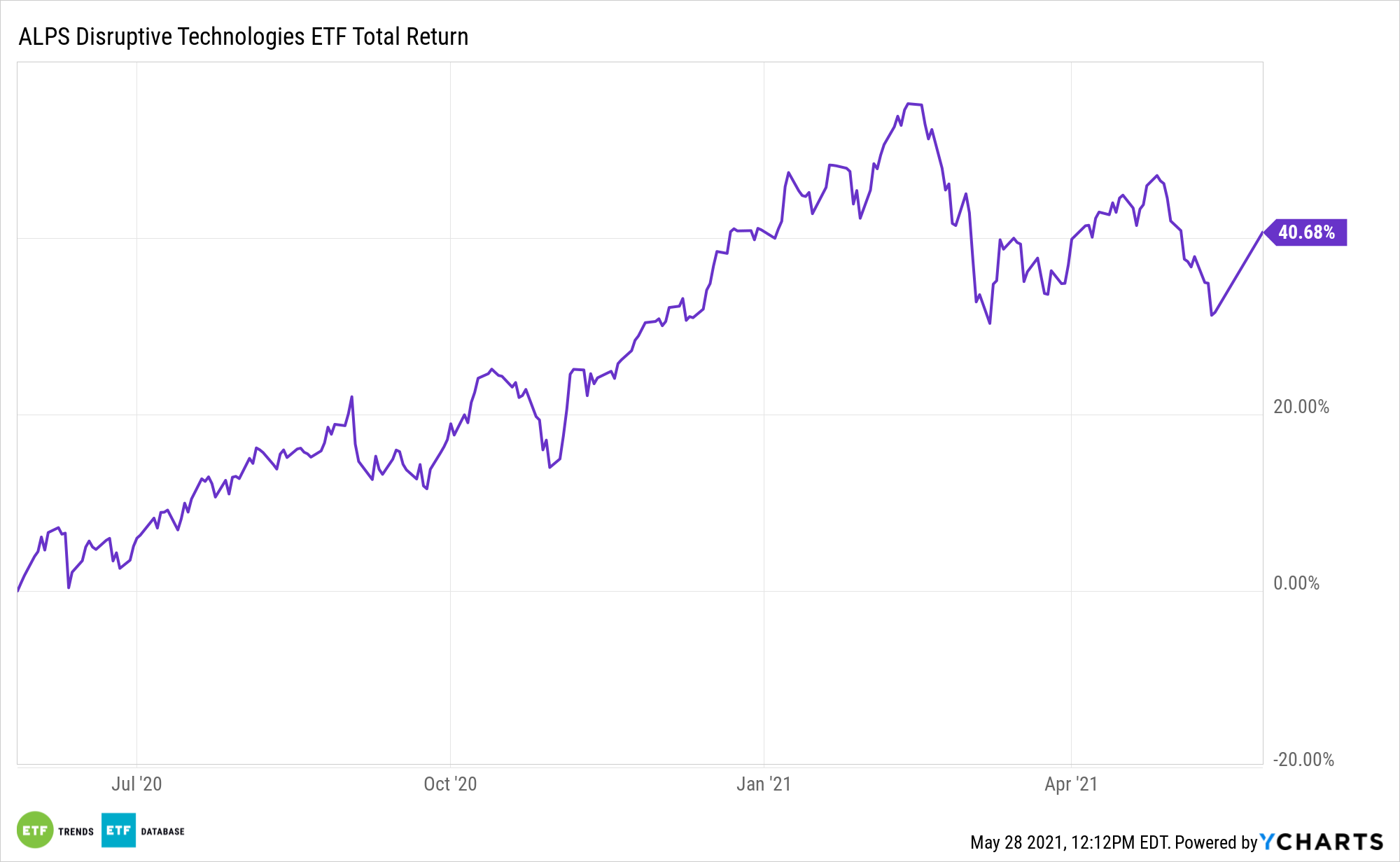

One strong fund is the ALPS Disruptive Technologies ETF (CBOE: DTEC). As highlighted by year-to-date inflows of $42.67 million, some prescient investors are using the growth-is-out-of-favor scenario to revisit DTEC.

That could prove to be a wise strategy due to the depth offered by the ETF. While many disruptive growth funds home in one or a small number of themes, DTEC’s expanse is advantageous for investors. The ALPS exchange traded fund features exposure to 10 disruptive market segments: Healthcare Innovation, Internet of Things (IoT), Clean Energy and Smart Grid, Cloud Computing, Data and Analytics, FinTech, Robotics, Artificial Intelligence, Cybersecurity, 3D Printing, and Mobile Payments.

More ‘DTEC’ Pluses

On the surface, DTEC would appear to be diversified simply because it provides access to 10 themes, but there’s more to the story. As seasoned investors know, some disruptive funds may advertise wide-ranging exposure, but in reality those products can be heavily concentrated at the industry or holdings levels.

Obviously, that strategy can introduce industry or individual stock risk, defeating the purpose of being diversified. On the other hand, DTEC takes diversification seriously. The themes represented in the fund range in weights of 9.21% at the bottom (3D printing) to 11.13% at the top (cybersecurity).

Likewise, no DTEC holding exceeds a weight of 1.36%, which effectively limits single stock risk. Adding to the DTEC diversification case is that the ALPS ETF is a legitimate departure from traditional tech-heavy benchmarks.

Owing to its next-generation leanings, DTEC shares just 17 holdings with the Nasdaq-100 Index (NDX) and the overlap by weight between DTEC and that popular benchmark is a scant 9%, according to ETF Research Center data.

Other technology funds to consider include the Technology Select Sector SPDR ETF (NYSEArca: XLK) and the Fidelity MSCI Information Technology Index ETF (FTEC).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.