The election of Joe Biden as the 46th president of the United States and the Democrats controlling both houses of Congress has prompted meaningful rallies for clean energy exchange traded funds this year. Yet investors shouldn’t be afraid to take new looks at traditional energy assets such as master limited partnerships.

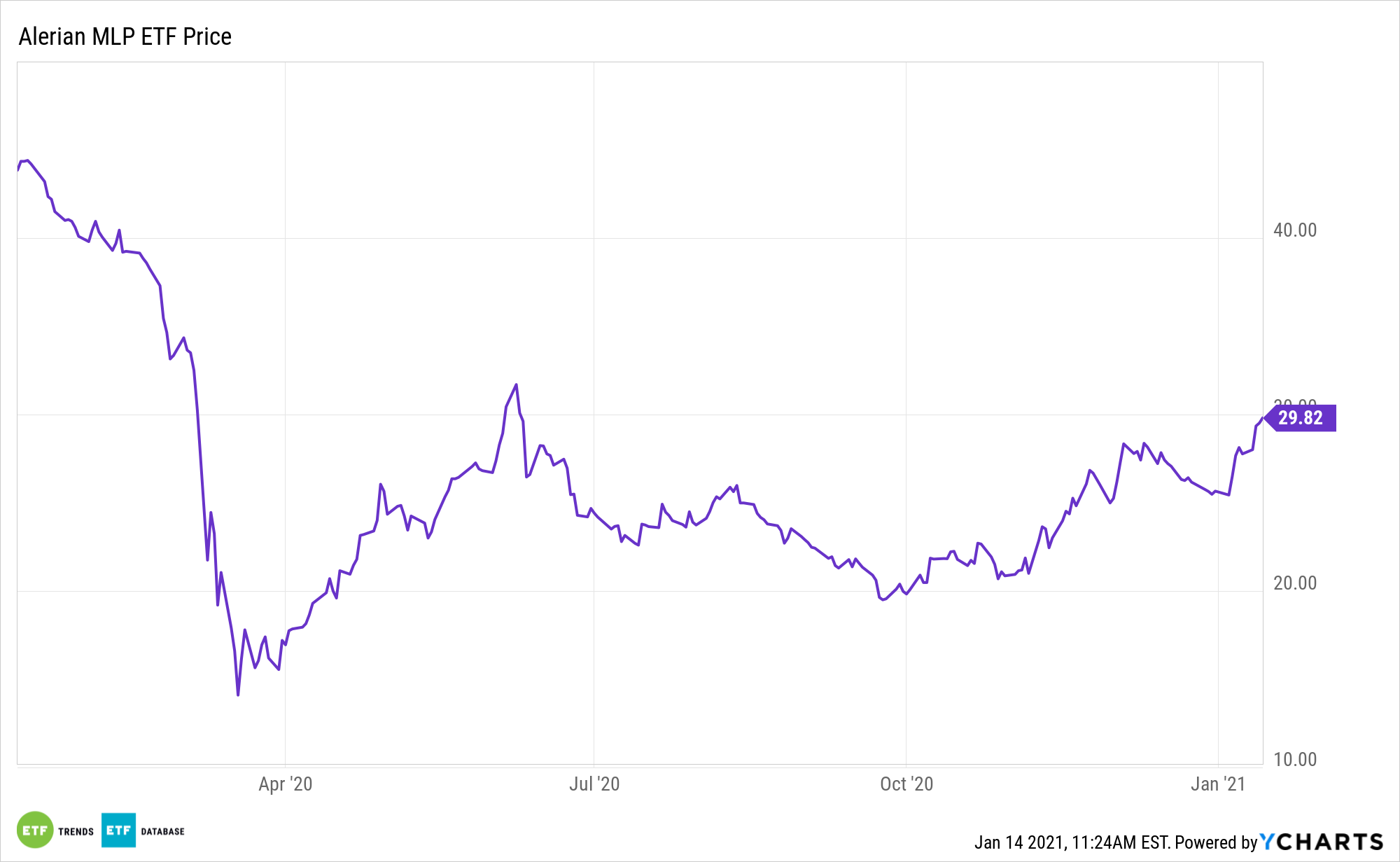

In fact, the case for an ETF like the ALPS Alerian MLP ETF (NYSEArca: AMLP) with Biden in the White House is surprisingly strong.

AMLP seeks investment results that correspond generally to the price and yield performance of its underlying index, the Alerian MLP Infrastructure Index. The index is comprised of energy infrastructure MLPs that earn a majority of their cash flow from the transportation, storage, and processing of energy commodities.

“With Democrats in the driver’s seat for the first time in many years, the question is not if taxes are going to get raised. Instead, it is when. Once fiscal stimulus is tackled alongside coronavirus relief, tax reform looks likely to be sitting mighty high on the priority list,” reports Seeking Alpha.

Tax Benefits for the AMLP ETF

MLPs are publicly traded partnerships known for a “pass-through” feature that helps investors generate stable, predictable cash flows. Investors, though, are required to pay income taxes in states where the MLP operates and have to report taxes on the K-1 form.

With MLP ETFs, investors won’t have to bother with the K-1 form and will only have to fill out the normal form 1099. If higher taxes come to pass, there are reasons investors may want to embrace MLPs through AMLP.

“Further, because MLPs typically are able to eke out a variety of deductions, taxable income is often lower than paid out cash flows, resulting in cash flow received by the owner being treated as return of capital. Thus, it is tax-deferred, lowering the cost basis of the investment rather than being treated like a typical corporate dividend,” adds Seeking Alpha.

MLPs primarily deal with the distribution and storage of energy products, so their business model is less reliant on the commodities market since MLPs profit off the quantity of oil and natural gas they are able to move around. Consequently, MLPs have historically shown a weaker correlation to energy prices over longer periods as MLPs act more like energy toll roads, profiting on the volume of oil moving through their pipelines.

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.