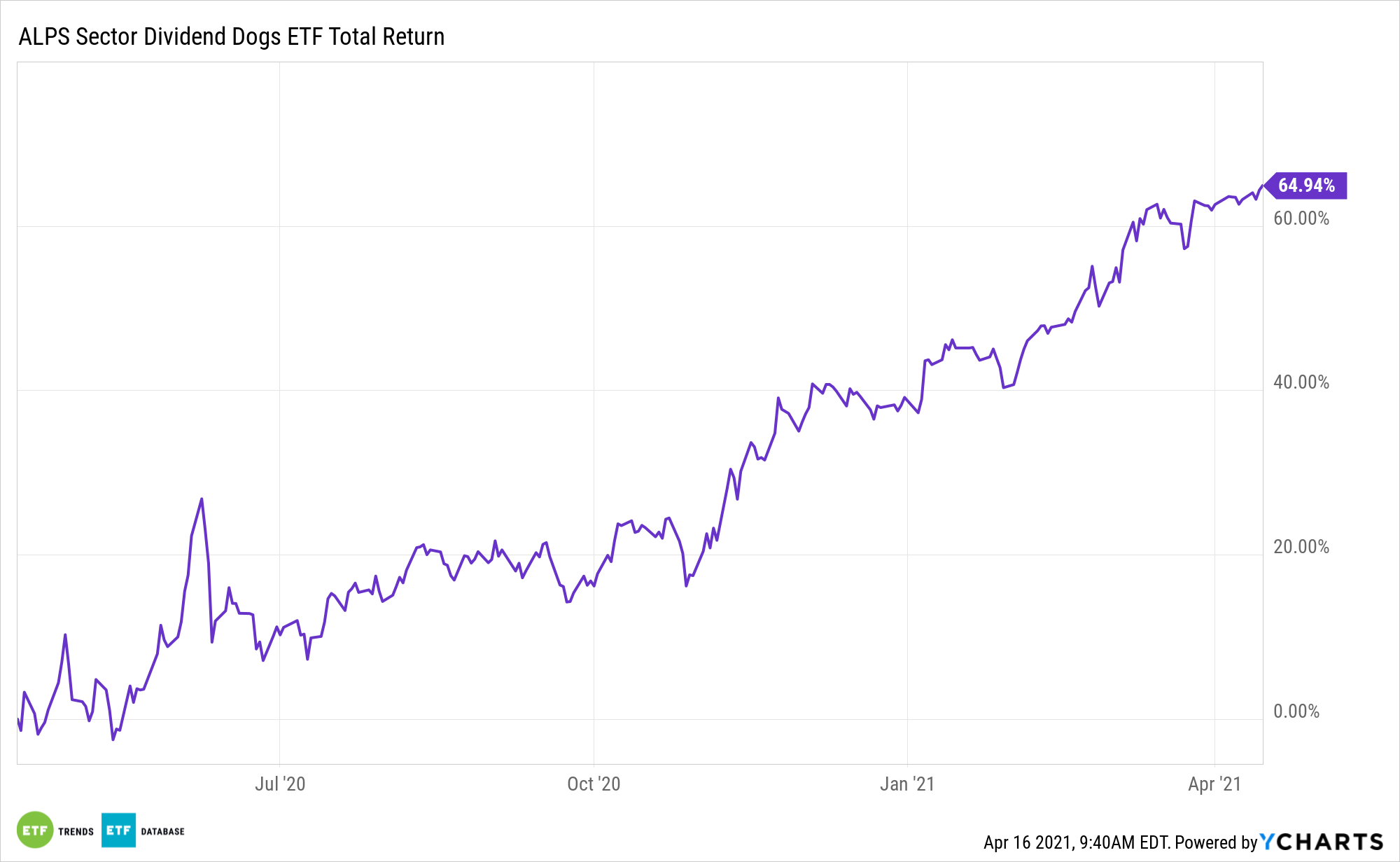

Cyclical stocks are leading this year, and that’s propelling the ALPS Sector Dividend Dogs ETF (SDOG) higher. Good news: many market observers see durability in that trend.

SDOG tries to reflect the performance of the S-Network Sector Dividend Dogs Index, which applies the “Dogs of the Dow Theory” on a sector-by-sector basis using the S&P 500 with a focus on high dividend exposure. SDOG’s equal-weight methodology is important because it reduces sector-level risk and dependence of some groups that are considered to be imperiled value ideas.

UBS sees opportunity in cyclical and value fare, which could augur well for SDOG moving forward.

“Furthermore, sharp declines in equity valuations are typically only caused by growth or policy concerns,” said David Lefkowitz, UBS head of equities America. “Higher interest rates do, however, have implications for positioning within equity markets. Cyclical sectors and value stocks tend to outperform when rates rise.”

Scintillating Cyclicals

There’s imminent allure with SDOG.

“Economically sensitive sectors and stocks have the most potential to surprise to the upside, easily beating dismal prior year earnings. This is reflected in the earnings momentum chart below, which gives energy, materials and financials an edge. Growth companies that excelled in 2020 will find it much harder to exceed prior-year levels,” according to BlackRock research.

Cyclicals are usually found in the energy, financial services, industrial, and materials sectors. SDOG helps advisors capitalize on the resurgent energy sector, rebounding financial services names, and the value proposition offered by materials stock.

Additionally, SDOG has allure as rising rates play.

“While equity market valuations are higher than average, stocks still look attractive relative to the rock bottom interest rates,” said Lefkowitz. “In fact, interest rates could rise by more than a percentage point before the yield spread between stocks and bonds would decline to a level that is lower than the long-term average.”

UBS is bullish on cyclical sectors, including energy and financial services, over defensive groups such as consumer staples and utilities.

Other high dividend ETFs include the SPDR S&P Dividend ETF (SDY), iShares Select Dividend ETF (NYSEArca: DVY), and iShares Core High Dividend ETF (HDV).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.