Emerging markets offer investors more income than many realize. Investors can tap into that theme with the ALPS Emerging Sector Dogs ETF (NYSEArca: EDOG).

EDOG tracks the performance of the S-Network Emerging Sector Dividend Dogs Index. The index is comprised of the highest paying stocks, or ‘Dividend Dogs’, from the S-Network Emerging Markets Index, which holds large cap, emerging market stocks. The Dividend Dogs include the five stocks in each of the ten Global Industry Classification Standard sectors that make up the S-Network Emerging Markets.

See also: The ALPS SDOG ETF: Dogs of the Dow Are Back

While dividends are a popular investment style and have been for decades, there’s still substantial criticism around payouts. However, today’s low interest rates and anemic bond returns remind investors that some exposure to dividend payers is advantageous. EDOG was able to skirt much of last year’s dividend strife.

“For stocks outside North America, cuts are determined by comparing adjoining fiscal year-end dividend per share figures over a multiyear period. If the company decreased its dividend per share year over year, it’s considered a cut. Cuts are far more frequent outside of North America. In some markets, dividends are often paid out opportunistically when the company has excess cash on hand,” according to Morningstar research.

EDOG’s Surprising Perks

Investors should consider quality dividend growth stocks that typically exhibit stable earnings, solid fundamentals, strong histories of profit and growth, commitment to shareholders, and management team conviction in their businesses.

“Dividend-paying stocks have a long and impressive history of delivering for investors—not just income but also total return. But they are best approached selectively,” notes Morningstar. “Companies that can sustain profitability due to an economic moat and that are financially healthy are best positioned to sustain their dividends. Equity income investors who prioritise income over total return can end up sacrificing both.”

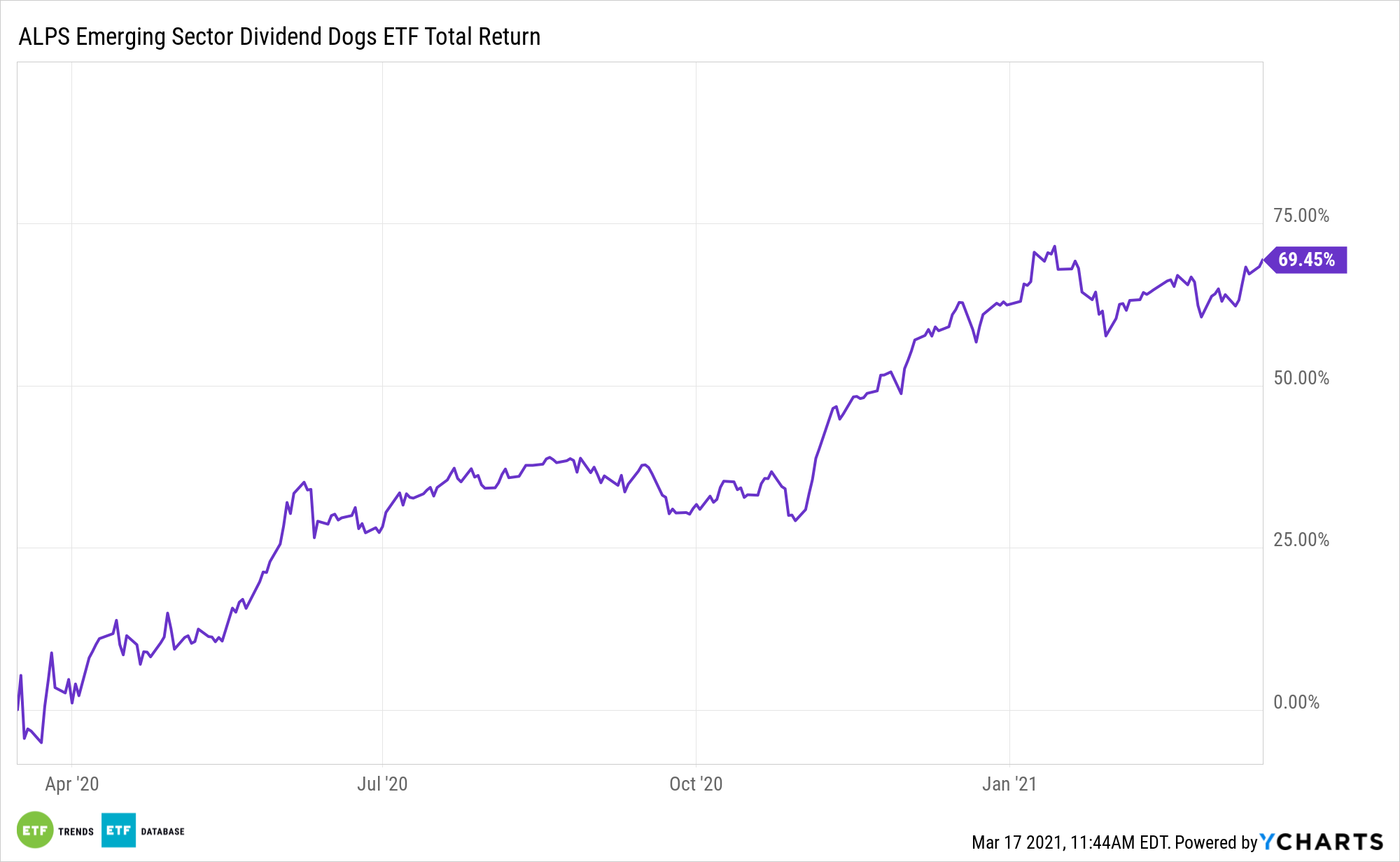

Up 4.31% year-to-date, EDOG yields 2.87%.

Other emerging markets dividend ETFs include the ProShares MSCI Emerging Markets Dividend Growers ETF (CBOE: EMDV), iShares Emerging Markets Dividend ETF (DVYE), and WisdomTree Emerging Markets Equity Income Fund (NYSEArca: DEM).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.