When it comes to deploying and investing in renewable energy, market participants frequently hear about costs.

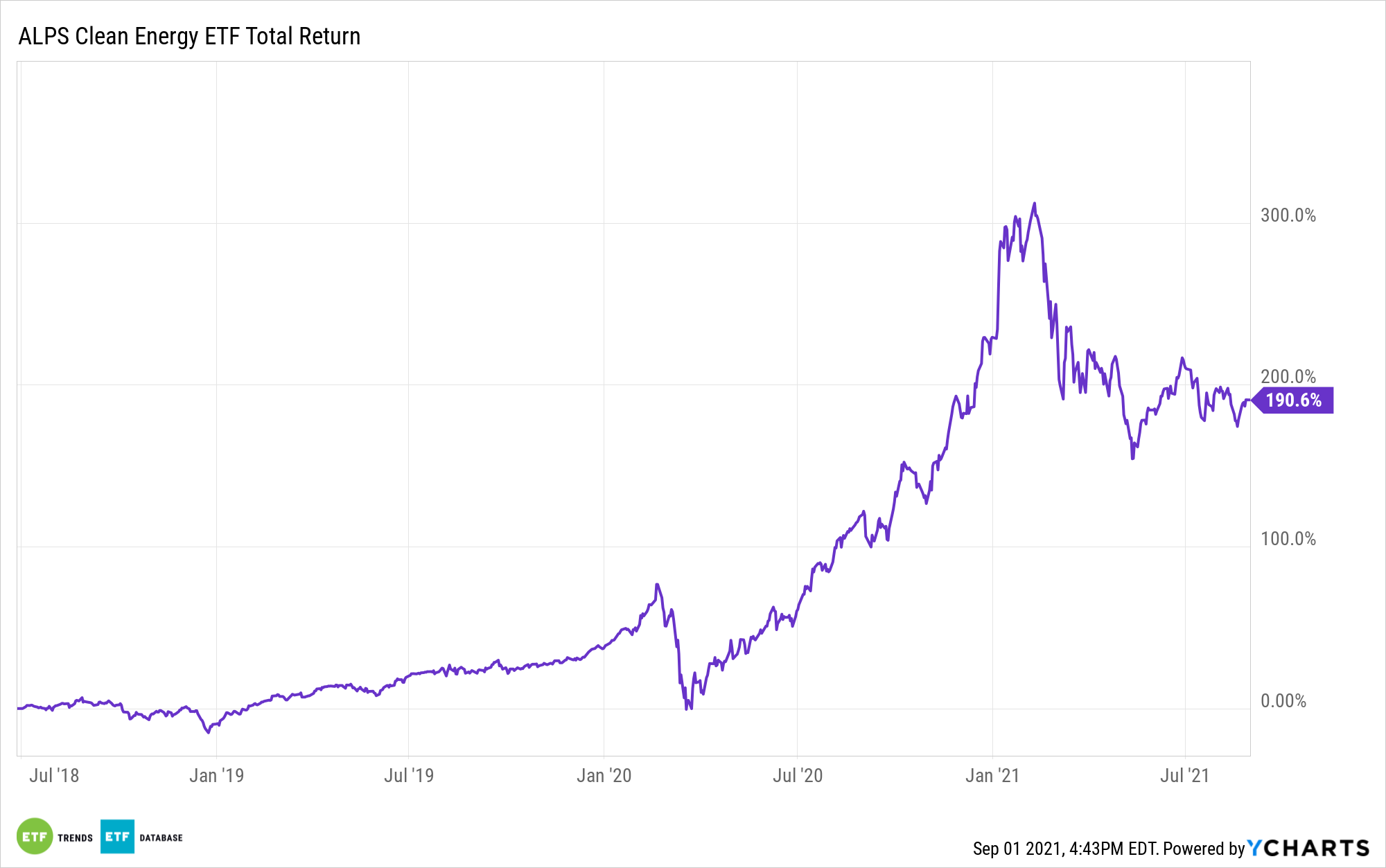

As in, the point at which the costs of installing solar and wind systems will decline to the point that adoption increases. Good news: That’s already happening. However, there’s still work to be done. Beyond this consideration, there are other forms of costs that investors in exchange traded funds like the ALPS Clean Energy ETF (ACES) should consider.

One of those considerations is whether the costs of going green outweigh the benefits. Again, good news, because the answer is “no.” At least, that’s the case with wind energy.

“The health and climate benefits of wind generation installed in the US in 2020 were more than twice the levelized cost of energy (LCOE) of the facilities, according to data released by the US Department of Energy (DOE) 30 August,” notes IHS Markit.

That’s directly relevant to ACES investors because wind equities account for 19.70% of the ETF’s weight. Only solar commands a larger allocation with its 24.18%.

“DOE valued the health and climate benefits of wind energy installed in the US in 2020 at $76/MWh, while the nationwide LCOE—or the lifetime cost divided by production—for wind was $33/MWh, it said in a report on onshore wind energy, one of three on wind the agency issued concurrently,” adds IHS Markit.

Of added benefit to ACES investors is the fact that as more customers become aware of the fact that cost-benefit is in favor of wind, adoptions correspondingly rise.

“A record 16.836 GW of US wind capacity was installed in 2020, bringing the cumulative total at the end of the year to 121.96 GW, DOE said. The momentum isn’t slowing, as projects totaling 34.76 GW were under construction (17.3 GW) or in advanced development (17.46 GW) at the end of 2020 in the US, the American Clean Power Association said in February,” notes IHS Markit.

In fact, new wind installations in 2020 outpaced solar for the first time on record. As Markit notes, wind accounts for 10% of generated power in 16 states and nearly a third or more in four states. That’s another sign ACES’ wind exposure is a potentially attractive trait for long-term investors.

Other alternative energy ETFs include the First Trust Global Wind Energy ETF (FAN) and the SPDR Kensho Clean Power ETF (CNRG).

For more news, information, and strategy, visit the ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.