Over the past few quarters, different narratives have emerged about consumer spending — it’s up, it’s down, it’s growing but at a slower pace — with differing results on a month-to-month, year-over-year, or quarterly basis. For investors, the important trends aren’t always easy to quantify, especially with so many moving parts.

From a high-level perspective, there are at least three different types of consumers:

- Price-sensitive consumers pressured by inflation. These consumers are spending less and likely searching for better deals and discounts in order to save money.

- Middle-of-the-road consumers, who may be cutting back in some areas but may continue to spend on items with strong brand recognition.

- Higher-income consumers, whose spending is relatively immune to economic conditions.

This note explores these trends, as well as some industry/thematic ETFs outside of the more common consumer discretionary sector ETFs.

Trend #1: Price-sensitive consumers search for deals by online shopping.

The personal savings rate still at only 4.1% in April 2023. However, price-sensitive consumers are not yet in the clear and continue to shop for discounts and deals. This is easiest to do online. Many retailers earn ad-based revenue based on web traffic or clicks. So, e-commerce companies may benefit even when purchases aren’t made.

E-commerce also continues to grow long-term for several reasons. First and most obviously, we are increasingly more dependent on technology and connected devices. We work, play, and socialize on the internet, so it makes sense that we also shop there.

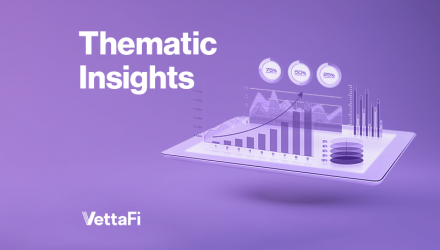

Second, there are fewer people on the road, especially with the continuation of remote work. Fewer people on the road means fewer chances that consumers will “drop in” to a store (see chart below).

Third, as consumers grow more dependent on technology, so do retailers. Whether a retailer has brick-and-mortar operations or e-commerce operations, they need proper inventory management systems in order to remain nimble in the event of future supply chain disruptions. A strong tech-based management system can serve as a good transition to combining brick-and-mortar with an expanding e-commerce operation.

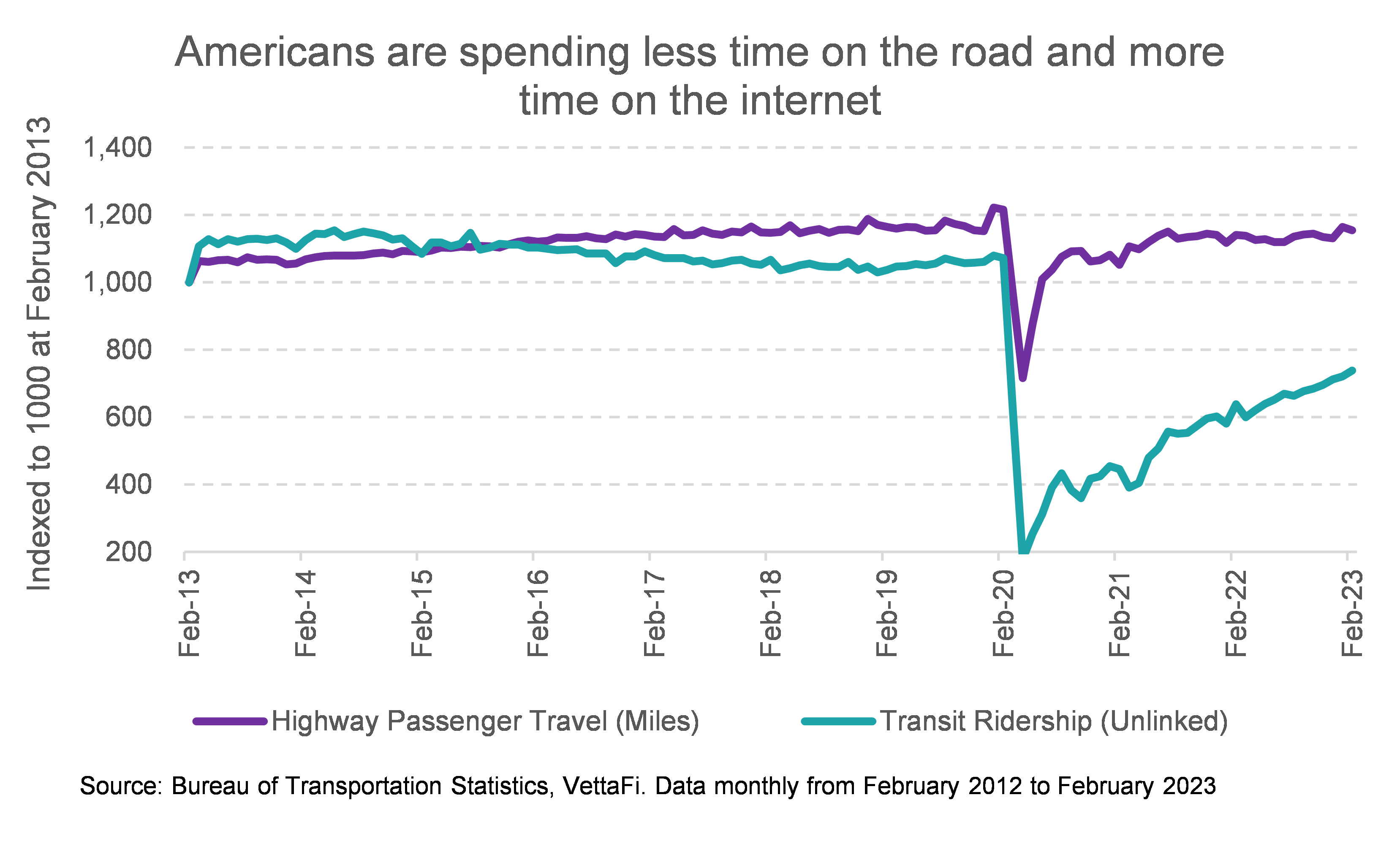

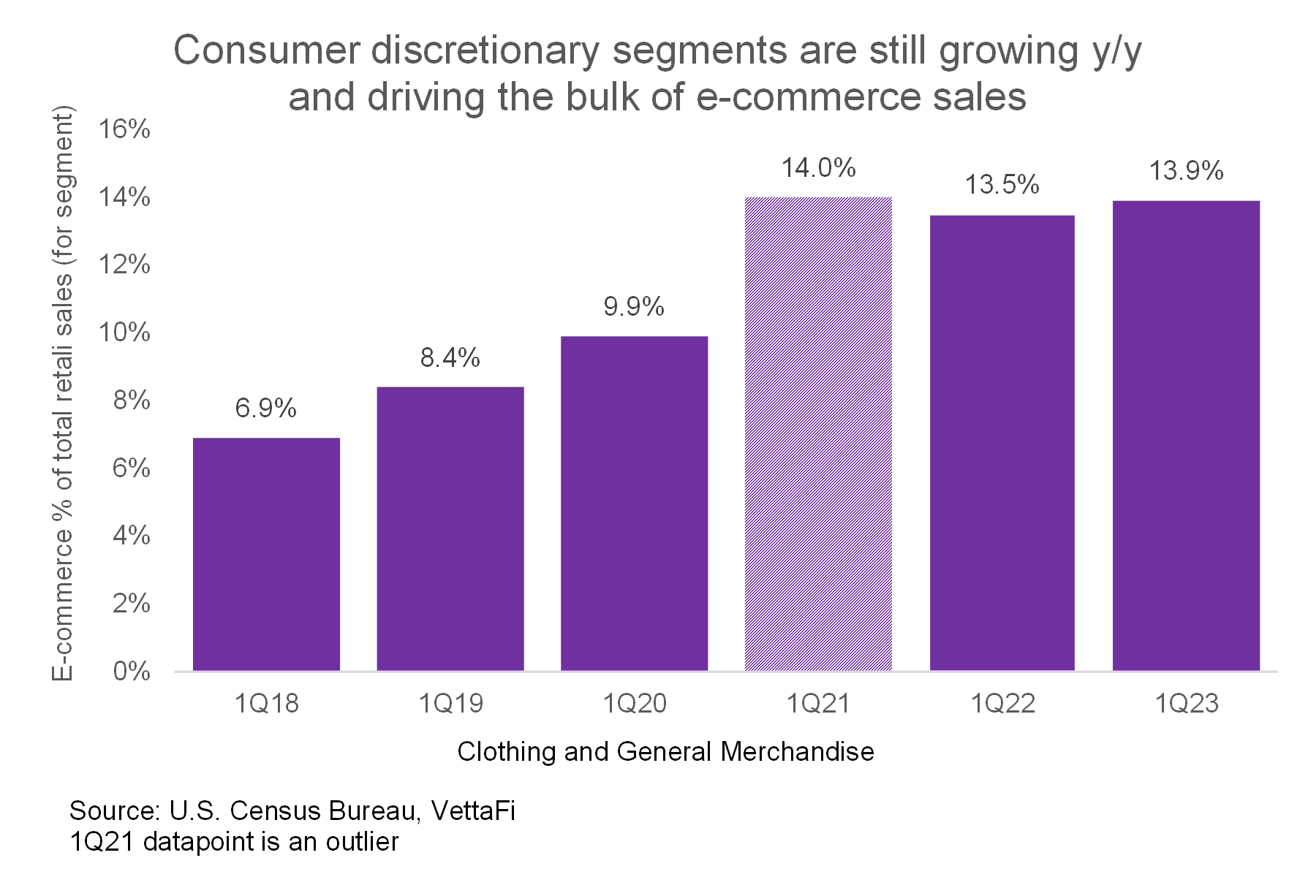

1Q23 U.S. e-commerce data were released at the end of May. The data showed that e-commerce spending has continued to follow these trends. E-commerce sales were 15.1% of total retail sales in 1Q23 — higher than the 14.5% reported in 1Q22 and the highest percentage since 4Q20. The strongest segments included clothing and general merchandise (which is easy for consumers to order in high volumes at low price points with fast shipping) and non-store retailers (which includes internet-based retailers and other retailers that sell directly to consumers).

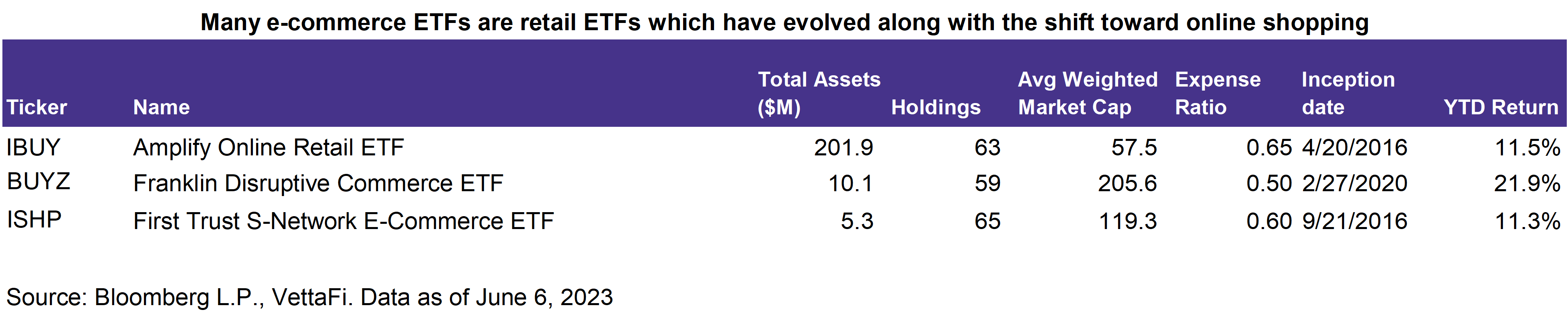

Retail ETF investments in this segment include the Amplify Online Retail ETF (IBUY), the Franklin Disruptive Commerce ETF (BUYZ), and the First Trust S-Network E-Commerce ETF (ISHP), which hold not only traditional retailers with an online presence but also internet-based companies.

Trend #2: The average consumer continues to shop for quality brands with strong name recognition.

Less price-sensitive consumers may notice that eggs cost 30% more than last year. (This number is down from 70% earlier this year.) However, they might still continue to spend on goods that have strong brand recognition but lower price points than luxury goods. These companies have likely benefited from the increase in social media usage, particularly for the younger generations (Millennials and younger).

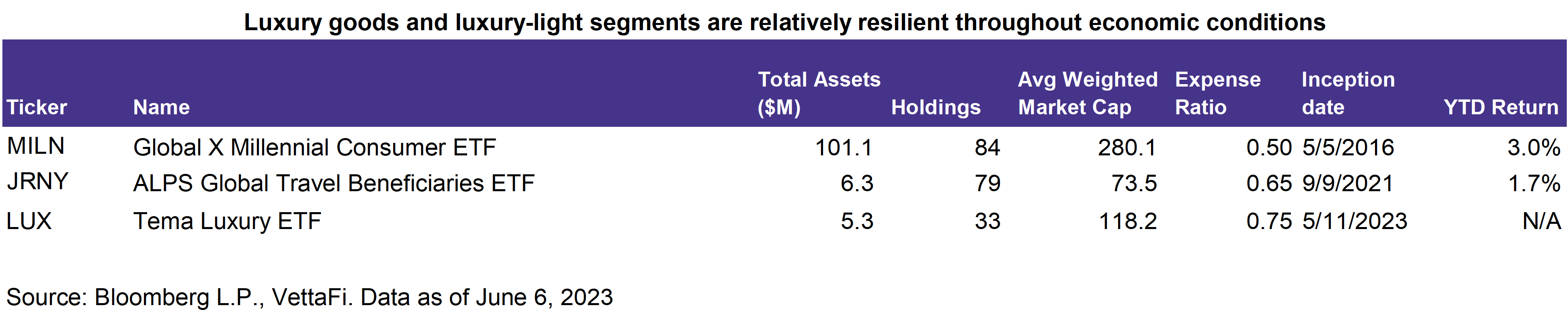

ETFs in this segment include the Global X Millennial Consumer ETF (MILN), which includes companies like Lululemon Athetica (LULU) and Starbucks (SBUX). Starbucks, for example, reported that its same-store sales increased 11% year-over-year globally and 12% year-over-year in the U.S. for the quarter ending April 2, 2023. 90-day active members in its U.S. loyalty program increased 15% year-over-year. Similarly, Lululemon has seen its same-store sales increase 16% on a constant dollar basis for its fiscal 1Q23.

Trend #3: Higher-income consumers are driving luxury goods sales independent of economic conditions.

There is a portion of higher-income consumers whose spending habits are not dependent on economic conditions. These consumers will continue to buy higher-end luxury goods even when other consumers are cutting back on spending. This makes luxury goods a more resilient segment of the retail market. Middle-income consumers may also continue to buy certain luxury goods despite economic conditions, since they may purchase these items only occasionally (e.g., a new car or a new luxury handbag).

Previously when I discussed luxury goods in this note, there were no U.S.-based luxury goods ETFs (the latest had closed in October 2022). Since then, the Tema Luxury ETF (LUX) launched on May 11. This is an active ETF that holds companies like LVMH Moet Hennessy Louis Vuitton (LVMH), Hermes International (RMS FP), and L’Oreal SA (OR FP). Only 16.1% of the ETF by weight is based in the U.S. (with 38.1% in France and 18.0% in Italy), so this ETF provides international exposure not found in domestic consumer discretionary ETFs like the Consumer Discretionary Select Sector SPDR Fund (XLY).

ETFs like the ALPS Global Travel Beneficiary ETF (JRNY) also hold luxury goods in addition to airline and lodging stocks, which may benefit from an increase in luxury and leisure spending.

For more news, information, and strategy, visit the ETF Building Blocks Channel.