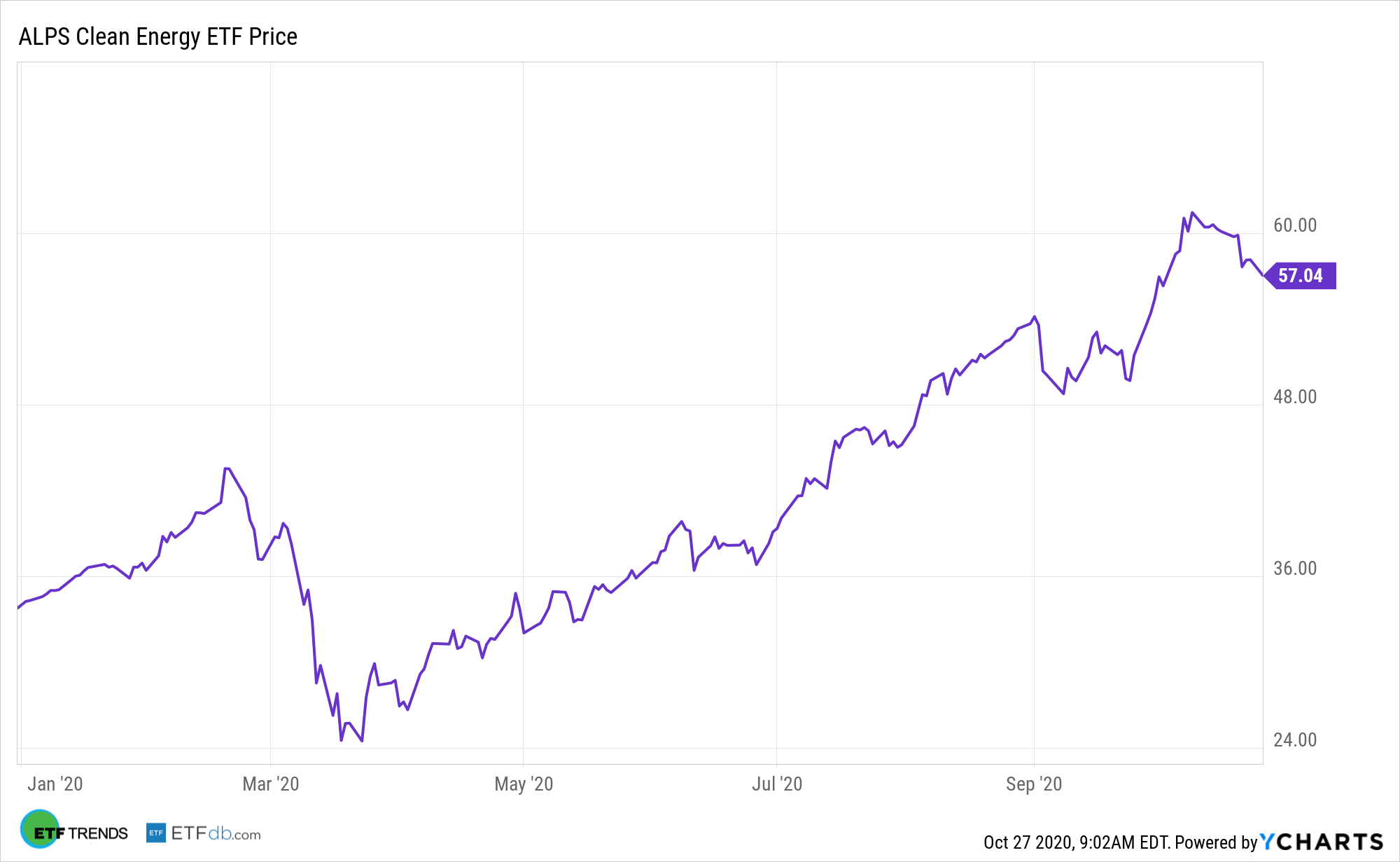

The ALPS Clean Energy ETF (ACES) is up nearly 69% year-to-date and while that’s undoubtedly impressive performance, it shouldn’t imply that upside from here is limited. In fact, some market observers believe renewable energy stocks can keep delivering gains for investors.

“Alternative energy stocks, including those focused on solar, are on a tear this year due to falling costs as well as optimism around supportive policies from a Biden administration, and JPMorgan believes there’s more upside ahead,” reports Pippa Stevens for CNBC.

ACES follows the CIBC Atlas Clean Energy Index. That benchmark is comprised of U.S. and Canada-based companies that primarily operate in the clean energy sector. Constituents are companies focused on renewables and other clean technologies that enable the evolution of a more sustainable energy sector.

A Clean Energy Awakening

ACES and rival funds are getting more attention in recent weeks due to talk about about a blue wave and former Vice President Joe Biden winning the White House, but it’s important to remember these assets were rallying before it Biden’s bounce in the polls and ACES can continue doing so regardless of what happens on Election Day.

“Long-term fundamentals for the overall space remain compelling, and we think the industry is more suited to long-term investors than at any prior time during our coverage,” said JPMorgan.

ACES takes a different approach than what is seen in other traditional clean energy ETFs. Many of the legacy funds in this space focus on one alternative energy concept, such as solar or wind power. Buoyed by double-digit growth rates in global solar installations over the next decade, ACES, with a substantial solar weight, could be a long-term winner.

“JPMorgan noted that the stocks in its alternative energy coverage universe have gained, on average, more than 130% this year compared with the S&P 500′s roughly 7% rise. Still, the firm said the risk-reward continues to look favorable, especially for companies involved in distributed power generation,” according to CNBC.

Fortunately, ACES shouldn’t be vulnerable to a surprise win by President Trump.

“But even if President Donald Trump is reelected, or if Congress remains split, JPMorgan doesn’t envision a drop-off for these stocks. The firm said that estimates and industry fundamentals would stay the same, although trading multiples could re-rate to levels seen prior to September’s run-up,” reports CNBC.

Other alternative energy ETFs include the First Trust Global Wind Energy ETF (FAN) and the SPDR Kensho Clean Power ETF (CNRG).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.