The complexion of the world’s energy mix is changing. Doors are opening for renewables, while many power providers are tiring of dirty sources like coal.

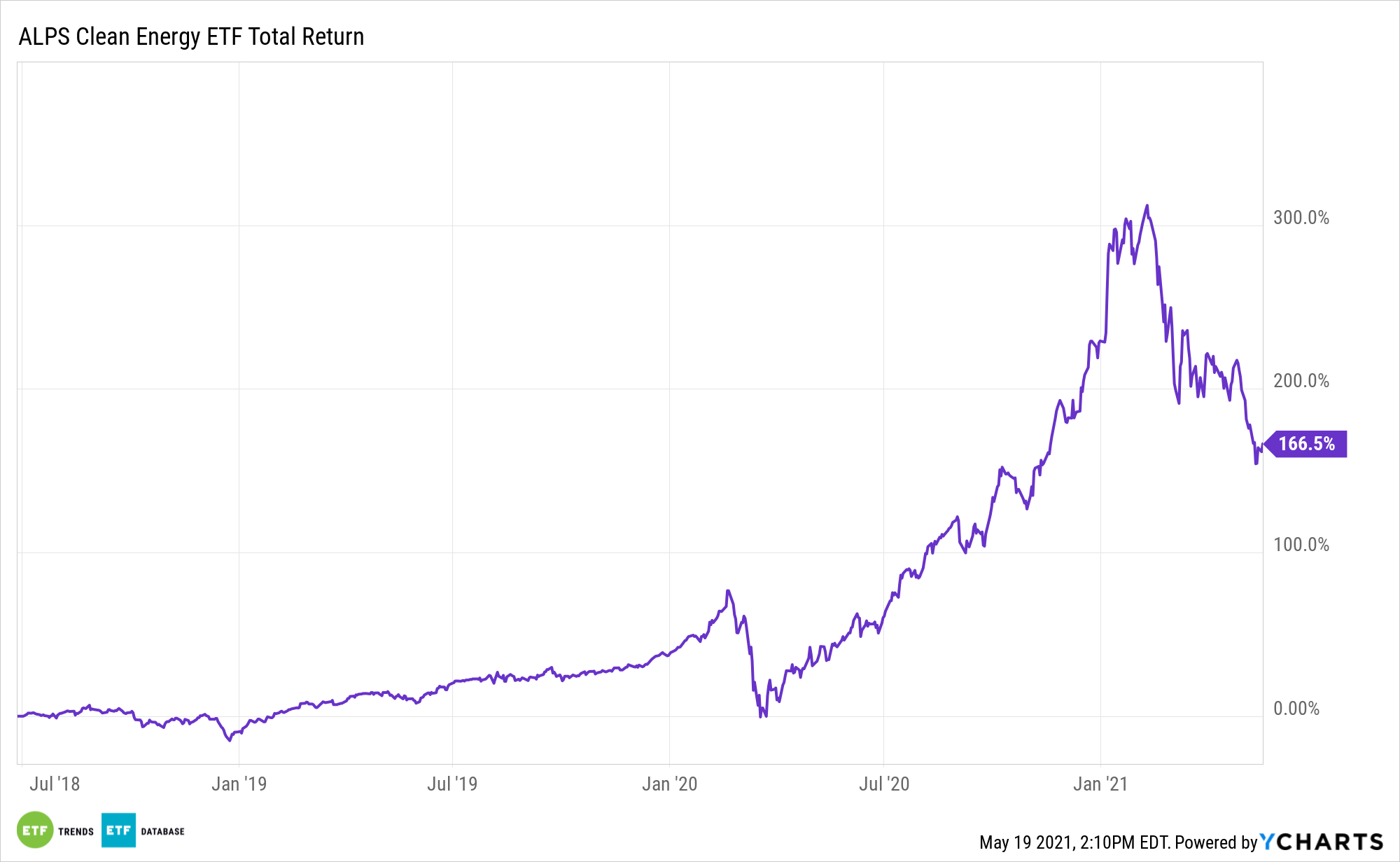

An array of exchange traded funds, including the ALPS Clean Energy ETF (ACES), provide exposure to the new normal in the energy realm. Following the installation of 275 gigawatts (GW) of renewable energy around the world in 2020, a 45% jump from the year prior, some analysts believe that a new age of energy is setting in.

“Annual worldwide renewable generation capacity additions are set to stabilize around 270-280 GW in 2021 and 2022, data released recently by the International Energy Agency (IEA) show,” says IHS Markit. “The ‘new normal’ far surpasses the IEA’s expectations of a year earlier, with Europe and the US compensating for a slowdown in Chinese capacity installations after 2020 saw record newbuild there.”

A Global Push

Biden is making good on promises to push a broad-based renewable energy agenda. Whether it makes it through Congress in the form desired by investors and green energy fans is another matter. Fortunately, international opportunities also abound in the renewables space with Europe, India, and Latin America upwardly revising forecast additions for this year and 2022.

Major governments around the world need to capitalize by favoring agendas that “encourage greater investment in solar and wind, in the additional grid infrastructure they will require, and in other key renewable technologies such as hydropower, bioenergy and geothermal,” according to IEA.

As for specific renewable industries, solar – one of the largest industry weights in ACES – is in pole position, augmenting dips in wind power installations.

“Solar PV newbuild is set to increase a further 8% year on year in 2021, the IEA said, largely as a result of lower investment costs and ongoing policy support. The IEA expects solar PV additions to reach 145 GW in 2021 and 162 GW in 2022, for new records and accounting for about 55% of all renewable newbuild in 2021 and 2022,” adds IHS Markit.

Other alternative energy ETFs include the First Trust Global Wind Energy ETF (FAN) and the SPDR Kensho Clean Power ETF (CNRG).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.