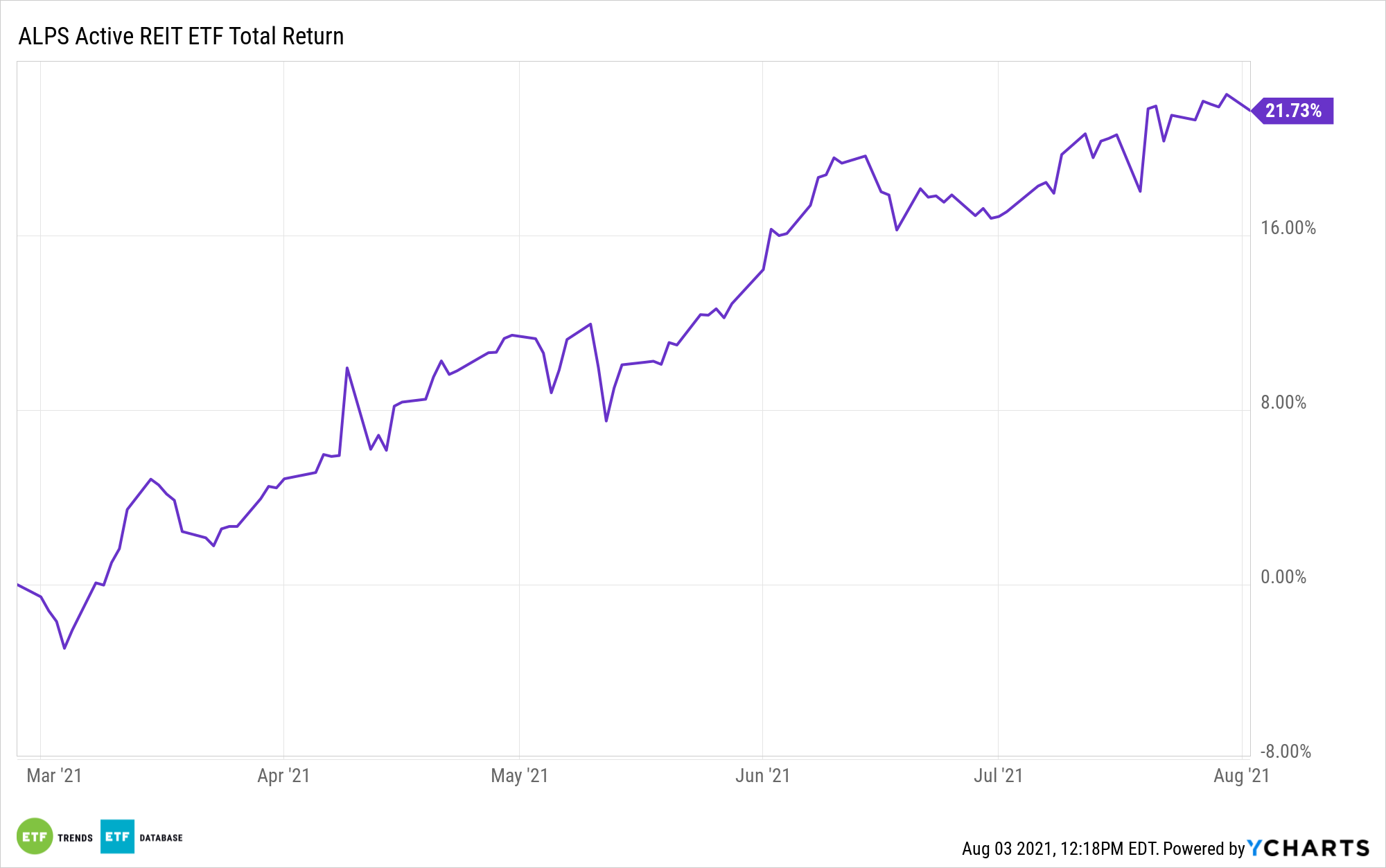

The real estate sector is impressing this year thanks to a combination of low interest rates and inflation, among other factors. Investors are looking to the ALPS Active REIT ETF (NASDAQ: REIT), which is higher by almost 21%.

The case for REIT doesn’t end there. In fact, the story for this exchange traded fund is just getting started, and not just because the ETF debuted in March. Rather, REIT is increasingly alluring because evolution and disruption are arriving in the real estate sector.

Some traditional passive strategies don’t adequately expose investors to those trends. However, REIT is actively managed and can respond swiftly to the real estate revolution. Take the case of industrial REITs.

Industrial REITs are a hot corner of the broader real estate sector due to the e-commerce boom, and are helping to fuel a new sub-industry: cardboard production.

“Corrugated cardboard represents around 80 percent of packaging used in online orders. According to research from Newmark, almost 407 billion square feet of corrugated cardboard was produced in the U.S. in 2020, up from 390 billion square feet in both 2018 and 2019,” reports The Real Deal.

Warehouse REITs are moving into cardboard production because so many are already located near or are themselves functioning as e-commerce shipping hubs.

“New or expanding warehouses and facilities for cardboard production are likely to be located near e-commerce warehouses to guarantee quick deliveries. Having good infrastructure for logistics and freight rail access nearby will be key factors in determining where the boom is felt,” according to The Real Deal.

Another element in this equation that augurs well for REIT is the domestic nature of cardboard output. The supply chain risks inherent in importing cardboard tie the industry much closer to the United States.

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.