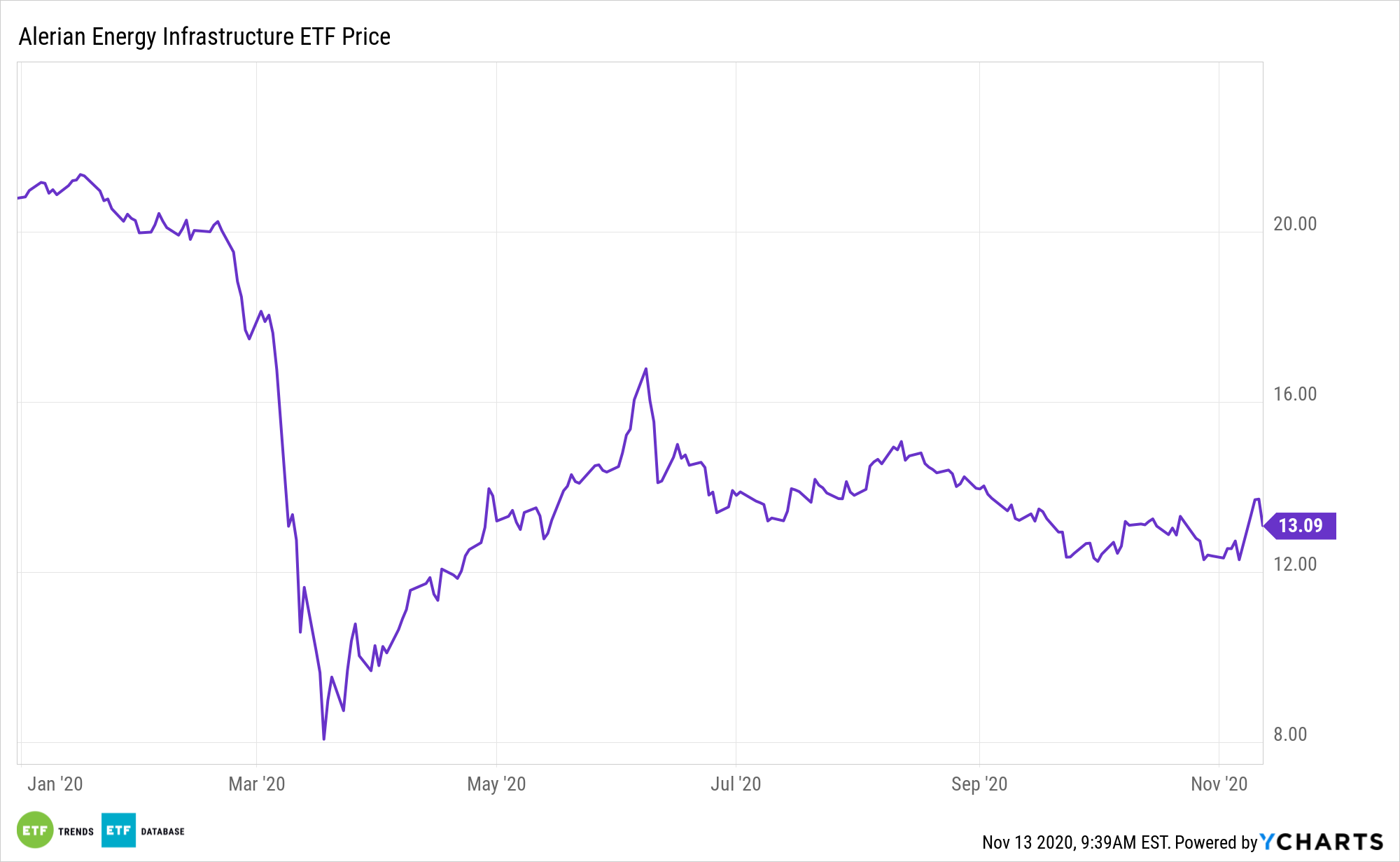

Don’t call it a comeback quite yet, but there are incremental signs pipeline assets, including the Alerian Energy Infrastructure ETF (ENFR), are perking up.

ENFR tracks the Alerian Midstream Energy Select Index (CME: AMEI). ENFR acts as a type of hybrid energy infrastructure ETF, which could help investors capture some of the high yields from MLPs while limiting the tax hit from solely owning MLPs.

Part of the steadiness attributable to some ENFR components are plans to keep spending and growth plans subdued in the new year.

“Kinder Morgan Inc., Enterprise Products Partners LP and Energy Transfer LP were among the midstream companies that expressed a desire to maintain cost efficiency, at least until the market further stabilizes. Record daily coronavirus cases in the U.S. could cause demand to pull back again, something the operators are watching for carefully,” according to S&P Global Market Intelligence.

Reasons to Believe for Midstream Operators

Some analysts argue the worst of the coronavirus pandemic impact on midstream operators, ENFR’s area of emphasis, is behind the group, perhaps setting the stage for a rebound as the economy steadies and oil demand bounces back.

MLPs don’t make their money based on oil or gas prices. Unlike other energy sector stocks, they deal primarily with the distribution and storage of energy products, so their business model is less reliant on the commodities market since they profit off of the quantity of oil and natural gas they are able to move around.

Integral to the ENFR thesis is how rapidly midstream management teams are responding to headwinds presented by the coronavirus pandemic. Fortunately, many are proving adept at dealing with a challenging operating environment.

“We were impressed how quickly [management]teams ‘got’ it,” according to UBS. “Within two quarters since the onset of [COVID-19], capex came down, there was a real hard focus on costs and a slew of buyback authorizations … clearly [management]is listening to investors and attempting to deliver.”

Other MLP funds include the Global X MLP ETF (NYSEArca: MLPA) and the JPMorgan Alerian MLP Index ETN (NYSEArca: AMJ).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.