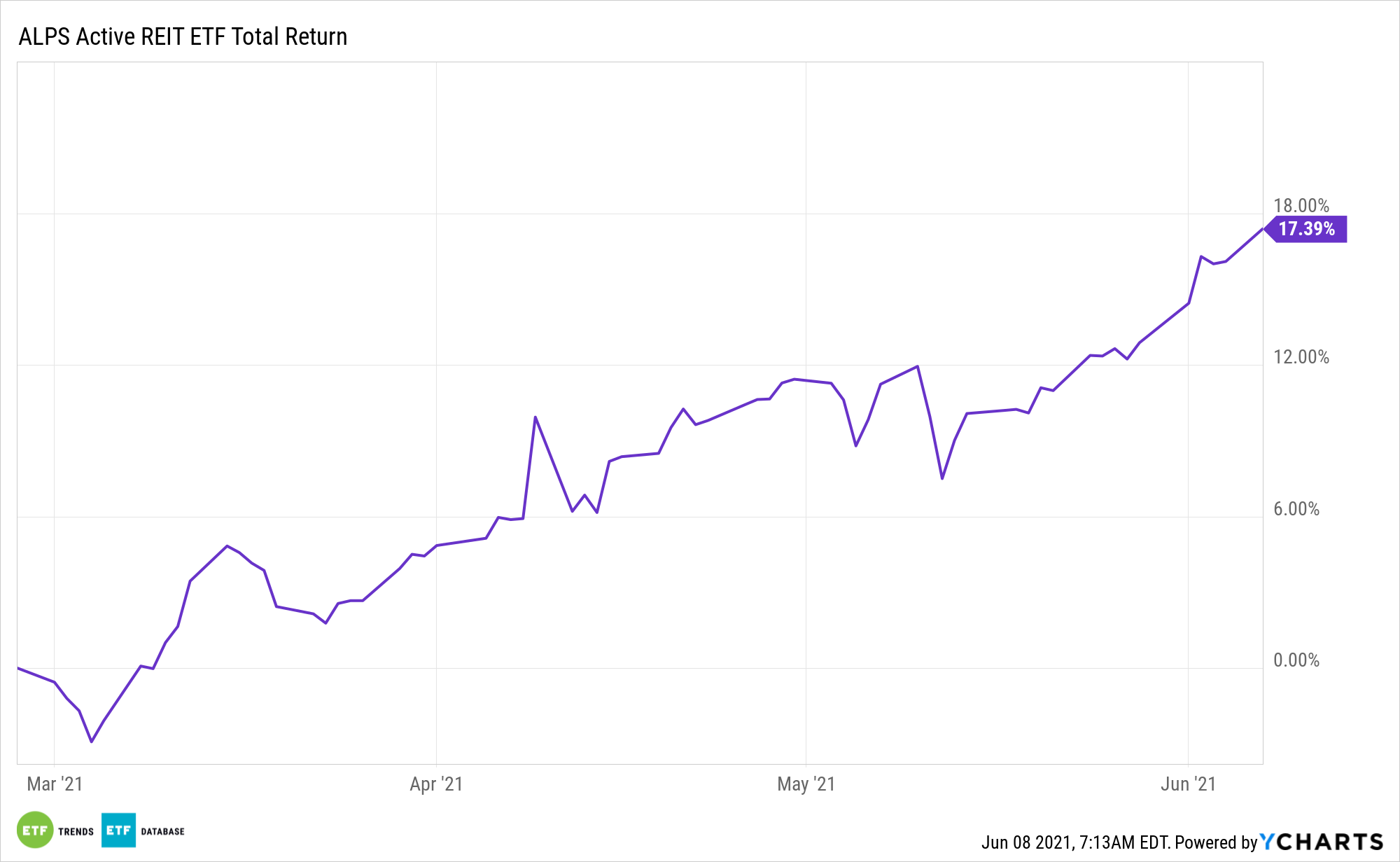

The ALPS Active REIT ETF (NASDAQ: REIT) debuted in March, making it one of the newest exchange traded funds providing exposure to real estate investment trusts (REITs). The ALPS fund is off to a hot start with a more than 17% gain since its launch.

Strong residential housing demand and low interest rates, obvious catalysts for REITs, are helping the ALPS ETF get off on the right foot, but there’s more to the story. The global supply chain shortage is highlighting the importance of data centers and providers of digital infrastructure – corners of the real estate market REIT can overweight because it is, as its name implies, an actively managed exchange traded fund.

On that note, real estate investors are embracing names such as American Tower Corp., Prologis Inc., Crown Castle International Corp., and Equinix Inc.

“The companies specialize in data storage, wireless infrastructure and warehouses. Exposure to these stocks would suggest investors are taking a bet on storage and supply chain concerns,” reports Kriti Gupta for Bloomberg.

Why It Matters to ‘REIT’

REIT is a semi-transparent ETF, meaning it doesn’t have to disclose its holdings on a daily basis. However, Prologis and Equinix combined for more than 18% of the fund’s roster at the end of the first quarter, according to issuer, confirming the fund has more than adequate leverage to data center demand.

American Tower (AMT) commanded a weight of nearly 3% in REIT, as of March 31. It’s not just ordinary investors that want data center REIT exposure. Pros do too. On Monday, private equity giant Blackstone said it’s acquiring data center REIT QTS Realty Trust (QTS) for $6.7 billion.

QTS wasn’t a member of the REIT lineup at the end of the first quarter, but that transaction underscores the vibrancy of the data center REIT market, and it could be a harbinger of further consolidation in the space.

REIT has another advantage that may be going overlooked when it comes to real estate ETFs: reopening leverage. At the end of the first quarter, REIT featured exposure to several hotel REITs, which should firm as more Americans resume leisure travel. One of the fund’s holdings on March 31 was MGM Growth Properties (MGP), a gaming REIT with significant exposure to the Las Vegas Strip and other US casino markets.

Other REIT ETFs include the Schwab US REIT ETF (NYSEArca: SCHH) and the Pacer Benchmark Data & Infrastructure Real Estate SCTR ETF (SRVR).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.