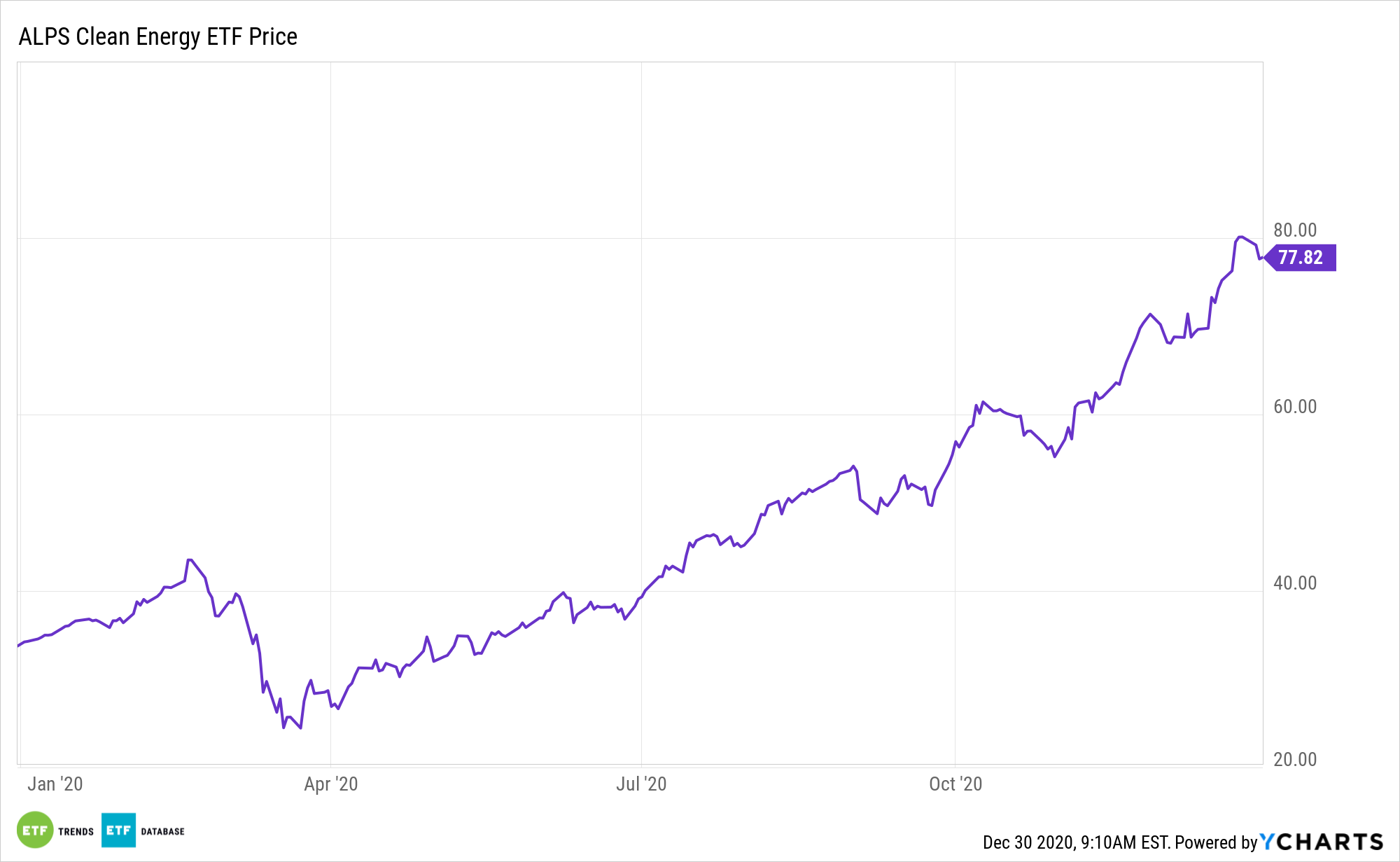

Up a staggering 134.63% in 2020, the the ALPS Clean Energy ETF (ACES) is easily one of this year’s best-performing non-leveraged exchange traded funds. For investors that missed this year’s move by ACES, many market observers believe there’s more coming in 2021.

ACES follows the CIBC Atlas Clean Energy Index. That benchmark is comprised of U.S.- and Canada-based companies that primarily operate in the clean energy sector. Constituents are companies focused on renewables and other clean technologies that enable the evolution of a more sustainable energy sector.

“Investors should increase their exposure to metal miners, clean energy and Chinese stocks to maximize their returns in 2021, according to Astoria Portfolio Advisors’ John Davi,” reports Fred Imbert for CNBC. “Stocks in these groups have been on a tear this year amid increasing expectations of an economic recovery as well as potential changes to the regulatory environment in energy.”

ACES Angles for 2021

The outlook for the renewable energy industry as a whole appears promising given the way the sector has been currently performing relative to other energy sources. An incoming Joe Biden administration that views clean energy favorably will also help ACES.

Renewable energy or clean energy ETFs that track industries like wind and solar farms are attracting more interest among investors seeking low-risk opportunities during periods of volatility.

“Clean-energy stocks have risen strongly this year as implementation costs, coupled with expectations of supportive policies from the incoming Biden administration,” according to CNBC.

A win by former Vice President Joe Biden – along with Democrats taking control of the Senate – could help accelerate a shift toward sustainability that is already under way, according to BlackRock research. “His climate policy would focus on four areas: electric power, transport, buildings and research and development (R&D) spending.”

ACES takes a different approach than most traditional clean energy ETFs. Many of the legacy funds in this space focus on one alternative energy concept, such as solar or wind power. Buoyed by double-digit growth rates in global solar installations over the next decade, ACES, with a substantial solar weight, could be a long-term winner.

Other alternative energy ETFs include the First Trust Global Wind Energy ETF (FAN) and the SPDR Kensho Clean Power ETF (CNRG).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.