House Speaker Nancy Pelosi said that she plans to bring the $1 trillion bipartisan infrastructure bill to the House floor for voting on Thursday, reports CNBC. The vote is currently hinging on a budget reconciliation bill between the Senate and the White House.

Centrist House Democrats have said that they would not vote for the infrastructure bill unless the up to $3.5 trillion budget reconciliation bill, which includes climate policy and social safety net legislation, is also passed.

The bill comes at time when the government is facing the possibility of shutting down and defaulting on its debt, and it would be the largest expansion of the social safety net in decades. The reconciliation bill includes paid leave, education, child care, green energy, and healthcare initiatives. It passed the House Budget Committee on Saturday and is ready to hit the House floor.

Progressive and moderate Democrats disagree with the size and breadth of the entire package, and Pelosi believes that it will pass, though it might be a for a cheaper price.

“I’m never bringing a bill to the floor that doesn’t have the votes,” she told ABC’s “This Week.” “You cannot choose the date. You have to go when you have the votes in a reasonable time, and we will.”

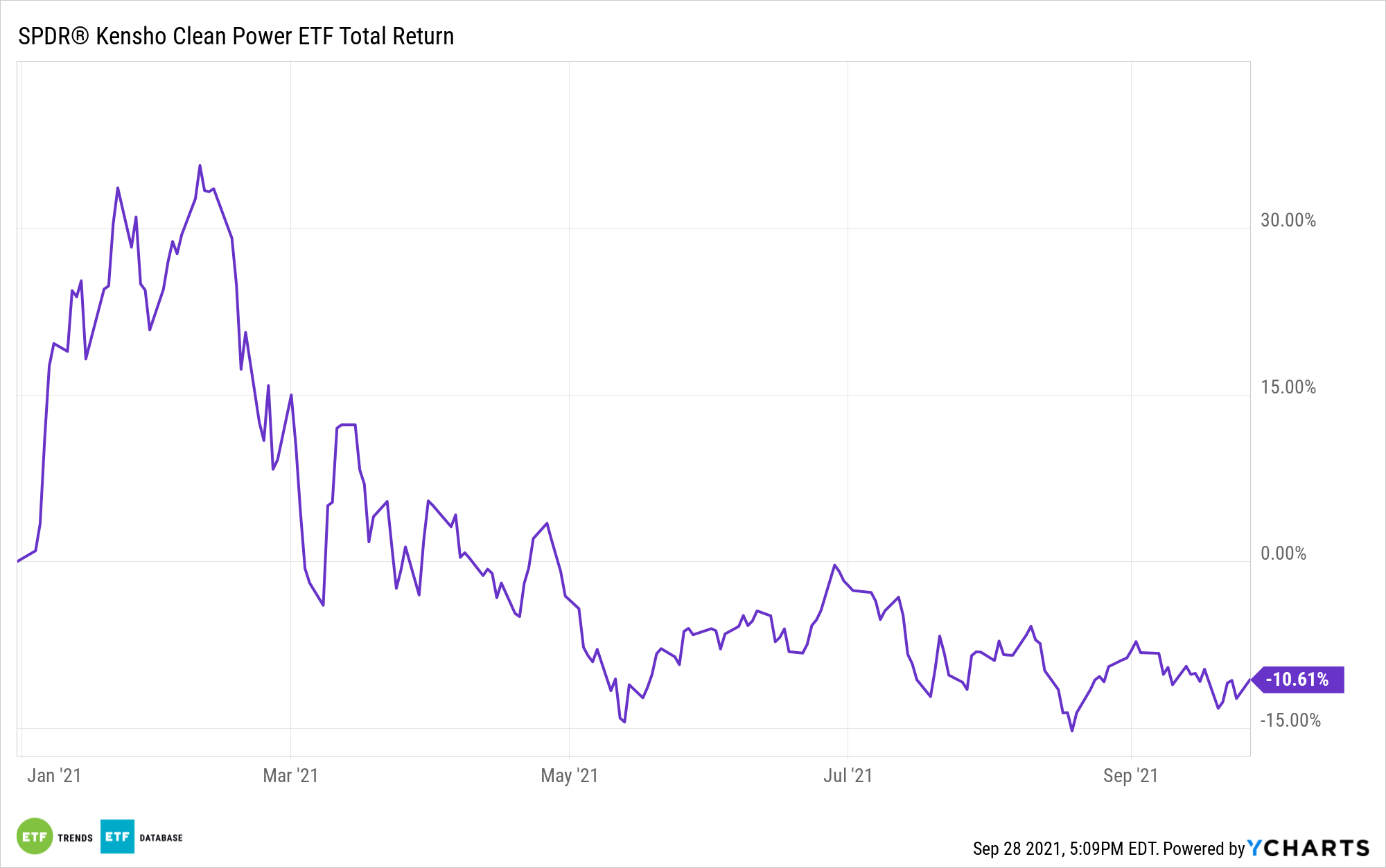

SPDR Offers Exposure to Clean Energy

For investors looking to invest in inherently ESG companies, one such option is a pure play based on the clean energy sector that looks to benefit from the reconciliation bill.

The SPDR S&P Kensho Clean Power ETF (CNRG) invests in clean energy and tracks the performance of the S&P Kensho Clean Power Index.

This benchmark combines artificial intelligence with a quantitative weighting methodology to invest in global stocks that are driving innovation in the clean energy sector, with respect to both products and services. This includes firms manufacturing technology used for renewable energy and companies that have services and products related to the generation and transmission of renewable energy, as well as supply chain companies.

CNRG allocates 18.51% of its portfolio to electrical components & equipment companies, 15.67% to electric utilities, 13.97% to semiconductors companies, and 10.57% to renewable electricity firms.

CNRG has an expense ratio of 0.45% and AUM of $355 million.

For more news, information, and strategy, visit the ESG Channel.