Socially responsible investments like those that track environmental, social, and governance factors have gained momentum, and have even caused some to push off investments in fossil fuel.

Money manager Jacinto Hernandez, a partner at Capital Group Cos., has questioned the sensibility of still investing in oil and gas companies after the novel coronavirus pandemic crushed global demand for fuel and the near-term outlook on the energy sector, the Wall Street Journal reports.

Even before the pandemic cut the world demand for fuel, the future of the crude oil industry was already under threat due developments in electric cars, the proliferation of renewable energy, and a spotlight on the long-term impact of climate change.

Furthermore, investors are now faced with an uncertain path in the direction that the oil industry will take as oil prices no longer follow the usually predictable cycle of boom and bust. There are even signs that oil demand may not ever fully recovery. The International Energy Agency projects that global oil demand will peak in the 2030s. Meanwhile, capital expenditures in renewable power supply are anticipated to overtake traditional energy for the first time, according to Goldman Sachs Group Inc.

Energy companies are even changing the way they do business in light of the more conscientious market environment. For instance, BP and Royal Dutch Shell PLC have pledged to meet net-zero carbon emissions and use their oil proceeds to fund billions of dollars in renewable energy investments. BP even plans to gradually reduce its fossil fuel production.

“The more we understand about the impact of Covid–19…the more convinced we are that the path we have chosen and the destination we have set are the right ones for BP,” BP Chief Executive Bernard Looney said in a note to employees in August. “And we intend to move quickly —within a decade, we expect to be a very different kind of energy company.”

However, investors are skeptical that these old energy companies can learn new tricks. According to a Boston Consulting Group survey of investors, 86% indicated that clean energy investments could help oil-and-gas companies, but only 25% of participants said oil and gas stocks will become a larger part of their portfolio in the next decade.

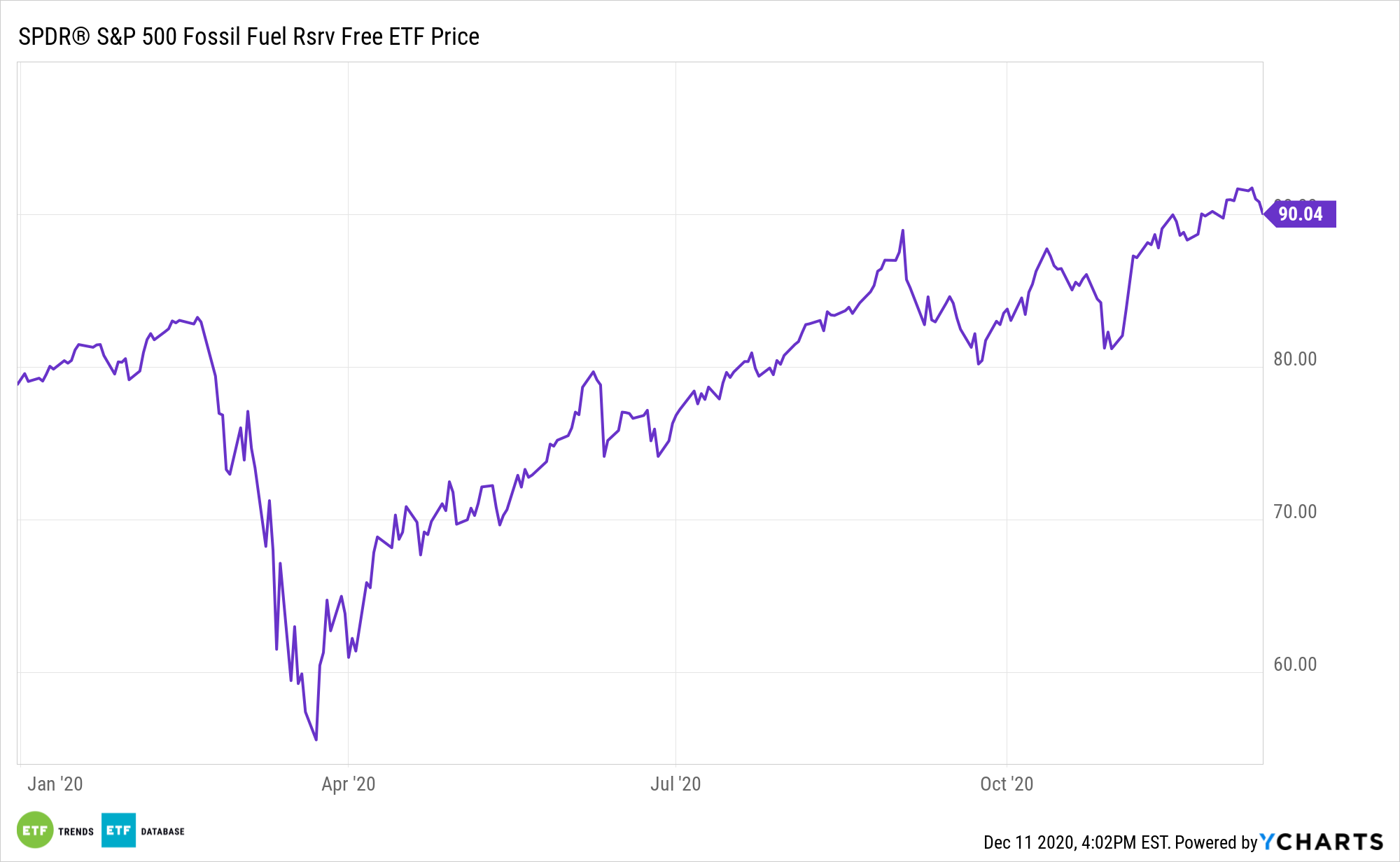

As a way for investors to meet this ongoing market shift, one may cut out their exposure to oil and gas all together. For example, State Street Global Advisors’ SPDR S&P 500 Fossil Fuel Free ETF (SPYX) tries to allow climate change-conscious investors to align the core of their investment strategy with their values by eliminating companies that own fossil fuel reserves from the S&P 500.

For more news, information, and strategy, visit the ESG Channel.