As the environmental, social, and governance (ESG) investing space expands on a yearly basis, companies looking to create their own ESG programs have more and more access to sustainability best practices. A Forbes article recently highlighted the five keys to building a successful ESG program.

- Knowing Your Audience: “While the primary audiences for these efforts are the analyst and investor communities, the public and media are critical. Both their commitment to their opinions and their ability to serve as instruments of amplification can help support your efforts.”

- Overseeing Efforts from an Organizational Structure: “It demonstrates the relevance and dedication of the company to the cause. When you’re determining where in the organization the function should be housed, remember that the higher up in the company that the responsibility for ESG implementation is placed, the greater the demonstrated commitment by leadership is.”

- Programming and Disclosure Requirements: “If there isn’t any activity, there isn’t anything to report. Unlike governance, which tends to be statutory and is highly regulated, there are many ways to report environmental and social impact.”

- Understanding Artificial Intelligence Aggregators: “his is the most challenging piece of the puzzle. Many aggregators rely on artificial intelligence to ‘find’ a company’s disclosure online, often without human intervention.”

- Utilizing Consultants: “Finally, consultants can help guide you through the process.”

Getting ESG Exposure in the S&P 500

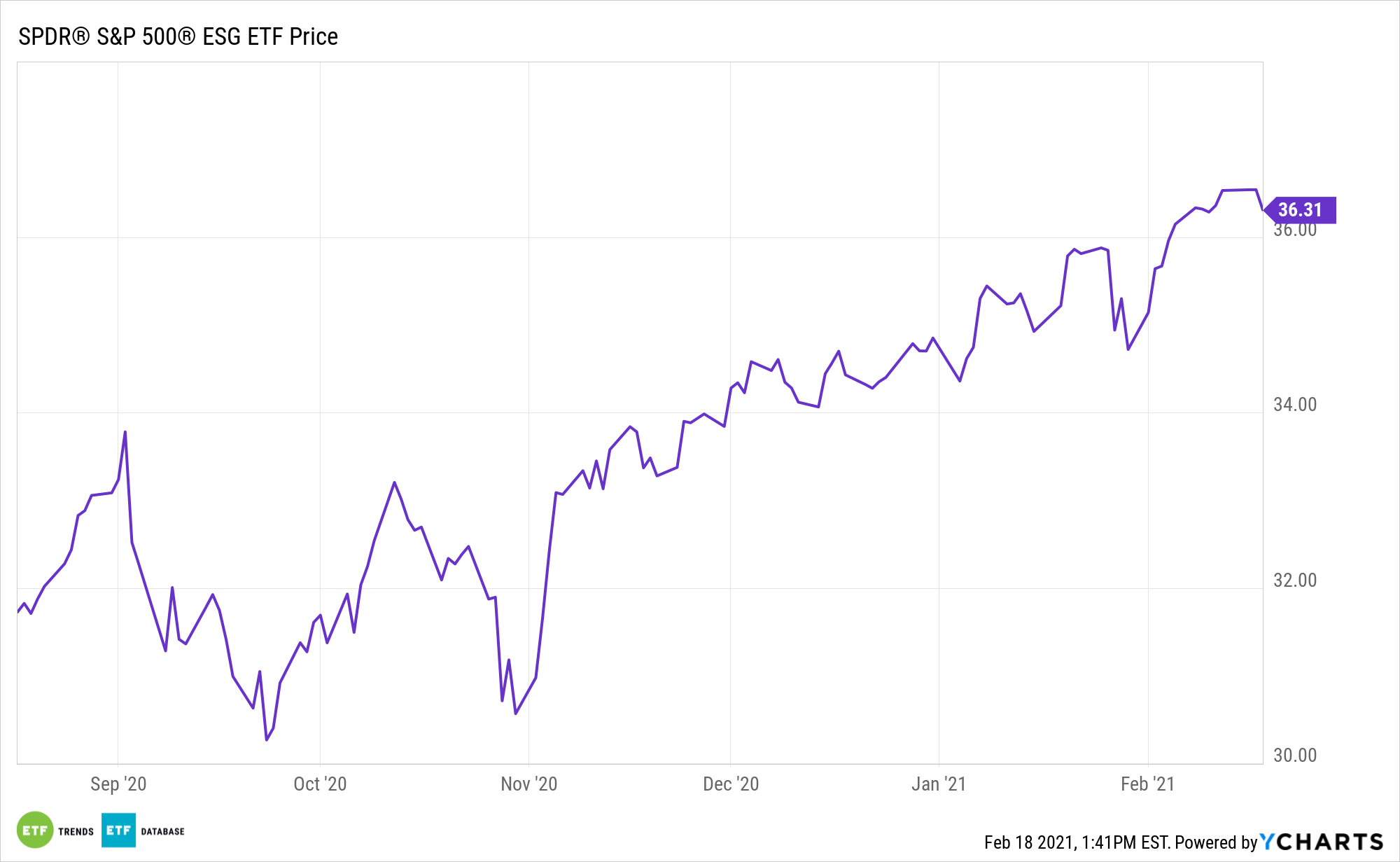

As ESG continues to seek a more organized structure for implementation, ETF investors can capitalize on the growth of the space via funds like the SPDR S&P 500 ESG ETF (EFIV). The fund seeks to provide investment results that correspond generally to the total return performance of an index that provides exposure to securities that meet certain sustainability criteria while maintaining similar overall industry group weights as the S&P 500 Index.

In seeking to track the performance of the S&P 500 ESG Index, the fund employs a sampling strategy, which means that it is not required to purchase all of the securities represented in the index. Overall, EFIV gives investors:

- Investment results that, before fees and expenses, correspond generally to the S&P 500 ESG Index.

- Exposure to an index that is designed to select S&P 500 firms meeting certain sustainability criteria while maintaining similar overall industry group weights as the S&P 500 Index.

- Potential ESG core exposure, based on its focus on sustainability criteria and comprehensive market coverage of the flagship core S&P 500 Index.

For more news and information, visit the ESG Channel.