Investors don’t have to look further than the S&P 500 for top ESG exposure thanks to funds like the SPDR S&P 500 ESG ETF (EFIV).

“Assets under management in ESG ETFs jumped three-fold from just under $59bn at the end of 2019 to $174 billion at the close of 2020, according to data from TrackInsight, an ETF data provider,” a Financial Times article said.

The fund seeks to provide investment results that correspond generally to the total return performance of an index that provides exposure to securities that meet certain sustainability criteria (criteria related to ESG factors) while maintaining similar overall industry group weights as the S&P 500 Index.

In seeking to track the performance of the S&P 500 ESG Index, the fund employs a sampling strategy, which means that it is not required to purchase all of the securities represented in the index. Overall, EFIV gives investors:

- Investment results that, before fees and expenses, correspond generally to the S&P 500 ESG Index.

- Potential ESG core exposure, based on its focus on sustainability criteria and comprehensive market coverage of the flagship core S&P 500 Index.

- A low expense ratio of 0.10%, 27 basis points below the category average.

- Strong 12-month performance, with a 21% gain

EFIV Is Big on Big Tech

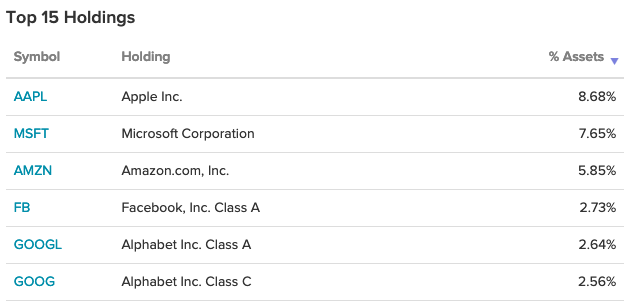

When looking under the hood of EFIV, big tech dominates the fund’s top three holdings with over 25% of assets in names like Apple, Microsoft, Google, Facebook, and Amazon. The majority of big tech companies have recently reported stellar earnings. More importantly, some have been scoring high on ESG metrics.

“Microsoft, for example, is rated ‘best in class’ in most ESG metrics, helped by having a human rights policy, a biodiversity policy and plans to be carbon negative by 2030,” the FT article noted.

“But since the pandemic hit, and the world was forced into lockdown last spring, the demand for Big Tech products and services only accelerated to new heights,” a Forbes article added.

For more news and information, visit the ESG Channel.