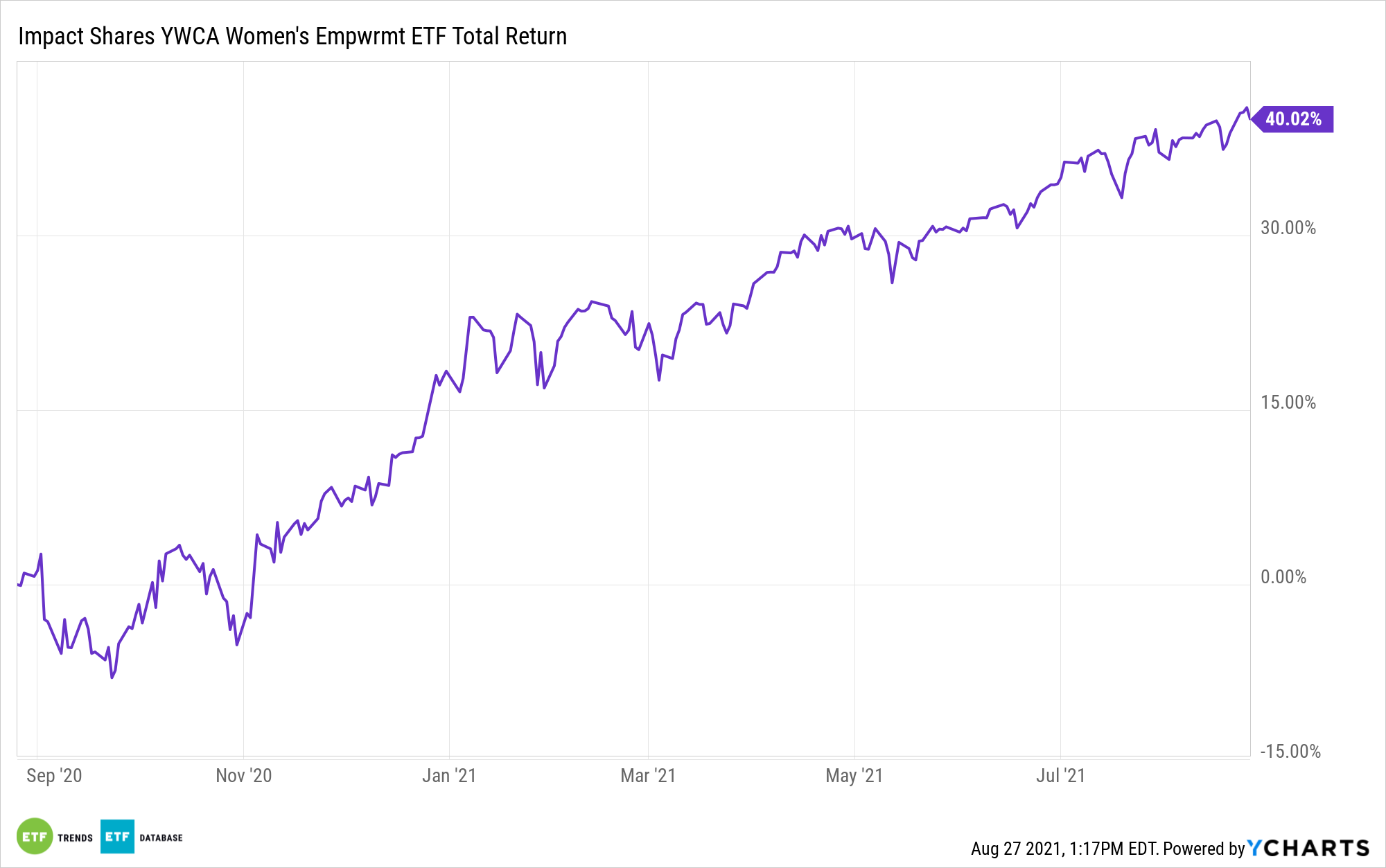

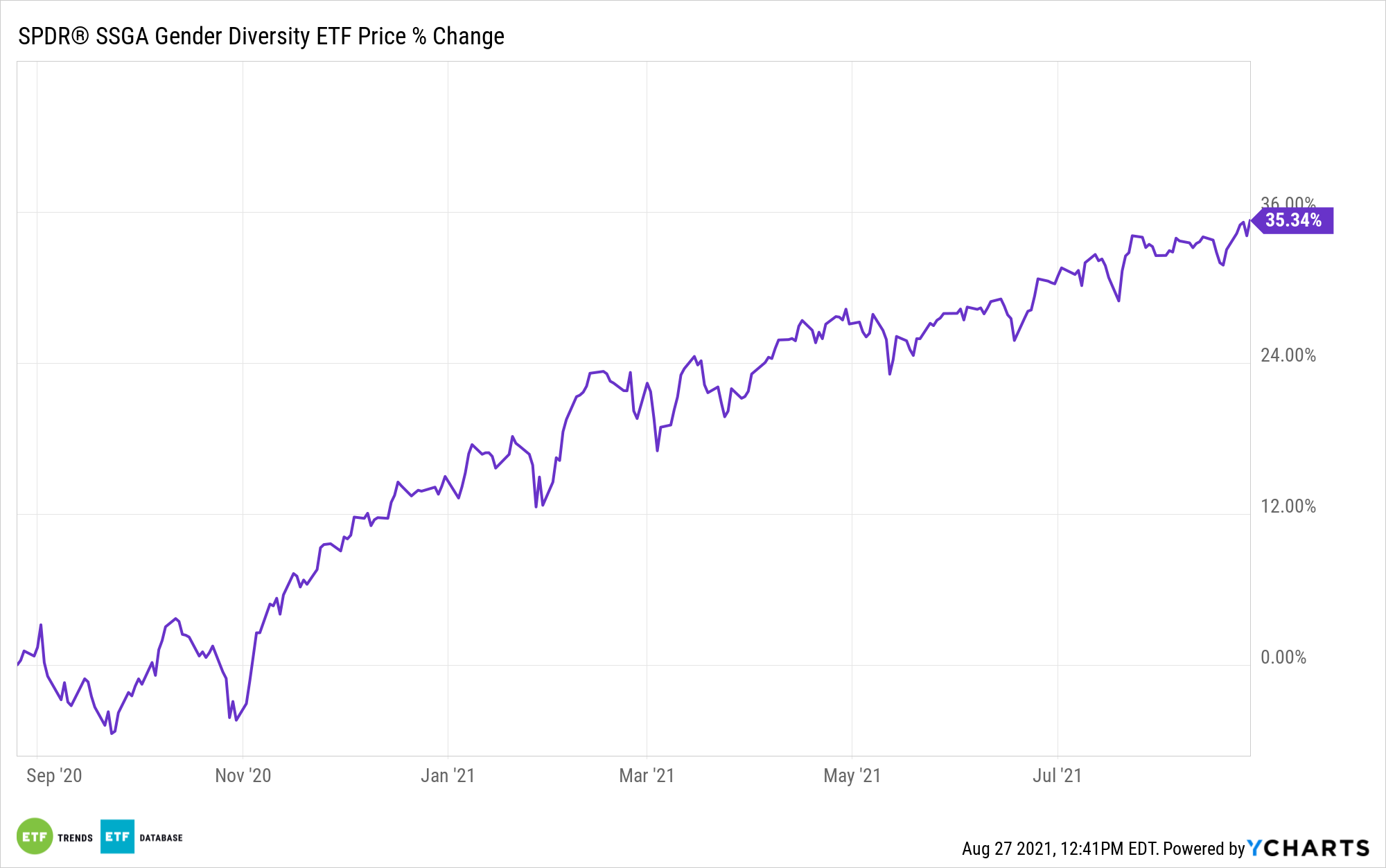

Both the Impact Shares YWCA Women’s Empowerment ETF (WOMN) and the SPDR SSGA Gender Diversity Index ETF (SHE) hit record highs Wednesday, the day before Women’s Equality Day on Thursday. WOMN was up almost 19% year-to-date while SHE was up 17%, reported CNBC.

Women’s Equality Day celebrates the day that the 19th Amendment, which prevented the discrimination of voting rights based on gender, was adopted. While it only gave voting rights to white women at the time, it was part of a movement that still works today to guarantee women equality across all walks of life within the U.S.

Thematic funds such as these two ETFs can often promote further change in the companies that they invest in. Both funds require a level of gender diversity within the executive leadership and fall under the umbrella of ESG investing that is seeing increased inflows.

They are funds that oftentimes can get overlooked, but they are offering excellent performance. CFRA’s Todd Rosenbluth, senior director of ETF and mutual fund research, explained in an interview on ETF Edge that “WOMN … has actually outperformed the Russell 1000 in the past year.”

“SHE … has also outperformed,” Rosenbluth said. “So, you cannot just feel good about what you’re doing, but actually add value to your overall account by investing in some of these more narrowly focused ESG products.”

Promoting Gender Equity With SHE

State Street Global Investors recognizes the importance of investing in a future that is more female by supporting the companies that are practicing gender equity today. The SPDR SSGA Gender Diversity Index ETF (SHE) offers data-driven exposure to companies with the highest diversity amongst leadership positions within their industries.

SHE follows the SSGA Gender Diversity Index, an index that tracks large-cap U.S. companies exhibiting gender diversity within their senior leadership.

The benchmark pulls from the top 1,000 U.S. stocks by market capitalization, utilizing three different gender diversity screens to narrow down its selection universe.

These metrics include the ratio of female executives and board of directors members to all executives and all board of directors members, the ratio of female executives versus all executives, and the ratio of female executives (excluding those on the board of directors) compared to the number of executives in total (again, excluding board members).

For the purposes of the index, “executives” are defined as any vice president position in a company and higher, or any position at managing director and above in a financial sector company.

According to their free-float market cap, the top-ranking 10% of companies within each sector are selected and weighted proportionally. Each stock has a maximum weight cap of 5%.

The top three sectors in SHE include information technology (32.40% of its portfolio), healthcare (12.55%), and consumer discretionary (12.53%).

Currently, the fund’s top three holdings include Walt Disney Company at a 4.89% weight, salesforce.com inc. at 4.85%, and Visa at a 4.77% weight.

SHE carries an expense ratio of 0.20%.

For more news, information, and strategy, visit the ESG Channel.